Boutique Capital partners with talented early stage fund managers to launch and operate successful boutique funds management businesses. Raising funds and investing them.

Quaystreet Good Returns Fund Manager Of Year Awards 2020 Winners

Paradice Cooper Investors 550 million fund.

Best boutique fund managers australia. They have a maximum holding size of 5 at cost. Those figures make the active funds managers some of the highest-paid executives across the Australian business sector. The business was founded by Tony Scenna and Corey Vincent.

They are both high conviction and index agnostic. There are over 200 boutique investment management firms in Australia with at least 100 fund products offered in the Australian equity market alone. We consider that our investment products are particularly suitable for pension phase investors and self-managed.

With Q1 FY21 in the books Mercer has released its quarterly performance update for the best and worst Australian fund managers. Look no further than Boutique Capitals fund manager partners. They typically hold 15-30 stocks with cash of 0-20.

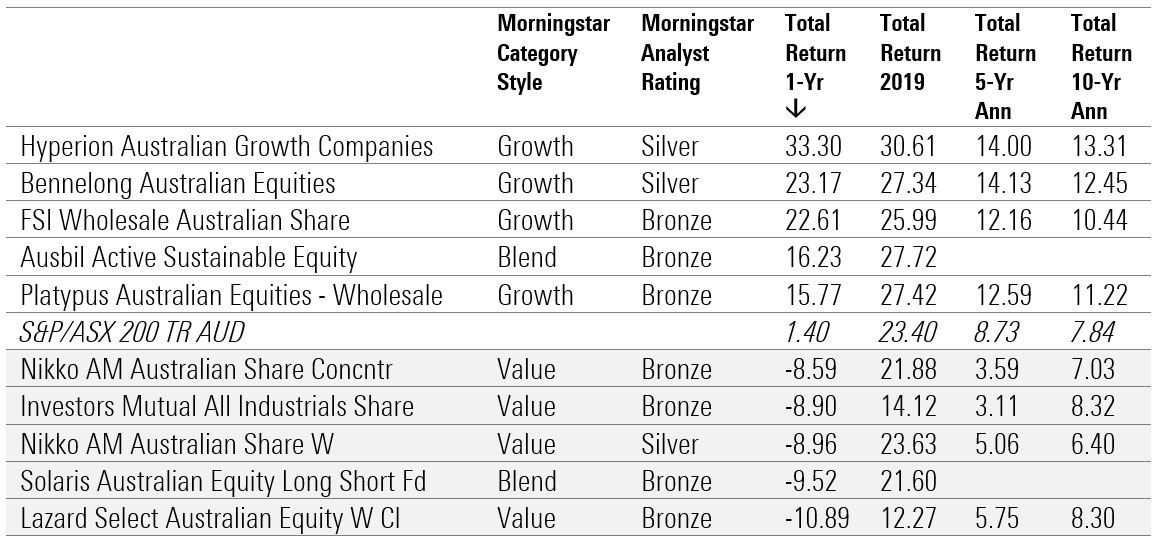

All three winners also won their respective Awards in 2019. Click through to invest in any of our funds below. The Top performing managed funds list is determined by the 1 year historical return of funds rated 3 stars or higher by Morningstar Research.

Plato provides objective-based global and Australian equity investment solutions for wholesale and retail investors. Save time and capital with our turnkey solutions and focus on what you do best. Alphinity Investment Management Alphinity is an active equities investment manager with dedicated teams managing both Australian and Global equity funds using a distinctive combination of fundamental analysis and specific quantitative inputs.

The same cannot be said for boutique funds management company. Colonial FirstChoice Investments - Acadian Geared Global Equities. Peter Cooper from Cooper Investors is one of.

We understand that regular income is very important to many investors and target a distribution yield of 5 per annum. Our partnerships with talented boutique fund managers throughout Australia means we offer investors access to quality investment opportunities in various asset classes. Plato was founded in Sydney Australia in 2006 and is majority owned and operated by its investment staff.

We provide a fixed-cost solution support and expertise to get you started faster. The Fiducian Australian Shares Fund has returned 9 pa. We aim to invest with the best investment managers in Australia.

We are a boutique investment management firm that builds on decades of experience in the financial markets along with a conservative approach to investing with the goal of generating regular income. Learn more about Alphinity Investment Management. Selector Funds Management - The Selector Ex-50 High Conviction Equity Fund excludes the top 50 stocks.

Dont let a lack of resources keep you from getting ahead. For the three provider Awards institutions were assessed based on the cumulative score of their top-performing funds. They say the greatest value lies in the smaller less researched businesses.

In what was a strong quarter for global equity markets Mercer said the median manager generated higher returns than the SPASX 300 Index. The most high-profile new boutique is Avoca Investment Management the Australian-equities small-cap manager established by former UBS portfolio managers John Campbell and Jeremy Bendeich. Looking for the best investment opportunities in Australia.

They are usually boutique fund managers who are often unknown by the greater investing community. One of the top performing boutiques was Lincoln Australian Growth which rose to the top quartile in that time period from the third across three years. Australias top performing equity managers unveiled Sarah Thompson Anthony Macdonald and Tim Boyd Jun 8 2020 932pm The end of June looms large in diaries of fund managers around the country.

The pair left their roles as portfolio managers for UBSs Australian Small Companies Fund in April this year and after a months break emerged with Avoca of which they are the majority owners. Plato Investment Management is an Australian owned boutique equities fund manager specialising in maximising retirement income for pension phase investors and SMSFs. Given 2018 was a rocky ride compared to the year before it Money Management looked at the performance of boutique managers across 30 November 2017 to 30 November 2018 to see which funds topped the charts.

Acadian Wholesale Geared Global Equity. We aim to pay monthly distributions. Australias most successful boutique fund and asset managers have suffered big profit falls and falling dividends as a volatile market took its toll on their financial results.

Extended out over 12 months which includes the March 2020 COVID-19 selloff the top quartile of investment managers. To be eligible for Canstars Managed Funds Star Ratings and Awards each fund and provider had to meet criteria that included. Having an initial minimum investment amount of 20000 or less.

Fund name APIR Morningstar rating Sector Returns. The largest boutiques include Perennial Investment Management Platinum Asset Management and Maple Brown Abbot and are increasingly regarded as large institutional investment management firms. As at March 31 Wilson HTM Asset Managements 176 million Australian Equity Fund had returned 125 per cent.

We dont charge any fixed management fees. Being open to new.

Tribeca Vanda Asia Credit Fund Tribeca Investment Partners Australia Based Boutique Fund Manager

Best Investment Funds Managers Australia Affluence Funds Management

The Australian Core Fund Taking On Europe Magazine Real Assets

Quaystreet Good Returns Fund Manager Of Year Awards 2020 Winners

Top 10 Banks In Australia Overview Of Australian Banks Careers

Fortlake Asset Management Experienced Fixed Income Manager

Equity Australia Asia Pacific Equities Fund Fund Manager League Table Citywire

Best And Worst Performing Equity Funds Of 2020 Morningstar Com Au

The Top 10 Boutique Fund Managers Across All Asset Classes Citywire

Fidante Partners Launches New Emerging Market Boutique Fund Manager Ox Capital Management Financial Corporate Relations

The 10 Fund Managers Who Made 300m Profits This Year

Boutique Fund Managers Boutique Capital

Comparing Managed Funds Here S Why Boutique Fund Managers Beat The Institutions Lincoln Indicators

Comparing Managed Funds Here S Why Boutique Fund Managers Beat The Institutions Lincoln Indicators

How An Invite Only Asset Manager From Australia Keeps Beating The Market

Prime Value Building Wealth Together

The Australian Core Fund Taking On Europe Magazine Real Assets