Infact the importance of doing nomination is enhanced by the recent regulatory requirement which makes is mandatory for a person investing into mutual funds to mention their nominee details. Under new insurance nomination of beneficiaries framework introduced from Sep 1 2009 you can make insurance nomination either at the time of buying a policy or at any time after the policy is issued.

Importance Of Nominee In A Life Insurance Abc Of Money

Importance of making a nomination Introduction This is an introductory guide to help you understand the importance of making a nomination in your life insurance policy to safeguard the interest of your loved ones.

Insurance importance of nomination part. A trust nomination under Section 49L or. As per the act a nominee is a trustee and not the owner of the assets. Making an insurance nomination allows you to distribute your policy proceeds to your loved ones according to your wishes.

What is a nominee. A couple of examples of such assets are bank account saving fixed and recurring deposits PPF PF Mutual funds demat account post office saving accounts insurance policy etc. It is important to understand the concept of a nominee in a life insurance policy.

Why should you make a nomination. The declaration of a nominee only allows the. In the unfortunate event of the death of the policyholder these individuals would receive the benefits of the policy.

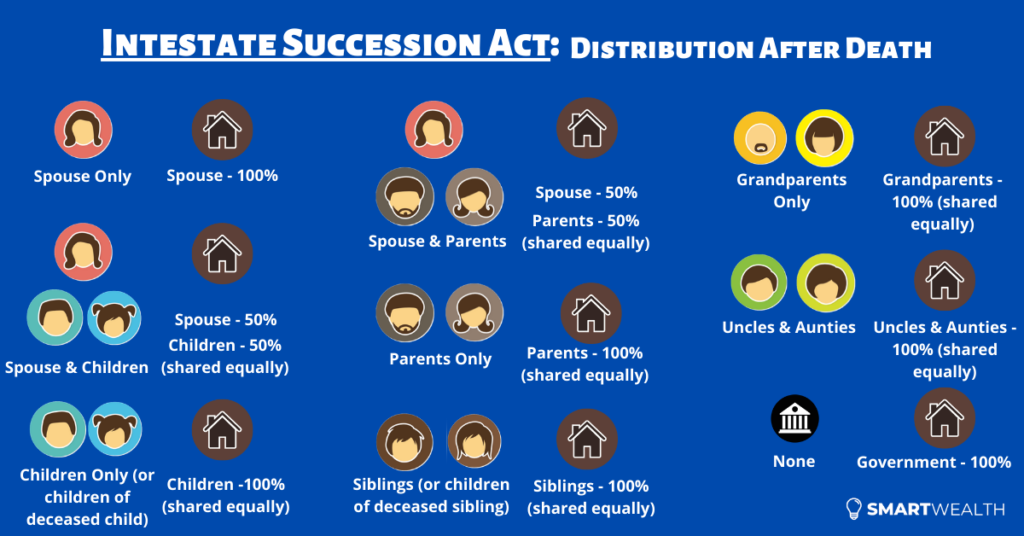

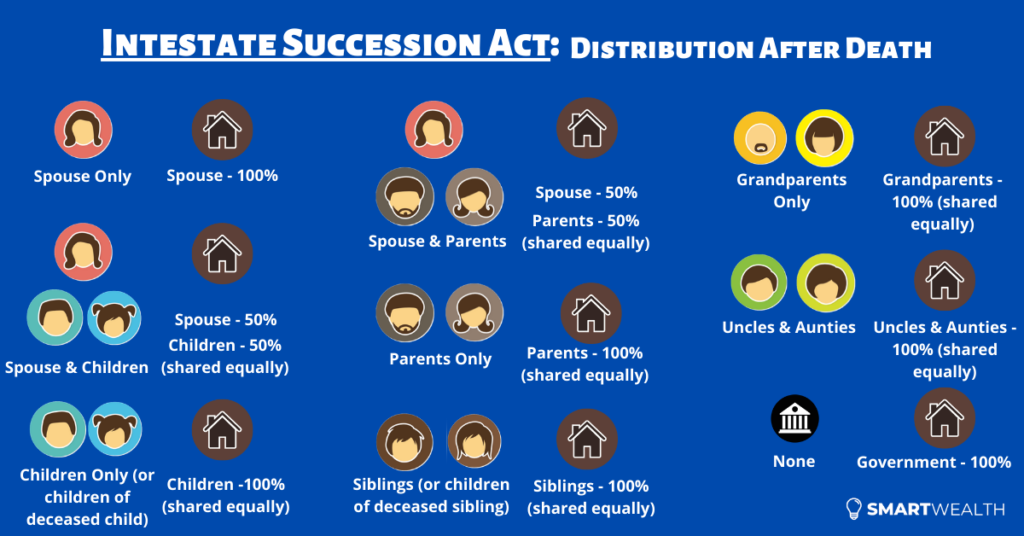

In the case of death cases the insurance. Why Nomination is Vital in Life Insurance. WHO IS CONSIDERED A FINANCIAL DEPENDANT ACCORDING TO THE LAW.

In simple terms making a nomination in your life insurance policy means choosing someone to receive or manage the money disbursed by the insurance company when you die. A NOMINEE is the person who has been proposed by the policyholder for receiving the claim amount of the life insurance policy upon hisher death. Another reason why its important to have a nominee in your insurance plan is to make sure the claim settlement process is smooth without any legal battles.

Your first choice of. Nomination in life insurance has one limitation as insurance policies are bought to secure your financial dependants. There are two types of nominations.

Nomination of Life Insurance Policies is a process whereby if the Life Insured dies within the policy tenure the Insurer would pay out the proceeds of that policy to the Nominee. TLDR What Do I Need To Know About Insurance Nomination. Nomination in Life Insurance A policy holder can appoint multiple nominees and can also specify their shares in the policy proceeds.

The nomination is a right conferred by the section 39 of the Insurance Act 1938 on the holder of a Policy of Life Assurance on his own life to appoint a persons to receive policy money in the event of the policy becoming a claim by the assureds death. The process of selecting that candidate or Nominee is called Nomination. LIST ON YOUR BENEFICIARY NOMINATION FORM.

The policy holder has to select a nominee to the life insurance policy at the time of purchase. Insurance nomination is useful if the death proceeds of a policy is solely for an entity who is guaranteed to be capable of receiving it such as a living trust. It is an important part of the policy and every policyholder should be aware about the same.

It is not wise to make insurance nomination to minors children. A nomination in a Life Insurance policy helps an insurance provider pay out any monetary benefits in the event of the demise of the insured person. It gives you some basic information to help you understand the nomination.

A nominee or nominees are individuals whom a policyholder mentions in their policy documents. The rules for nomination in life insurance have changed for insurance policies maturing after March 2015. I wish it was that simple though for there are several things that you should know before rushing into making a nomination.

Thus insurers insist on full details of the nominee and relationship. An insured person will usually nominate a dependent in his or her Life Insurance policy. It is important that the nominee has an insurable interest in the life of the insured.

Proper nomination in Life Insurance is important to ensure that in the event of death the life insurance claim money goes into the right hands. A revocable nomination under Section 49M of the Insurance Act. But adding a nominee to a Life Insurance policy is not binding.

Importance of Having a Nominee On a Life Insurance Policy In a life insurance policy the policyholder nominates a person to whom the insurer must pay the policy proceeds in the event of hisher demise this person is called the nominee. A financial Dependant or a Beneficiary. Well to save time and hassle.

If you do not make a nomination in your insurance policy your insurance company is not obligated to release the policy moneys until your loved ones obtain a Grant of Probate or Letter of Administration or Distribution Order which may take several years. Here are the disadvantages of insurance nominations. Thats why we have created a checklist for you of things you need to know about nomination for a life insurance policy.

The Importance of Nominating a Beneficiary. Anyone who is financially dependent upon you in terms of Section 37C of the Pension Funds Act In other words anyone who. The holder of a policy of life insurance on his own life either may at the time of affecting policy or at any subsequent time before the policy matures nominate the person or persons to whom the money secured by the policy shall be paid in the event of his death.

The Importance Of Insurance Policy Nomination In Singapore

How To Choose Nominee For Insurance Policy Businesstoday

Assignment Of Life Insurance Policy Types Details Rules

Life Insurance Assignment And Nomination Explained

Importance Of Making A Nomination Life Insurance Corporate

The Importance Of Insurance Policy Nomination In Singapore

Basics Of Nomination In A Life Insurance Policy

Difference Assignment Vs Nomination In Life Insurance Policyx Com

Importance Of Nomination In A Life Insurance Policy

Difference Assignment Vs Nomination In Life Insurance Policyx Com

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premium Payable For Life Life Insurance Calculator Life Insurance Policy Term Insurance

What Is Beneficiary Nominee Nomination Importance Rules And Benefits

What Is Beneficiary Nominee Nomination Importance Rules And Benefits

Things You Need To Know About Nomination In Life Insurance Mintpro

Life Motor Health Insurance Nominate Right To Secure Your Loved Ones The Economic Times

Problematic Life Insurance Nomination

Can I Use My Will To Distribute Insurance Proceeds Singaporelegaladvice Com