That in turn could allow cities counties and states to provide property tax relief for homeowners and still have access to funding for administration schools and other services. 5500 x 2 11000 As the landlord has passed on the Property Tax Rebate of 1800 to tenant he has waived a further amount of 9200 ie.

/HOWMONEYISMADEREALESTATEFINALJPEG-8db8883c13df4233ba2aad6ae392647f.jpg)

How To Make Money In Real Estate

It prevents lenders from foreclosing on property owners with 10 units or fewer until May 1 if they have experienced a Covid.

Covid 19 tax relief for rental property owners. The federal Tax Cuts and Jobs Act TCJA and the Coronavirus Aid Relief and Economic Security CARES Act ushers in some changes rental property owners can take advantage of. Households affected by COVID-19. For tenantssub-tenants who have received rental relief from their landlordsintermediary landlords in the form of rental waivers under the Rental Relief Framework the reduced amount of rental expenses incurred by the tenantssub-tenants will be allowed for tax deduction if such rental expenses are incurred in the production of income and not prohibited for deduction under Section 151 of the ITA.

The type of benefit you are eligible for depends on the type of rental income you incur. Many residential rental property owners have had their rental income affected by COVID-19. Rental Income or Business Income.

The federal state and local governments announced several protections. The federal government has implemented stimulus measures most notably the Coronavirus Aid Relief and Economic Security Act CARES Act to combat the economic impact of the COVID-19 pandemic on businesses individuals and families. Coronavirus COVID-19.

Theres a large list of government-sponsored and private relief programs to help US. Whether your loan is owned by the government a national or state charter bank or private institution you may be eligible to reduce or delay payments for up to 12 months. Our website provides some frequently asked questions FAQs and other information to help you and your clients understand their rental.

At the beginning of 2021 the UK government announced a strict England-wide lockdown from 6th January 2021 imposed to halt the spread of the more transmissible COVID-19 variants. These funds were distributed to the states to award by September 30 2021. Paying or Collecting Rent Tenants who are asked to self-isolate or who.

Amount of Property Tax Rebate passed on to tenant. COVID-19 tax implications for rental property owners. Impact of COVID-19 on self-catering accommodation providers.

Next review clients property tax assessments with them every year. The law does offer minimal relief for landlords. Bills tax relief rental supports and the health and safety information listed on this page is meant to support tenants and property owners minimize COVID-19 pandemic impacts.

1800 In this scenario tenant qualified for 2-month rental waiver ie. Below are financial aid programs. COVID-19 land tax relief boost for landlords and tenants A land tax relief scheme which supports landlords provide significant rent reductions for their residential and commercial SME tenants impacted by COVID-19 restrictions will be significantly expanded and.

Affected taxpayers are granted an extension to file 2019 California tax returns and make certain payments until June 15 2020 in line with Governor Newsoms March 12 Executive Order. You can share ownership of rental property with other people and the amount of rental income on which you will pay tax will depend on your share of the property. Its amazing how often we find errors miscalculations or outdated information when reviewing our clients assessments.

These restrictions meant people were only permitted to leave home for a very limited number of essential purposes and as a result all non. The CAA provided 25 billion for federal rental assistance to eligible households that were unable to make rent payments due to the coronavirus pandemic. 5500 x 2 - 1800 of rent in 2020 making it a total of 11000.

As a result your clients may ask you about what they can claim this tax time. Owners of rental properties suffered major financial difficulties during the COVID-19 pandemic. CRA has put together many emergency response benefits to help individuals and business owners.

Property owners impacted by COVID-19 may be eligible for temporary relief. In addition to loan programs mortgage relief and other measures that may benefit real estate businesses and investors the CARES Act contains tax relief provisions that could benefit property owners. A federal ban on evictions is putting the squeeze on smaller landlords who are unable to directly access Covid rental relief funds and some are starting to sell properties.

COVID-19 and residential rental property. How business property owners and their advisers can defend themselves post-COVID. This type of arrangement is called a Forbearance PlanAgreement.

On Friday the president signed the COVID-19 aid relief and economic stimulus package known as the CARES Act providing a 2 trillion stimulus package which includes 349 billion allocated to small businesses expands unemployment insurance payments provides certain tax credits and benefits grants certain student loan relief and provides direct payments to taxpayers via an immediately. First keep abreast of legislative announcements that could affect business clients taxes. Affected by the COVID-19 pandemic The Franchise Tax Board FTB has announced special tax relief for California taxpayers affected by the COVID-19 pandemic.

Heres a closer look at what you can expect when filing 2020 rental property taxes.

How To Save Tax On Rental Income Deductions Calculations Procedure

Our Guide To Understanding Your Property Taxes In Market City And Omaha Property Tax Understanding Yourself What Is Property

A Financial Calendar For 2020 21 Keep Your Date With Investments Taxes And Holidays Incometax Finance Calendar Investing Financial Finance

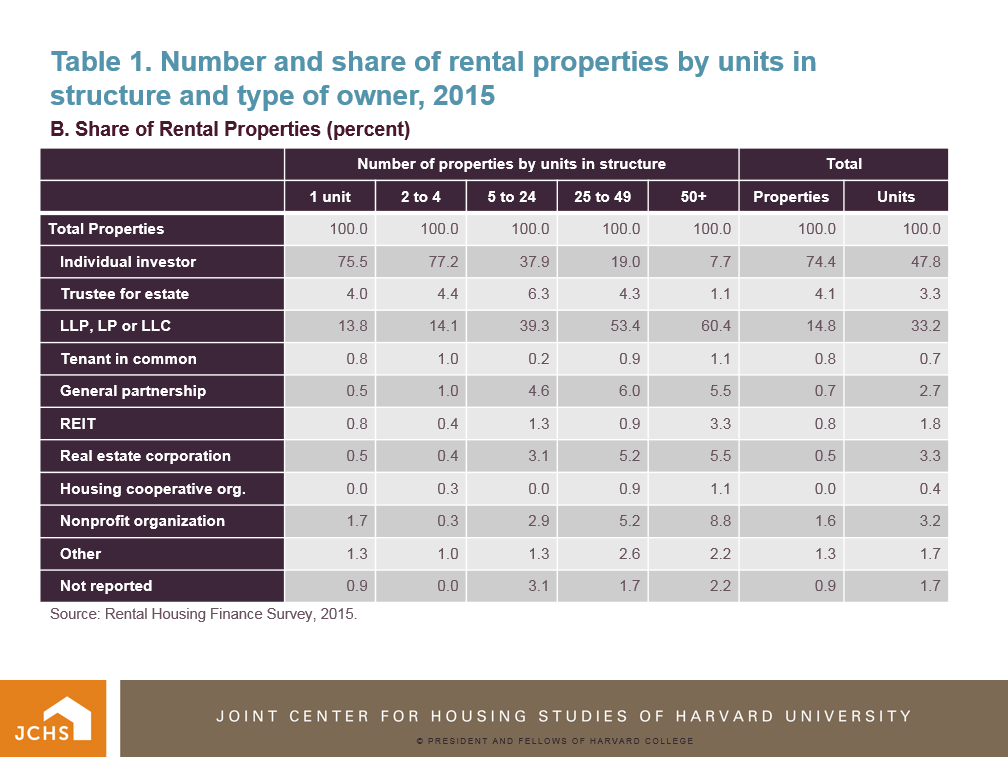

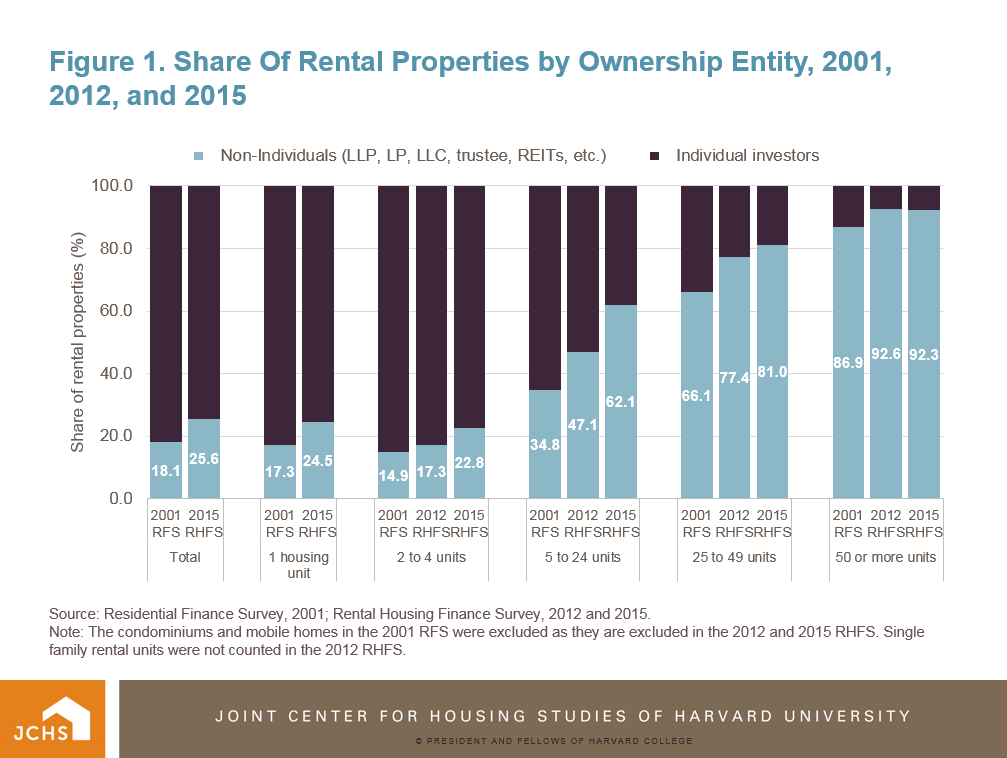

Who Owns Rental Properties And Is It Changing Joint Center For Housing Studies

Who Owns Rental Properties And Is It Changing Joint Center For Housing Studies

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Free Rental Property Management Spreadsheet In Excel Rental Property Management Rental Property Rental Property Investment

5 Reasons You Should Hire A Property Manager For Your Rental Home Rental Property Management Property Management Being A Landlord

Rental Property Improvements Depreciation New Tax Law

Pin On Spanish Life Properties

Every Landlord Hopes To Receive Timely Rent Payments The Truth Is That This Is Not Always The Rental Property Management Being A Landlord Real Estate Rentals

September 2019 Business Due Dates Cpa Business Advisors Inc Business Advisor Business Tax Due Date

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Income Expense Worksheet Rental Property Management Rental Income Real Estate Investing Rental Property

Landlords How To Pay Your Mortgage Property Expenses Covid 19

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Covid 19 Crisis May Affect Tax Angles For Rental Property Losses Mlr

Why Depreciation Matters For Rental Property Owners At Tax Time Stessa