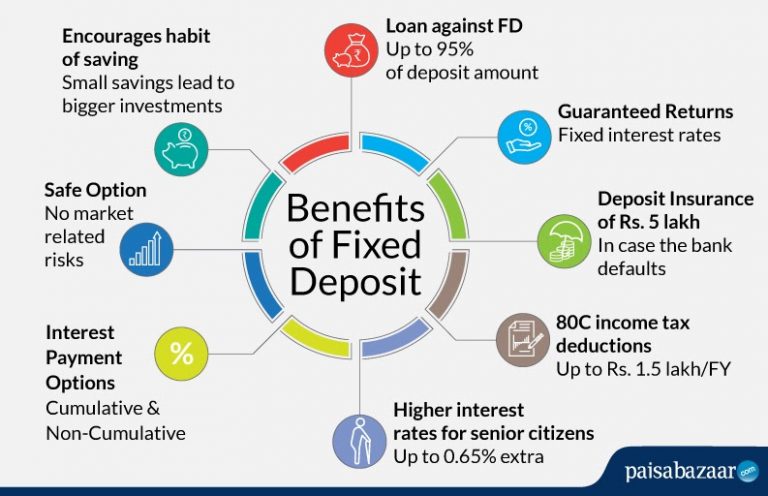

One has to spread his investments - deposit with a nationalised bank stocks debentures mutual funds gold. So there is almost no risk in fixed deposit.

What Is Fixed Deposit Meaning Interest Rates Benefits Risk Bank Fd Vs Corporate Fd

You will earn more interest than savings account even if you apply for a short-term deposit.

Why higher fixed deposit rate is bad. Small banks need to pay more interest to attract customers eyeballs as some people might not even heard of these banks before. This is kind of a marketing strategy. In fact the longer you keep your money in the fixed deposit account the more interest rate youll earn.

Fixed deposits from banks offer fixed interest rates at a contracted rate and until maturity. This is not bad at all and is a good 15 per cent more than what fixed deposits of leading. In a falling interest rate environment FDs that are due to mature will get offered a lower rate at the time of maturity.

It is similar to a depo rate which can refer to interest paid on the. Here are four probable reasons why that happened. Why HIGHER Fixed Deposit Rate is a BAD news to you.

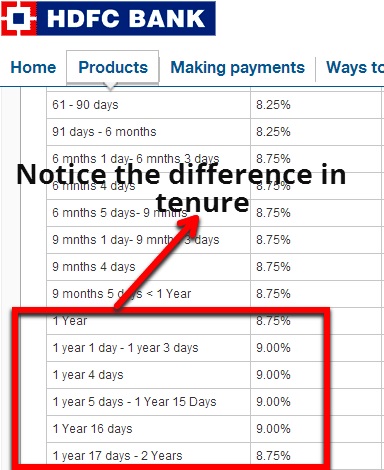

Banks often try to win customers by offering better interest rates on fixed deposit. Since you agree to keep the money deposited with the bank for a fixed period of time and are discouraged from withdrawing the bank gives you a very good interest rate. Fixed Deposits lately come with advertisements of super high attractive interest rates but many people eagerly sign up only to find they didnt get the rate thought they would.

Higher interest rates This is still highly dependent on the particular bank or financial institution youll use for your fixed deposit account. Bank of Barodas 1 year to 2-year and 3. Competitive bank fixed deposit rates.

Why is this BAD news to some of us. An FD account is an investment in which the customer deposits a big sum of money usually starting at RM1000 and upwards for a fixed time period. If you put.

A balance in the savings account which is more than Rs 1 lakh attracts an interest rate of 7 per cent. Bank FDs carry the risk of being locked in for a long tenure at low rate of return. Because of higher FD rate offered the cost of funding of that particular bank will be higher as well thus it may affect the base rate BR subsequently.

Short to medium term tenures have higher rates. Of course the effect will be higher interest being charged to loan borrowers. Interest rates offered on FDs are higher than those offered on Savings Accounts so helping your money grow in a term deposit is the more lucrative option.

This is because these small banks are at an disadvantage when competing against those large banks in taking deposit. Lets say you have a large sum of cash which you intend to use to buy something in a month or two. The negative aspect of fixed deposits especially in these days is that the interest rates are not attractive and barely equals the rate of inflation.

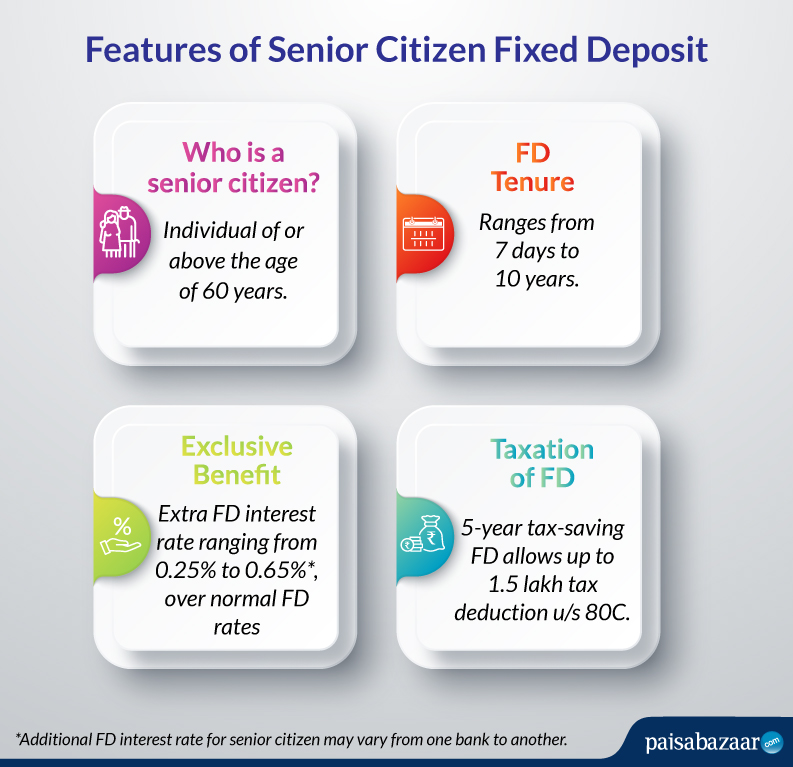

Placing your money in a fixed deposit account usually earns you a higher interest rate compared to a savings account. In addition financial institutions offer a greater rate for senior citizens when they open an FD. Also the returns will not face any impact on whether the market is fluctuating.

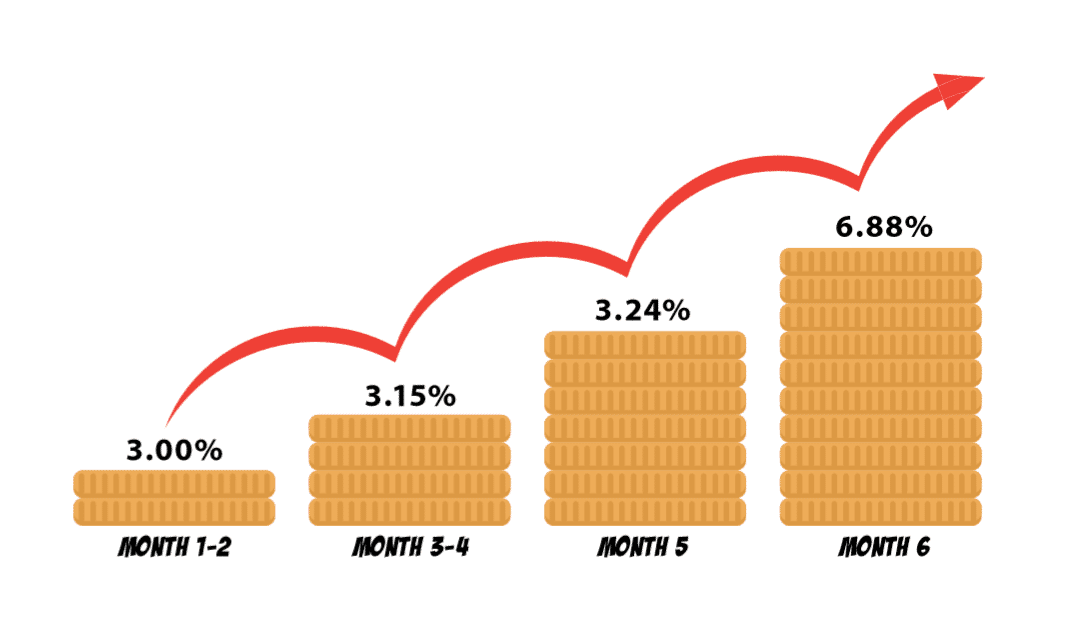

Coupled with aggressive FD promotions dished by almost all the banks recently it was like an FD heaven win-win situation for both banks and depositors. Generally speaking small bank or unknown bank will pay a higher fixed deposit rate. Currently interest rates of deposits with tenures ranging from one to three years and in some cases up to five years are slightly higher than the rates on FDs of longer duration.

Another strong reason why I love fixed deposit is the competitive fixed deposit rates. April 28 2016 Maybe due to the unfavourable market environment many people are flocking to place their money in bank Fixed Deposit. For instance PNB offers 675 percent for FDs with tenures between 1 year and 3 years and for 3-5 years FDs it is 625 percent.

A fixed deposit offers higher rates which leads to achieving better returns. Before the COVID-19 pandemic the fixed deposit interest rate in Malaysia ranged from 315 to 40 per annum. In general though almost all banks offer comparatively higher interest rates for fixed deposits relative to normal savings account.

This is because these small banks are at an disadvantage when competing against those large banks in taking deposit. Small banks need to pay more interest to attract customers eyeballs as some people might not even heard of these banks before. You must understand why.

Therefore you will be able to earn more on your capital. Compared to a bank savings account the fixed deposit interest rates are higher. Generally speaking small bank or unknown bank will pay a higher fixed deposit rate.

Also people tend to choose. Interest rate risk. Youll Get Higher Interest Rates.

And during special campaign and promotion some bank offers interest rate. Some banks offer interest rates of more than 9 per cent for fixed deposits of 1-2 years. Deposit accounts include certificates of deposit CD savings accounts and self-directed deposit retirement accounts.

Bank Fixed Deposit Fd What Happens If You Not Renew Or Withdraw It

Benefits Of Fixed Deposits Fds In India

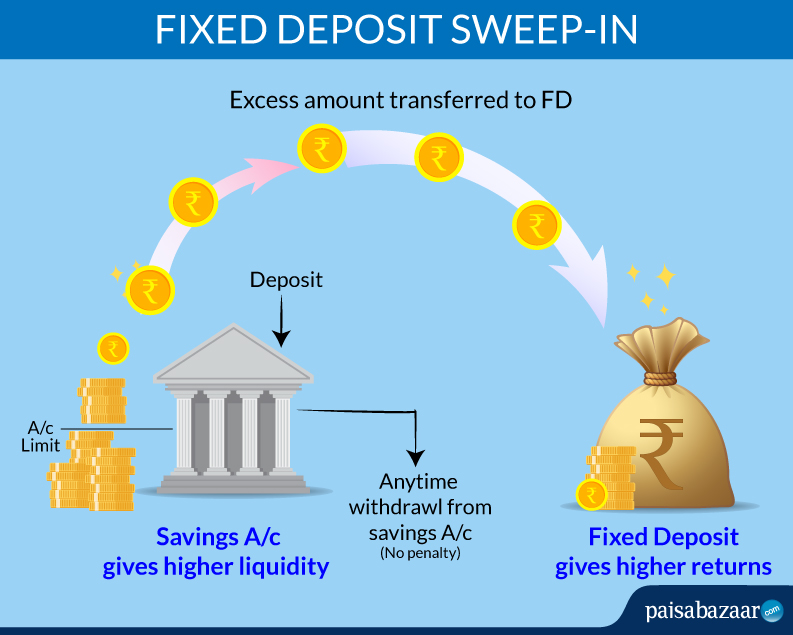

Fixed Deposit Sweep In Hdfc Yes Bank Sbi Icici Bank Paisabazaar Com

Fd Interest Rates 2020 Should You Invest In Fixed Deposits With Banks

Commercial Credit Sri Lanka Fixed Deposit Interest Rates Credit Walls

Latest Post Office Small Saving Schemes Interest Rates Jan Mar 2020 Post Office Interest Rates Investment In India

Everything You Need To Know About Fixed Deposits

Idbi Bank Freedom Deposits Offers Interest Rates That Are Amongst The Highest In The Industry Now Get The Bene Interest Calculator Deposit Best Interest Rates

Best Fixed Deposit Rates In Singapore Interest Rates Singapore Deposit

Fd Interest Rates High Fixed Deposit Interest Rates Jul 2021

Fixed Deposit 9 Interest Rate Jana Small Finance Bank Finance Bank Deposit Bank Ad

Senior Citizen Fd Rates Schemes 2021 I Paisabazaar

Fixed Deposit Rates In Malaysia V No 15

Commercial Credit Sri Lanka Fixed Deposit Interest Rates Credit Walls

How Much Interest Will I Get If I Deposit 40 Lakhs In A Fixed Deposit Account Quora

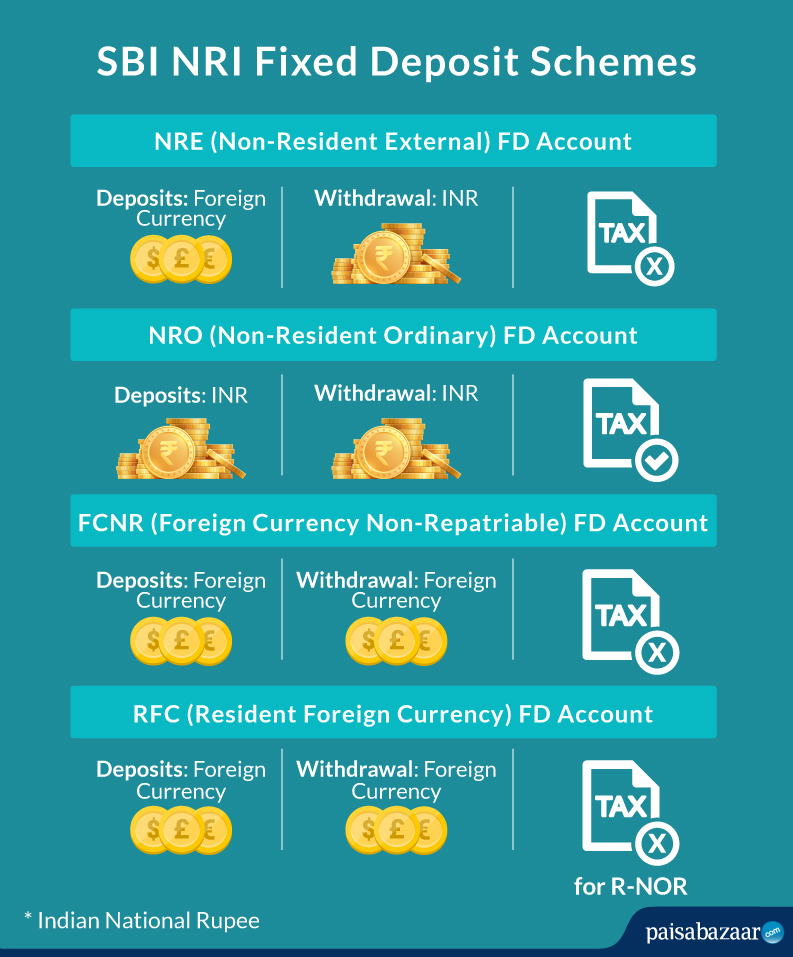

Sbi Nri Fd Rates Sbi Nre Fd Interest Rates 2021

What Is Loan Against Fd Fixed Deposit Features How It Works Yadnya Investment Academy

Commercial Credit Sri Lanka Fixed Deposit Interest Rates Credit Walls

Fixed Deposits How Fd Laddering Can Maximise Your Investment Benefits The Financial Express