Thus if a unit trust consultant fails to explain how my money is going to be invested then I reckon that the investment is very risky. Each beneficiary can be similar to a shareholder and are provided with units like shares in.

Other Than Asset Class How Else Can One Classify Mutual Funds Schemes Amfi Mutual Funds Investing Mutuals Funds Investment In India

So You want to Buy Units in a Unit Trust Fund.

Unit trust how to classified as. Are the cash flows solely payments of principal and interest. Xiii The law stipulates that a FEE with at least two members can elect to be classified as either a corporation or a partnership while an entity with a single owner can elect to be classified as either a corporation or a disregarded entity. A unit trust is an unincorporated mutual fund structure that allows funds to hold assets and provide profits that go straight to individual unit owners instead of reinvesting them back into the.

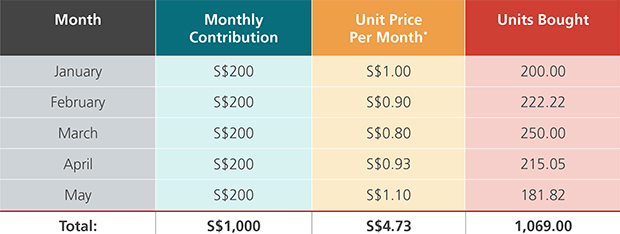

Simply put a unit trust fund is a way for you to invest your money. However in a Unit Trust - non-fixed. Unit investment trusts UITs and mutual funds are both baskets of stocks bonds and other securities that pool investors finances.

Unit trust fund rankings or ratings and other methods of evaluating a funds performance only enable you to compare the performance of your unit trust fund with other funds. Instead they can be redeemed - but only ever for a value of 100. This is the flexibility that a unit trust provides.

Here are some guidelines. 5w are contractually linked instruments classified. There are many beneficiaries to the trusts called Unit Holders.

Knowing adds certainty. Its all about you online and off. This is if there are 50 or more Unit Holders.

A unit trust is a form of collective investment constituted under a trust deed. The trustee has no discretion on which unit holder gets which distribution portion of income or capital of the trust. Ho 3w is the objective of the business model in which the asset is held assessed.

For example as a fiduciary a trustee has a duty to act in the best interests of the unitholders. Find funds that have lower sales charges. Manage your money online.

A unit trust is a fund which adopts a trust structure. An Investment Management Company or in some cases through your bank. 2w are debt investments classified.

Unfortunately many investors often misinterpret these evaluations as recommendations when they are not. A unit trust is where the unit holders who are all predominantly un-related members of two or more separate families getting together to hold an asset together usually a large property or shareholding or run a business together. S 102P 1 c Income Tax Assessment Act 1936.

A Unit Trust is classified as a Public Unit Trust. For unit trust investment an investor must be a sophisticated investor before heshe is qualified to invest in a fund categorized as a wholesale fund under the guideline issued by Securities Commission of Malaysia SC. A fiduciary is a person who holds a legal or ethical relationship of trust with one or more parties.

Trusts may be classified by their purpose duration creation method or by the nature of the trust property. Access your U-Online accounts securely anytime anywhere easy money. Unit Trust How to classified as Sophisticated Investors.

But more than 50 means you become a Public Unit Trust. If you invest in a unit trust or fund your money is pooled with money from other investors and invested in a portfolio of assets according to the funds stated investment objective and investment approach. Sure have lots of Unit Holders.

Certain unit investment trusts generally where there is an ability to vary the investments are not considered trusts for US tax purposes. Ho 6w are debt investments classified on. Those created while the grantor is alive are referred to as inter vivos trusts or living trusts.

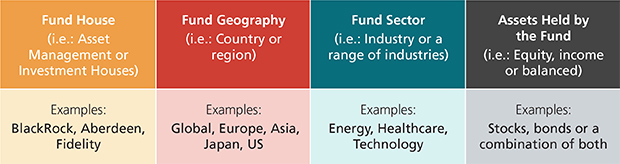

You can invest in a unit trust fund through financial services providers such as a broker. Unit trusts may have corporate trustees to limit any liability incurred by the trustee to that corporate entity and protect the assets of the unit. A unit trust pools investors money into a single fund which is managed by a fund manager.

Mutual funds are open-ended and actively managed with shares being offered to the public. Unit trust is a fixed express trust which allocates a share of property for beneficiaries in a trust agreement. UITs are trust funds with a set number of shares and end dates and they are often set up in series.

Not all funds use a trust structure. To stock investors investing without knowledge is very risky. Further ordinary units and further income units may be issued.

Income units can not be sold. These investment trusts are treated in the same manner as a traditional business entity under the rules discussed above ie. Unit Trust - non-fixed Yes units in a Unit Trust - non-fixed may be issued in the future.

One common way to describe trusts is by their relationship to the life of their creator.

Airconditioning Refrigeration Electrical And Appliances Sales Repairs Installations And Maintenanceover 30 Building Trade Industrial Heating Durban North

Taxbenefit In 2020 Wealth Creation Mutuals Funds Investing

Know About Tax On Mutual Fund And Taxation Rules Mutual Funds Investing Mutuals Funds Investing

Different Types Of Funds For Investors Personal Financial Planning Investing Wealth Management

What Is Unit Trust Investment Dbs Singapore

Best Time To Invest Is Now In 2021 Mutual Funds Investing Finance Investing Investing

Helpful Tips For Gold Investment Goldinvestment Goldcoins Investing Mutuals Funds Finance Investing

What Is A Balanced Mutual Fund Mutuals Funds Credit Score What Is Credit Score

Pin By Rabea Ikbal On Learn English Words English Language Learning Learn Arabic Language

Day 6 Design In The Historic Environment Gilfach Y Berthog Site Plan Sketch Plan Sketch Architecture Analysis

Grade 7 Health Unit 1 Maintaining Personal Standards And Commitments Health Unit Health Education Health Quotes

Pin On Ebecore Com 1410117 22167712648

Understanding Distribution Of Income By Unit Trust Funds

Won T I Need A Large Amount To Invest In Mutual Funds Mutuals Funds Mutual Funds Investing Investing

Mutual Fund Taxation How Mutual Fund Returns Are Taxed In India Mutuals Funds Money Market Fund

What Is Unit Trust Investment Dbs Singapore

Seven Reasons To Do A Sip Mutual Fund Investing Infographic Investment Sip Investment Mutual Funds Investing Investing Infographic Investment Infographic

Back To School Science Process Skills Bundle 6 Hands On Lessons And Posters Science Process Skills Back To School Mini Lessons