The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. O-SIIs are institutions that due to their systemic importance are more likely to create risks to financial stability.

Https Www Imf Org Media Files Publications Cr 2017 Cr17244 Ashx

SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

What is domestic systemically important banks. Each year in August RBI will disclose the names of banks designated as D-SIBs using two-step technical process that is not important for ordinary exams except may be for RBI Grade B office interviews. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs. Banks whose assets exceed 2 of GDP are considered part of this group.

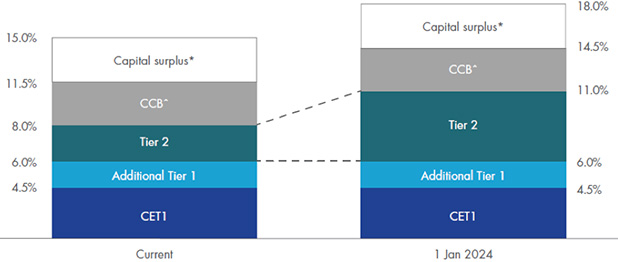

128 domestic systemically important banks dsibs It is the thrust of the Bangko Sentral to ensure that its capital adequacy framework is consistent with the Basel principles. Guideline for dealing with Domestic-Systemically Important Banks which sets out the assessment methodology to be applied by the Bank for classifying an institution as being systemically important. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019.

The first group SCO505 focuses mainly on the assessment methodology for D-SIBs while the second group RBC407 focuses on higher loss absorbency HLA for D-SIBs. The 12 principles can be broadly categorised into two groups. What is Domestic Systemically Important Bank D-SIB.

According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. Whilst maximizing private benefits through rational decisions these. Whereas the G-SIB framework considers the global impact of banking failures by realigning the framework it is hoped that the externalities of bank failure at the local level can be identified.

D-SIB means that the bank is too big to fail. The objectives of the guideline are. The list of institutions included in this section follows the EBA Guidelines on the criteria for the assessment of Other Systemically Important Institutions O-SIIs - pursuant to Article 131 3 of Directive 201336EU.

The banks whose assets exceed 2 of GDP are considered part. Last week the Reserve Bank of India RBI declared HDFC Bank Ltd to be a domestic systemically important bank D-SIB. Ii to assess the systemic importance of banks along the.

I to put in place a reference system for assessing the systemic importance of banks. The additional Common Equity Tier 1 CET1 requirement for D-SIBs was phased-in from April 1 2016 and became fully effective from April 1 2019. Hence the Bangko Sentral is adopting policy measures for DSIBs which are essentially aligned with the documents issued by BCBS on global systemically important banks GSIBs and DSIBs.

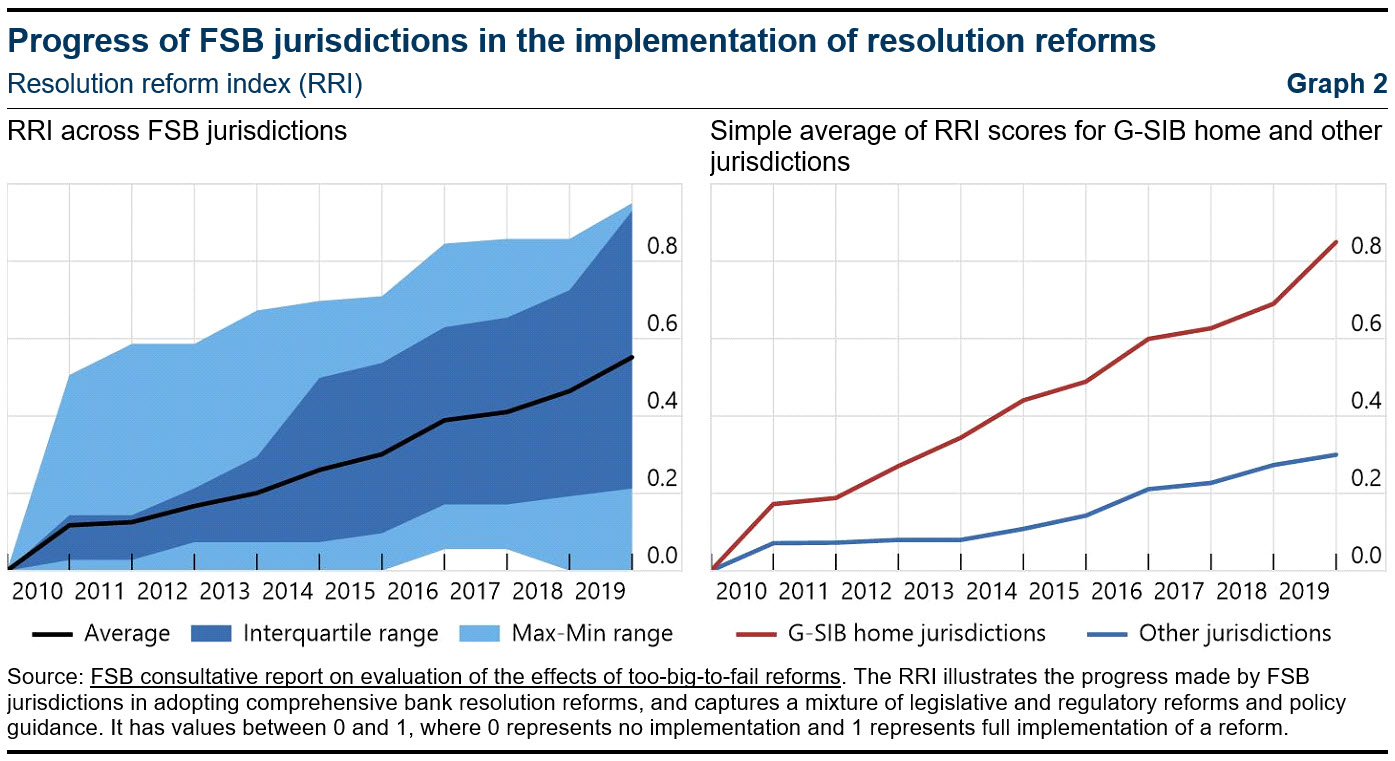

The global list came about following concern over the banking sectors vulnerability during the 2007-10 financial crisis. The other two such banks. The official G-SIB list is updated every November and.

Domestic Systemically Important Banks D-SIBs At the 2011 G20 summit it was proposed that the G-SIFI framework addressing the issue of too-big-to-fail should be extended to cover D-SIBs. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. The Committee has developed a set of principles that constitutes the domestic systemically important bank D-SIB framework.

Where have you heard about the list of systemically important banks. A framework for dealing with domestic systemically important banks assessment conducted by the local authorities who are best placed to evaluate the impact of failure on the local financial system and the local economy. SBI ICICI Bank and HDFC Bank continue to be identified as Domestic Systemically Important Banks D-SIBs under the same bucketing structure as in the 2018 list of D-SIBs.

There are also various national lists of systemically important banks referred to by regulators as domestic systemically important banks D-SIBs. What is a domestic systemically important bank and why is it important. RBI issued guidelines for Domestic Systemically Important Banks D-SIBs.

Https Www Bnm Gov My Documents 20124 883228 Policy Document Dsbi Feb2020 Pdf E9ccf184 8530 A328 21fd 23810edddcd9 T 1587360482884

What Exactly Is Meant By Tier 1 And Tier 2 Capital Quora

Addressing Sifis Implementation Financial Stability Board

Hong Kong Monetary Authority Systemically Important Authorized Institutions Sibs

Hdfc Bank Not Among Domestic Systemically Important Banks Examrace

Sbi Icici Bank Hdfc Bank Remain Systemically Important Banks Rbi

More Lenders Likely To Be Added To Rbi S List Of Systemically Important Banks Report

What Exactly Is Meant By Tier 1 And Tier 2 Capital Quora

Https Www Financialresearch Gov Viewpoint Papers Files Ofrvp 17 04 Systemically Important Banks Pdf

What Are Domestic Systematically Important Banks D Sibs Sbi Hdfc Icici Too Big To Fail

Expectations On The Use Of Pillar Ii Capital Buffers For Dtis Using The Standardized Approach To Credit Risk

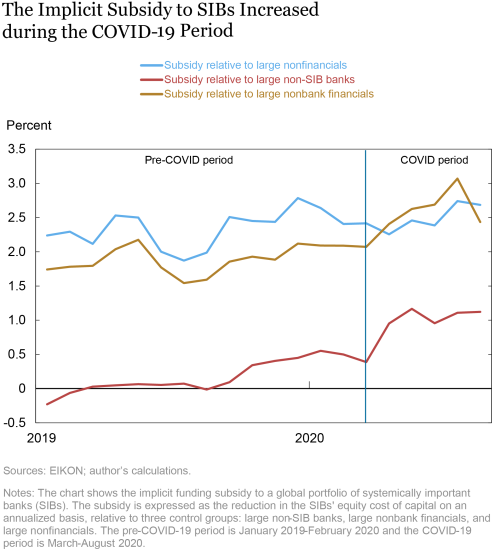

Did Subsidies To Too Big To Fail Banks Increase During The Covid 19 Pandemic Liberty Street Economics

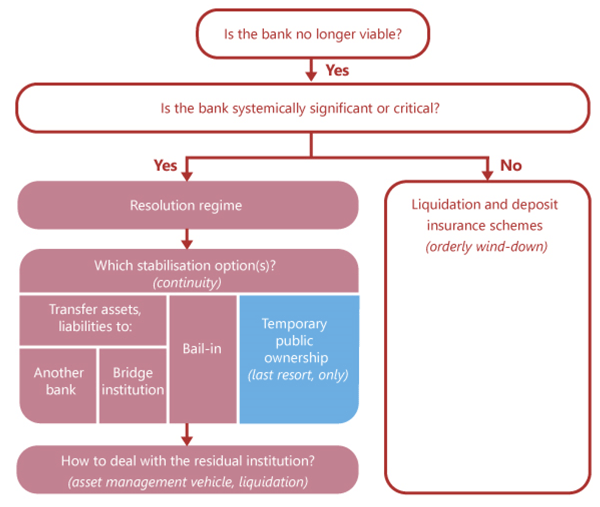

Bank Resolution Framework Executive Summary

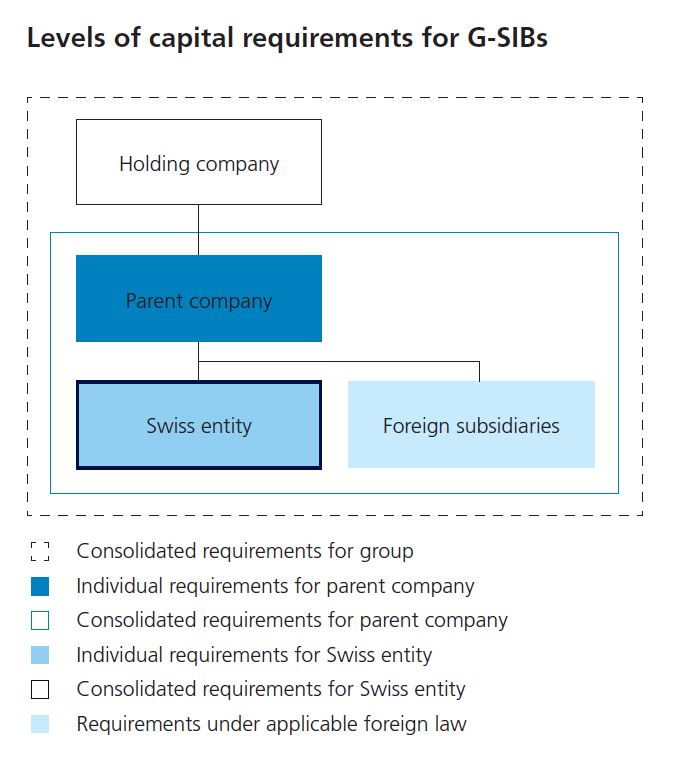

Capital Requirements For Systemically Important Banks

Https Www Bis Org Publ Bcbs233 Pdf

All About Systemically Important Banks D Sibs And G Sibs

List Of Systemically Important Banks In India D Sibs Framework