Amendments are also made to provisions regarding withholding on supplemental wages to reflect the new rate of withholding. Relief restricted to 10.

How To Calculate Income Tax In Excel

Pensions 201011 Change 200910 Annual allowance 255000 10000 245000 Lifetime allowance 1800000 50000.

Personal income tax 2010. Indexing of the personal income tax system helps keep the tax system up to date to reflect the annual rise in the price of goods and services. 3 Relief at 20. Notes 1 From 201011 the personal allowance of any individual with income above 100000 is reduced by 1 for every 2 of income above the 100000 limit.

117 Zeilen General Information for Senior Citizens and Retired Persons - For tax year 2010. DEX 93 -- Personal Income Tax Correspondence Sheet. From 2010 the personal allowance will be tapered to zero for those with incomes over 100000.

Income from other business is taxable at 535 percent. 20 NYCRR section 2911 b and Appendix 10-C. Personal Allowances for people born before 6 April 1948.

The 25 amount covers taxes calculated on income only within the 25 bracket. The Income Tax and Personal Allowances are used to calculate the amount of Income tax due in the 2010 to 2011 Tax Year if you are an employee your income tax will typically be calculated and deducted from your salary as Pay As You Earn PAYE along with your other salary deductions like National Insurance Company. Is the fast safe and free way to prepare and e-le your taxes.

Chargeable income of that individual is less than 05 per cent of the total income of that individual the individual shall be charged to tax at the rate of 05 per cent of his total income. LIMITS ON PERSONAL EXEMPTIONS AND OVERALL ITEMIZED DEDUCTIONS ENDED For 2010 you will no longer lose part of your deduction for personal exemptions and itemized deductions regardless of the amount of your adjusted gross income. Information from each Form W-2 Wage and Tax Statement Enter amounts in whole dollars.

2010 Personal Income Tax Calculator Personal Income Tax Rates Canada Calculate your 2010 personal income tax combined federal and provincial tax bill in each province and territory of Canada. The average tax liability for all filers was 2790 in 2010 up 60 percent from 2663 in 2009. Round by eliminating any amount less than 050 and increasing any amount that is 050 or more to the next highest dollar.

Personal Income Tax Act. Or ii where the defined aggregate income is less than RM100000. DFO-02 -- Personal Individual Tax Preparation Guide for Personal Income Tax Returns PA-40.

The number of taxpayers choosing to file their return electronically in 2010 grew 139 percent to 134 million. The 2010 total tax liability for all filers was 50 billion up 74 percent from 47 billion in 2009. The basic and higher income tax rates remain at 20 and 40 for 200910 and 20102011.

Ratios of enterprise and personal income taxes to GDP. For example a single person earning 50000 would be in the 25 tax bracket in 2010. The 468125 covers taxes calculated on income that falls in the 10 and 15 brackets.

From 2010 incomes above 150000 will be subject to a new 50 income tax rate. 4 Relief at 30. Conditions for claiming carry-back loss under section 44B of ITA 1967- z The amount of adjusted loss for the basis period for the year of assessment 2010 allowed for carry-back- i shall not exceed RM100000.

PA-19 -- PA Schedule 19 - Sale of a Principal Residence. And passive income such as interest and royalties is taxable at a standard rate of 20 percent. The defined aggregate income of the year of assessment 2009.

Delaware Non-Resident Individual Income Tax Return Instructions for Form 200-02 Download Fill-In Form 181K 2010 Income Tax Table Download Fill-In Form 53K 200 V Payment Voucher Download Fill-In Form 90K Schedule W Apportionment Worksheet Download Fill-In Form 127K 200-01X Resident Amended Income Tax Return Download Fill-In Form 274K. The rule amends withholding tables and other methods applicable to wages and other compensation paid on or after September 1 2010. The calculator reflects known rates as of Janunary 06 2010 and please also note that the personal income tax calculator doesnt reflect the CPP and EI deductions or contributions for your 2010 personal income tax.

2 Only available where at least one partner was born before 6 April 1935. For details on these and other changes see page 6. Indexing rate for taxation year 2010 The indexing rate for 2010 corresponds.

2010 Personal Income Tax Forms. 2010 Pennsylvania TeleFile Worksheet 1-888-4PAFILE 1-888-472-3453 Number of Forms W-2 If more than 7 youcannot use TeleFile. The Personal Allowance goes down by 1 for every 2 of income above the 100000 limit.

The Income Tax and Personal Allowances for 2010 were set at the 2009 budget. In practical terms indexing the tax system increases the amount of many deductions and tax credits by a rate determined on the basis of the rise in consumer prices in Qubec. China is now levying 345 percent on personal income from a salary.

PA-1 -- Online Use Tax Return. It can go down to zero. She would pay federal income tax of 468125 plus 25 on her income over 34000.

The personal income tax PIT was not introduced until the 1990s see Figure 83.

Tax Revenue Statistics Statistics Explained

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The History Of Taxes Here S How High Today S Rates Really Are

Personal Income Tax An Overview Sciencedirect Topics

Sources Of Central Government Gross Tax Revenue 2010 Download Scientific Diagram

Tax Revenue Statistics Statistics Explained

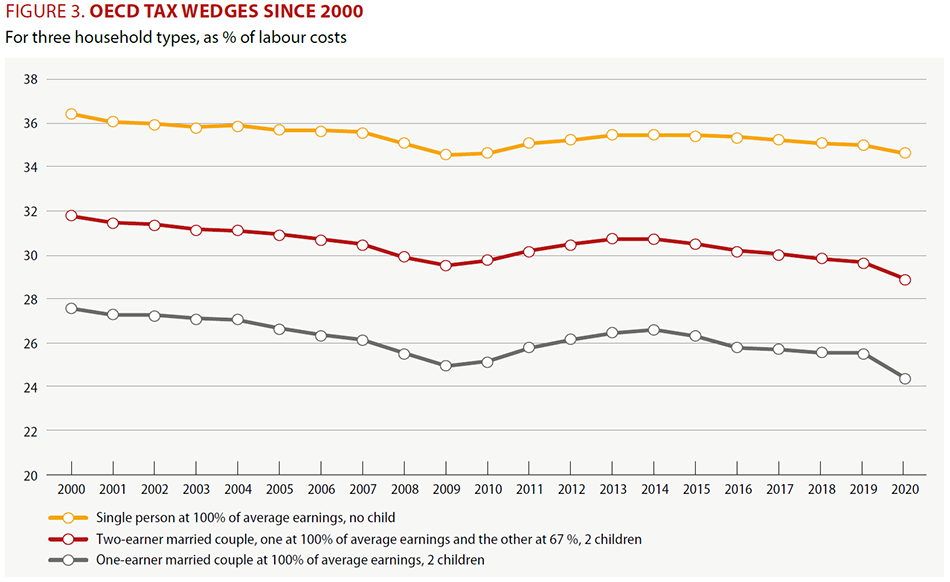

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

The Top Rate Of Income Tax British Politics And Policy At Lse

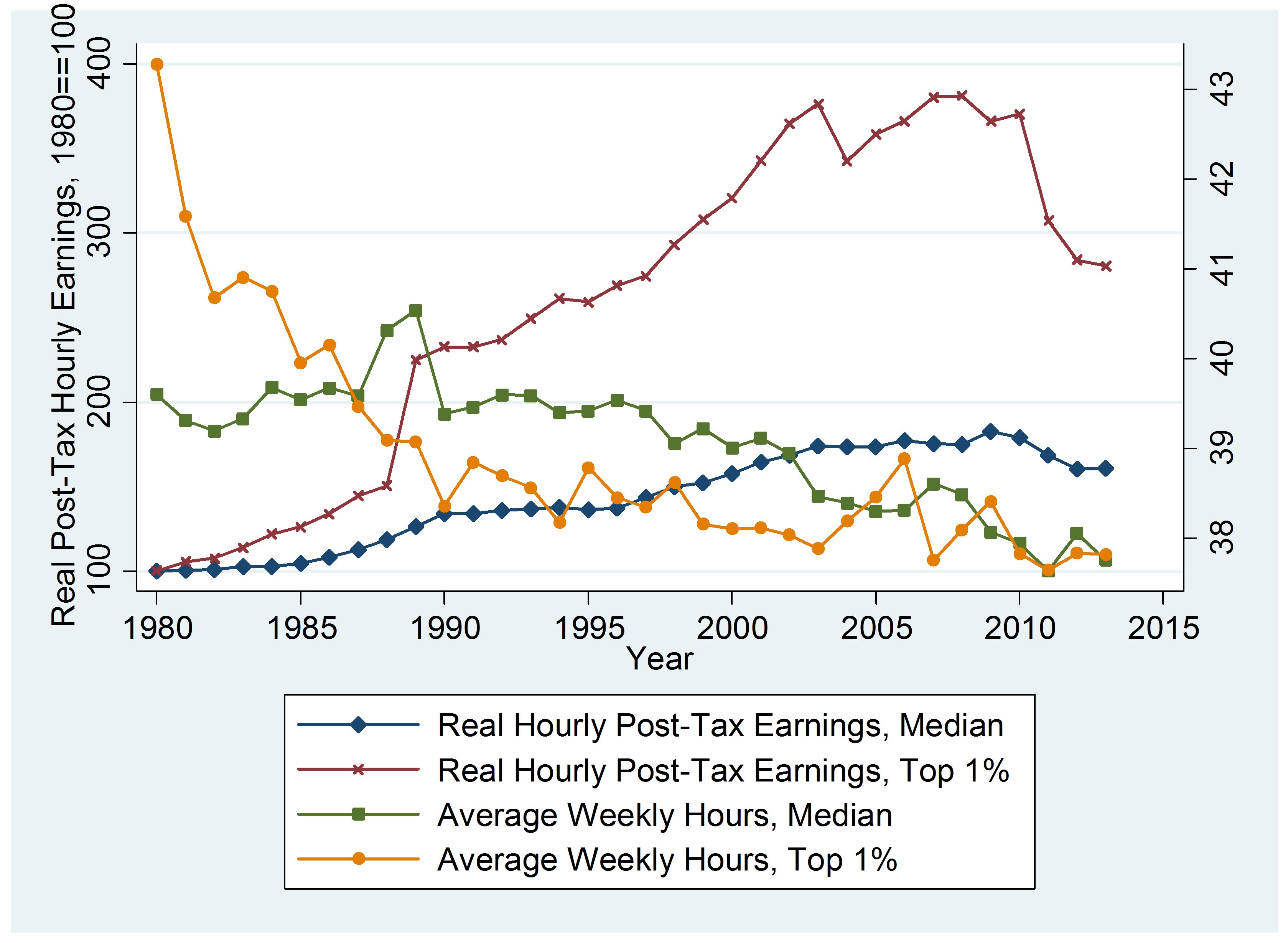

Tax Rate An Overview Sciencedirect Topics

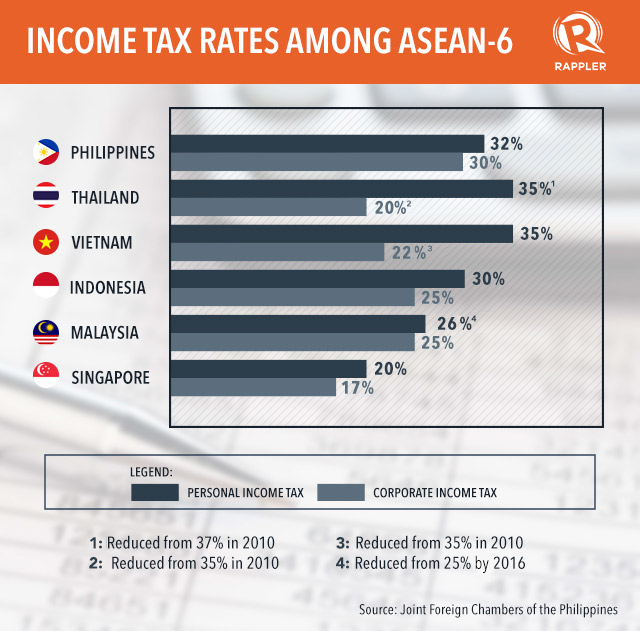

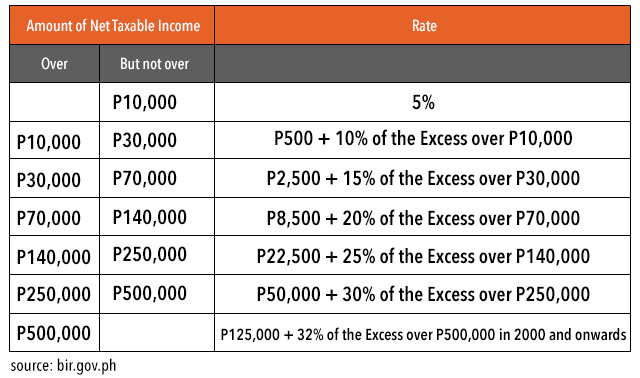

Why Ph Has 2nd Highest Income Tax In Asean

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

The Top Rate Of Income Tax British Politics And Policy At Lse

Why Ph Has 2nd Highest Income Tax In Asean

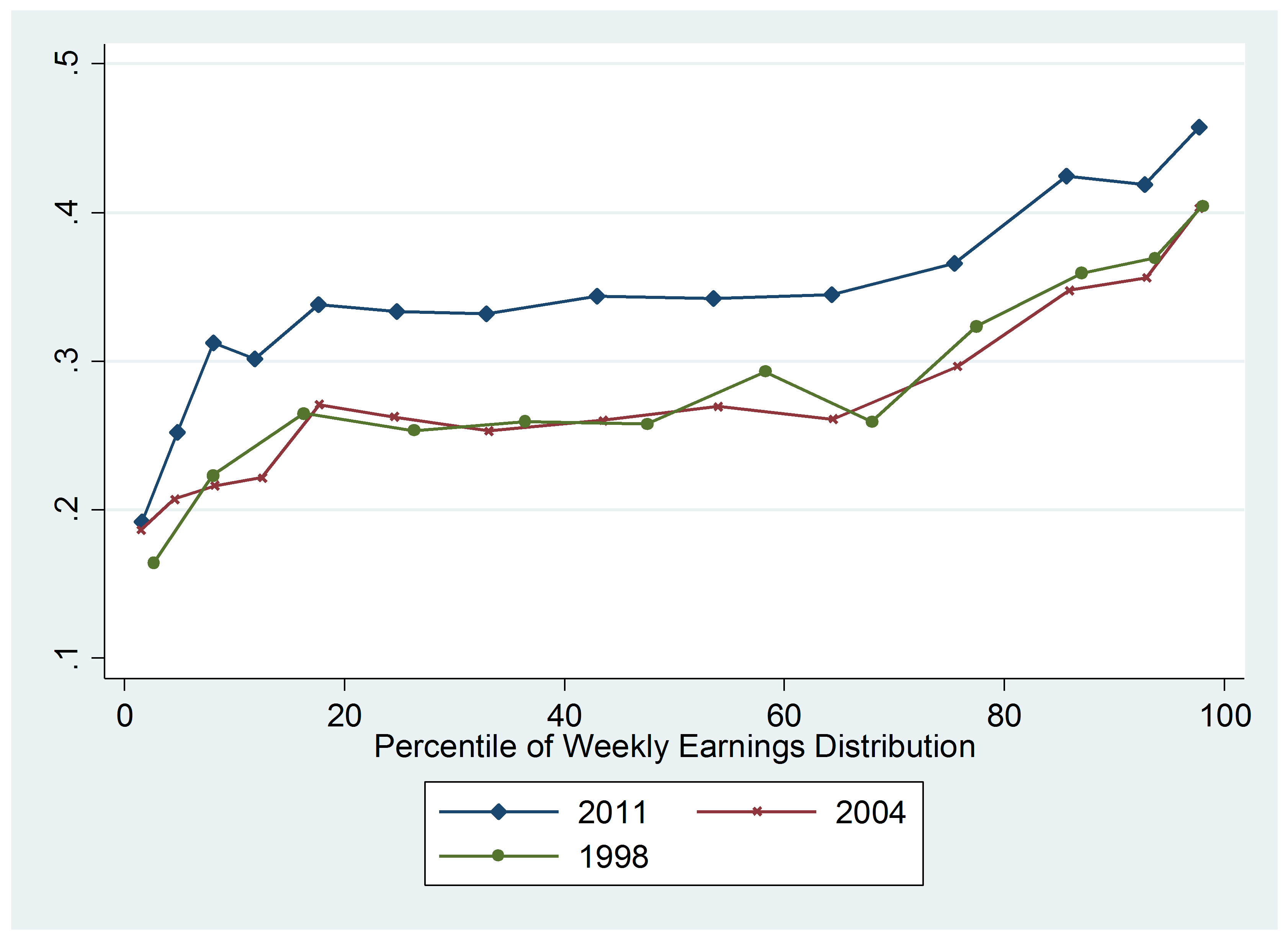

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center