Borrowing deal with Prosper. This allows borrowers to obtain loans without having to go through the strict requirements of banks.

Pdf Peer To Peer P2p Lending Platform Adoption For Small Medium Enterprises Smes A Preliminary Study

Peer-to-Peer P2P lending is a crowdfunding type that allows individuals and institutional investors to provide debt financing to a consumer natural person or business borrower legal entity in the form of a loan agreement that includes the obligation to repay the.

P2p lending knowing all sc approved p2p. As per the Peer-to-Peer Finance Association P2PFA cumulative lending through P2P platforms globally will be a 150 billion industry. The reason is on P2P lending platform we can not get a lot of information about borrowers the only reference sources are metrics provided by P2P lending. As part of SCs effort to nurture and facilitate market-based innovation in FinTech under the email protected initiative the regulatory framework for equity crowdfunding ECF was introduced in February 2015Continuing on the initiatives SC has introduced the regulatory framework for P2P setting out requirements for the registration and obligations of a P2P operator as provided in the revised Guidelines on Recognized.

Below is the intro of SC approved P2P operators as at end Aug 2018. Loan-based crowdfunding also known as peer-to-peer P2P lending has evolved as a disruptive force in lending in recent years. Among other criteria the directors of an operator must demonstrate that they are fit and proper to operate such business.

The process is simple and easy to understand as a lender your. It was the very first peer-to-peer lending app that comes in the US marketplace. That the likelihood of meeting all of these 15 investors is fairly lowunless you use an online peer-to-peer P2P lending platform.

Faircent is a Gurugram-based P2P lending platform founded by Nitin Gupta Rajat Gandhi and Vinay Mathews in 2013. Most of the personal loans offered on P2P platforms range from 1000 to 40000 and have repayment periods of approximately 36 months. My first guess for this question is that credit assessment metrics on P2P lending platform have certain reference value especially for platform with good performance like Prosper or LendingTree.

P2P lending is when investors lend money to individuals and businesses through online platforms. See screenshots read the latest customer reviews and compare ratings for Peer to peer lending - The full P2P lending guide. P2P lending sites like Lending Club Prosper and Upstart three of the largest P2P lenders provide low-cost platforms where borrowers can request loans and investors can bid on them.

It is one of the first P2P lending platforms to start operations in the country. In May 2019 SC Malaysia issued additional licenses to 5 new P2P lending operators. P2P lending is also known as crowdlending or social lending.

Borrow up to 40000 and repay within 3 or 5 years with fixed rates from 1068 to. Based on SC requirements an operator must be incorporated under Companies Act 1965 with a minimum paid-up capital of RM5 million. This means that there are three participants in the business model.

I have never used the P2P lending platform before but Im always curious about why investors always can earn profit from these risky loans. P2P lending generally promises higher returns than traditional investments but investors take on higher risk as well. Peer-to-peer lending is the process by which borrowers seek funding for a project or other kind of loan through non-traditional means by connecting with private lenders.

Peer-to-peer lending is a relatively recent development that uses the Internet to connect individual investors with other individuals such as small business owners seeking to borrow money. A P2P lending platform operator must be approved by the SC. In traditional P2P lending the platform administrates the transactions debt collection and marketing towards both lenders and borrowers in return of a fee.

But over the last decade a new form of lending called Peer-to-Peer Lending P2P for short has seen a tremendous amount of growth and attention. Sites that support P2P lending have majorly increased its adoption as a viable alternative financing method. Prosper app is one of the best lending apps handling P2P lending app in the market.

Blockchain-based P2P lending platforms allow investors to approve loans against residential properties but the value of properties dont remain stable always. There were six licensed P2P lending operators initially introduced in Malaysia. B2B Finpal Sdn Bhd B2B Finpal A local P2P lending player founded by two prominent businessman.

P2P lending platforms in Malaysia. Peer-to-peer P2P lending is a strategy that enables people to get loans directly from other individuals without the involvement of a financial institution as the middleman. The US UK Europe and China are the major markets for the crowdfunding industry.

What is P2P lending. It connects the borrowers and lenders directly eliminating intermediaries to. They are CapitalBay Capsphere Services Crowdsense MicroLeap and Money Save Capital.

The borrowers can get personal loans up to 40000 with a fixed-rate and a fixed-term of 3 to 5 years. LendingClub offers four types of loans to borrowers. Download this app from Microsoft Store for Windows 10 Windows 10 Mobile Windows 10 Team Surface Hub HoloLens.

The platform and 3. After understanding how and why P2P lending existed nowadays click here to read our previous article lets move on knowing all the approved P2P operators in Malaysia now. P2P lenders using blockchain can help reduce delays make quick approvals eliminate the need for middlemen and bring transparency.

The Prosper platform was founded in 2005.

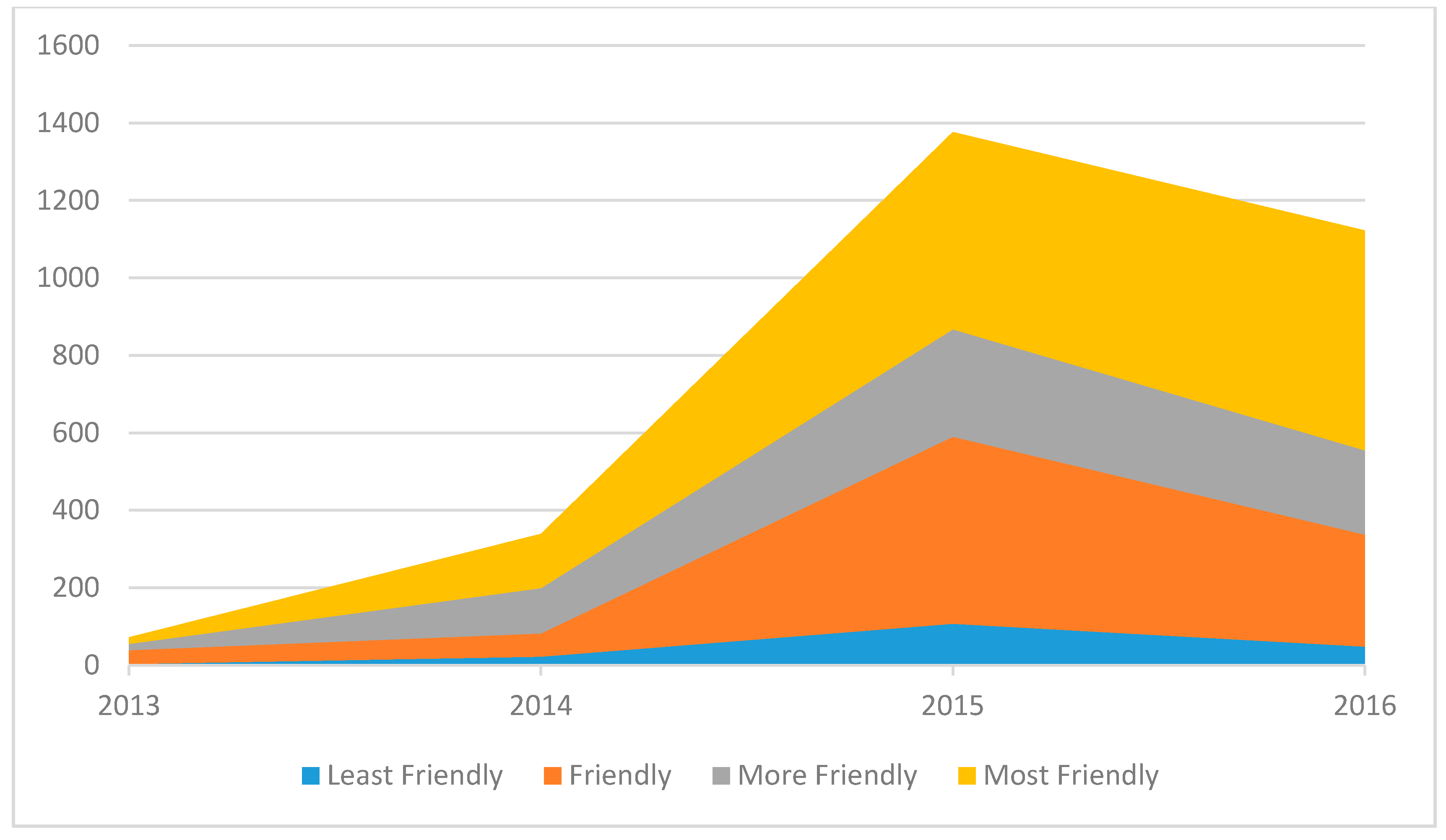

Sustainability Free Full Text Business Friendliness A Double Edged Sword Html

Https Www Atlantis Press Com Article 125939928 Pdf

Finance Malaysia Blogspot Crowdfunding What Is P2p Financing And What S In It For Investors

Peer To Peer Lending State By State

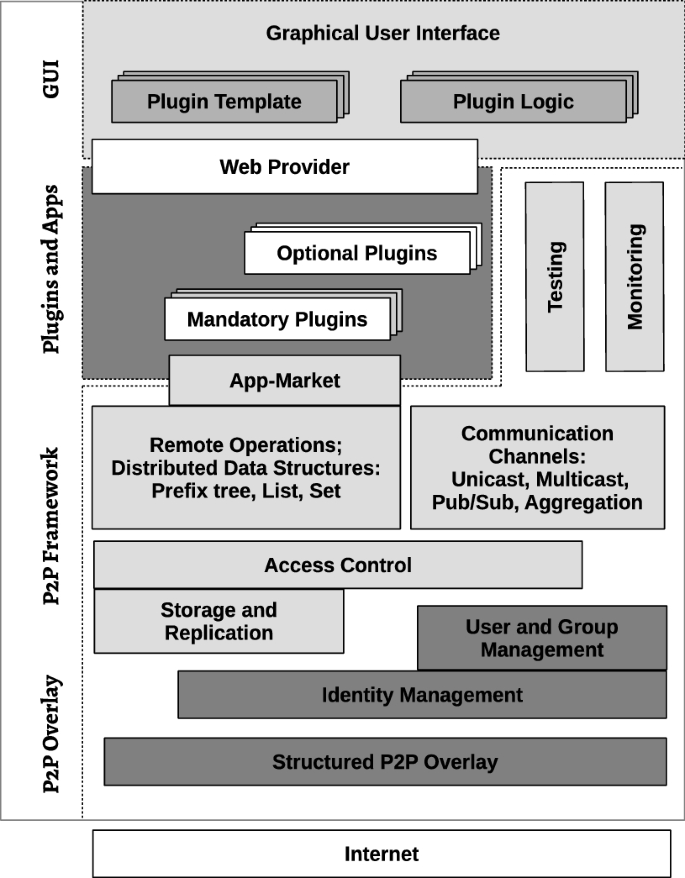

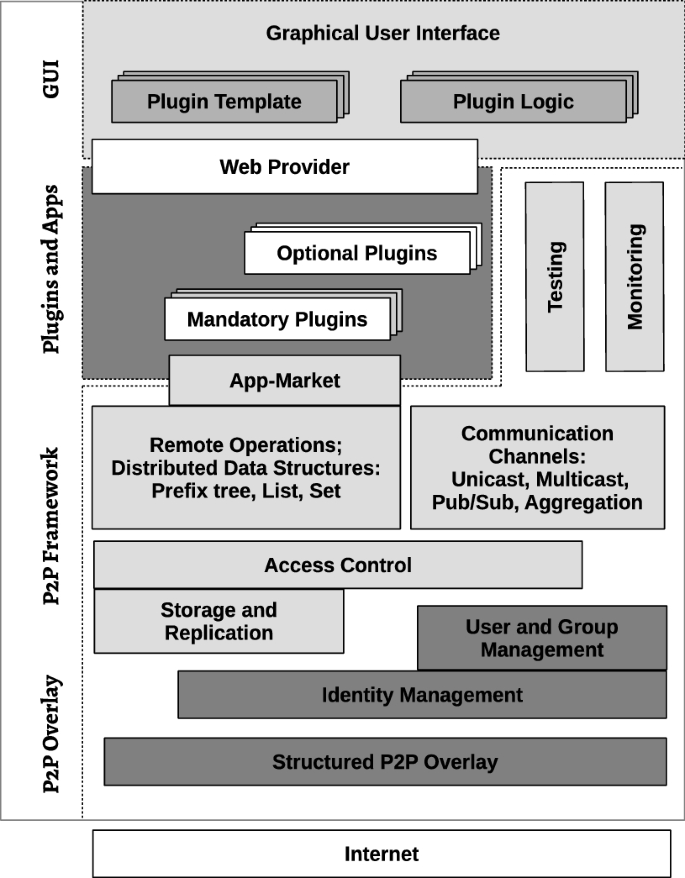

Peer To Peer Based Social Networks A Comprehensive Survey Springerlink

Peer To Peer Lending State By State

Finance Malaysia Blogspot P2p Investment What Are The Differences Between Funding Societies And Fundaztic Platform

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators

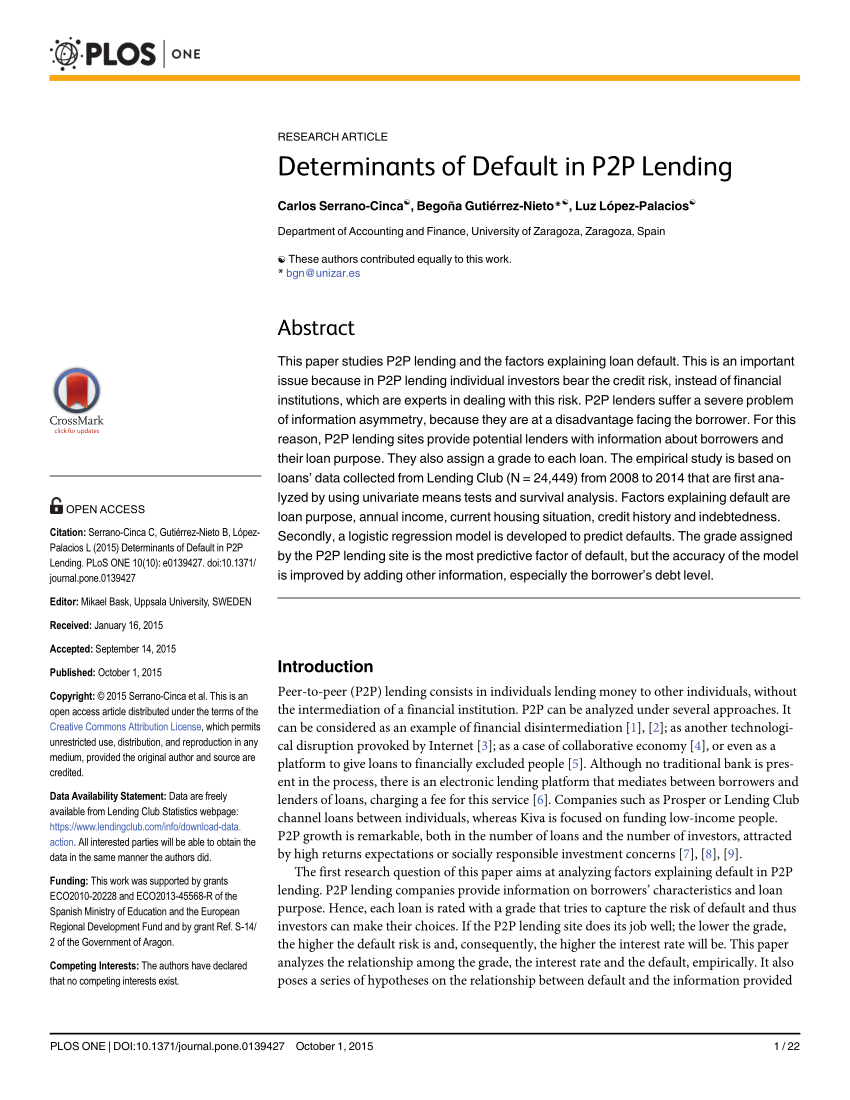

Pdf Determinants Of Default In P2p Lending

Pdf Peer To Peer P2p Lending Platform Adoption For Small Medium Enterprises Smes A Preliminary Study

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators

Finance Malaysia Blogspot Crowdfunding What Is P2p Financing And What S In It For Investors

Finance Malaysia Blogspot Crowdfunding What Is P2p Financing And What S In It For Investors

Peer To Peer Lending State By State

Finance Malaysia Blogspot P2p Lending Knowing All The Sc Approved P2p Operators