If you have been asked to work from home because of the COVID-19 emergency you may be able to claim tax relief against the cost of home expenses. Any employee who falls ill pursuant to exposure to Covid-19 at work will be entitled to claim from the Compensation Fund.

Global Covid 19 Individual Income Tax Responses Airinc Workforce Globalization

To claim CoviD-19 Tax Relief for PAYE.

Covid-19 tax relief for paye. The first deferment can be claimed in your April 2020 EMP201 return which is due by 7 May 2020. Relief for Kenyans as Uhuru cuts PAYE tax He further ordered the reduction of VAT from 16 to 14 effective 1st April. 100 tax relief for gross income of up to KES24000 per month The Government has proposed to extend 100 tax relief to persons earning gross monthly income of up to KES24000.

PAYE to move from 25 per cent to 30 per cent. Broadly speaking claimants are. The Minister of Employment and Labour has issued a Directive called Covid19 Temporary EmployeeEmployer Relief Scheme C19 TERS effective 26 March 2020.

Check if you can claim Previous. A total of R30 billion has been allocated to a special National Disaster Benefit Fund which will pay Unemployment Insurance Fund benefits for up to. Tax assistance COVID-19 and emergency support.

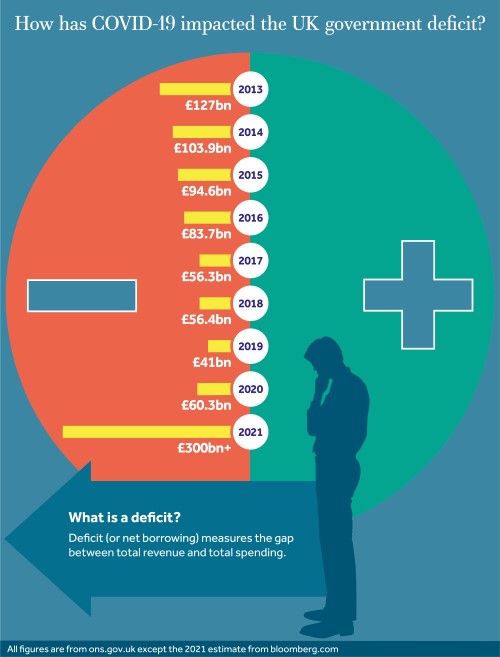

The UK government has announced a range of emergency tax measures designed to help businesses deal with the fallout from the COVID-19 outbreak including a deferral of VAT payments and a relaxation of Time to Pay rules. Tax compliant small to medium sized businesses play an important role in stimulating. Although the announcements are welcome.

For example if you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 120 per week in tax relief 20 of 6. PAYE tax relief period The Covid-19 Tax Relief for PAYE is available for the four-month tax period from 1 April 2020 to 31 July 2020. - The United Kingdom provides an automatic three-monthdeferral for Value-Added Tax VAT payments for all businesses from 20 March 2020 to 30 June 2020.

The Fourth Schedule to the Income Tax Act for late payment of PAYE. No penalties and interest will be imposed for the deferred tax debts. COVID-19 outbreak and lockdown as well as reducing the burden of payroll taxes in the short term Government proposes a four-month holiday non- payment for skills development levy contributions 1 per cent of monthly payroll made by employers.

It also provides a six-month deferral for income tax payments for self-employed persons from 31 July 2020 to 31 January 2021. Last week government gazetted new details to about the Covid-19 Temporary Relief Benefit scheme which will see the Unemployment Insurance Fund pay out money to companies who cant afford it to help pay salaries. The address by President Cyril Ramaphosa on Monday 23 March 2020 set out certain fiscal relief measures to help small and medium enterprises SMEs and vulnerable firms mitigate cash flow.

VAT to move from 14 per cent to 16 per cent. Personal Finance Tax BENEFITS. As part of the relief measures Kenyans earning Ksh24000 and below will receive a 100 percent waiver on pay as you earn PAYE while earners above the threshold will see their PAYE.

Tax relief proposed by the President for SA SMEs. If you have a tax agent they should also be able to help. The article has been updated to clarify the position for workers between 30 and 65 under the new ETI scheme.

Tax relief and income assistance is available to people affected by the downturn in business due to the COVID-19 novel coronavirus. Global Edition EYs Tax News Update. Budget 2021 It was announced in Budget 2021 that the following expenses will be covered as an allowable home expense for e-working tax relief.

Effective 1 January 2021. This Directive will remain in operation for a period of 3 months or until it is withdrawn by the Minister whichever comes first. We have a range of ways to help depending on your circumstances.

End of covid-19 tax relief. REASONS FOR CHANGE The recent COVID-19 outbreak will have significant and potentially lasting impacts on the economy with businesses facing the risk of cash flow problems. 31 March 2020 Global Tax Alert South Africa introduces tax relief measures in response to COVID-19 at 30 March 2020 EY Tax News Update.

3 rows A. PAYE Pay As You Earn needed to be paid by the employer typically on higher earning employees wages without affecting the employees salary. The COVID-19 Tax Relief for PAYE is the payment of 65 of the total PAYE liability and.

On 25 March 2020 the Kenyan President announced the following tax measures to help the Kenyan economy in response to COVID-19 and its impact on the local economy.

Hmrc If You Re Working From Home Because Of Covid 19 You May Be Able To Claim Tax Relief It S Quick And Easy To Do On Gov Uk Check If You Re Eligible

Jurisdictional Tax Measures In Response To Covid 19 Kpmg Global

Tax Compliance And Covid 19 Hmrc Takes New Approach To Investigations And Disputes Osborne Clarke Osborne Clarke

Flash Alerts Covid 19 Kpmg Global

Why Businesses Expect A Shift To Covid 19 Tax Enforcement

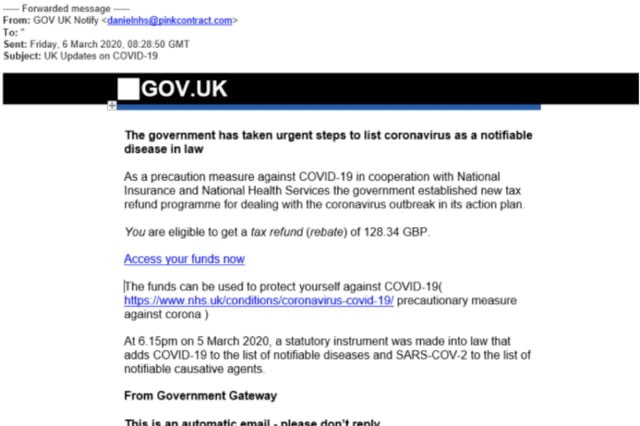

Coronavirus Scams Police Release A Warning As Fake Emails And Texts About Tax Refunds On The Rise The Scotsman

Https Assets Kpmg Content Dam Kpmg Us Pdf 2020 04 Tnf Sa1 Apr2 2020 Pdf

Hmrc Our Coronavirus Helpline Is Very Busy At The Moment If You Ve Missed Or Are Worried About Missing Your Next Tax Payment In The Coming Days Please Call If It S About

Global Covid 19 Individual Income Tax Responses Airinc Workforce Globalization

Press Release Covid 19 Tax Relief Measures Extended To September 30 2020 Guyana Revenue Authority

Government Tax Incentives And Covid 19 The Next Stage Of Thinking Rsm Global

Https Www Pwc Com Ng En Assets Pdf Tax Measures Address Covid 19 Africa Pdf

Hmrc Issues Warning On Self Assessment Scammers Ftadviser Com

Covid 19 Coronavirus A Cross Jurisdictional Update On The Pandemic S Impact On Tax Regulations Allen Overy

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Covid 19 Ireland Income Tax Immigration Considerations

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Https Assets Kpmg Content Dam Kpmg Us Pdf 2020 04 Covid 19 Tax Developments Summary April10 2020 Pdf

United Kingdom Tax Development In Response To Covid 19 Kpmg Global