New Basic Savings Quantum Begins January 2017. If your EPF Account 1 savings balance is RM50000 the Eligible Investment Amount is.

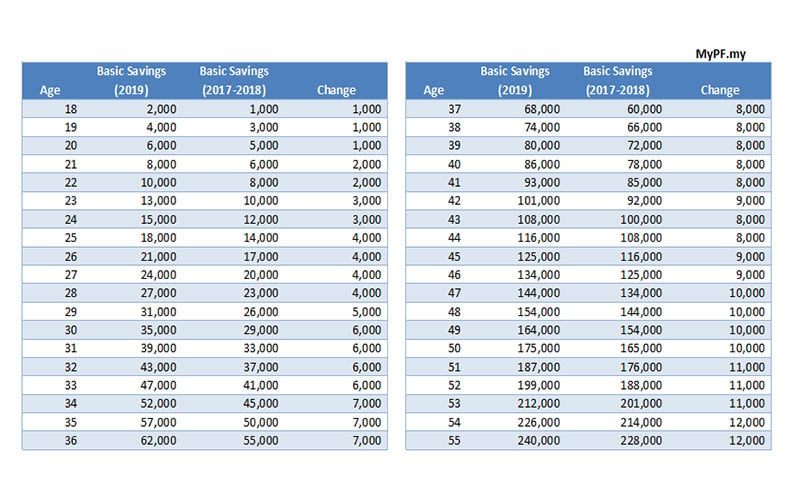

Finance Malaysia Blogspot Epf Mis Revised Basic Savings Table Effective Jan 2019

If your EPF Account 1 balance is below your basic savings you cannot invest through MIS.

Epf mis revised basic savings table and. The Act extends to the whole of India except the State of Jammu and Kashmir. What are the changes affecting EPF basic savings starting January 1st. Epf basic saving table Effective Jan 2014 1.

Introducing EPF i-Invest. Basic Savings refers to the amount that is considered. 20 rows New Basic Savings Quantum Begins January 2019.

If the minimum fund investment amount is RM1200 you must invest at least RM1200 in the unit trust fund up to a maximum of RM2500. KUALA LUMPUR Nov 28. If your EPF Account 1 savings balance is RM37000 the Eligible Investment Amount is.

Basic Savings in Account 1 can be invested 1 What is EPF-MIS. You may check out the latest minimum savings from the EPF website. Investment is transacted directly from your EPF Account 1.

KUALA LUMPUR 30 September 2016. How can you withdraw from EPF to invest in EPF Members Investment Schemes MIS. Calculate potential gains or risk losses from investingThe.

Wide range of EPF-qualified unit trust funds. RM50000 RM35000 x 30 RM4500. EPF Members Investment Withdrawal Eligibility Revised Basic Saving Table effective Jan 2014 Age Current 1st Jan 2014 RM 18 1000 1000 0 19 2000 2000 0 20 3000 4000 1000 33 21 4000 5000 1000 25 22 5000 7000 2000 40 23 7000 9000 2000 29 24 8000 11000 3000 38 25 9000 13000 4000 44 26 11000 15000 4000 36 27.

Effective 1 January 2017 the eligible amount members will be allowed to invest under the EPF-MIS has been increased to up to 30 per cent in excess of their Basic Savings from Account 1 from the current 20 per cent. See basic savings table below. EPF revised the amount in light of the rising cost of living longer life expectancy and a higher inflation rate.

The last revision took effect in 2017. KUALA LUMPUR 28 November 2018. Employees Provident Fund EPF Scheme This is payable for all establishments that have or are employing 20 or more people and are engaged in an industry listed under one of the 180 industries under Section 6 of Act with 12 of the basic pay Daily Allowance food concession along with retaining allowance if there are any up to a maximum of.

A scheme that allows EPF members to transfer a portion of their savings for investment in unit trusts. The amount will be set as the minimum target EPF basic savings members should have upon reaching. If you are 30 years old the Basic Savings is RM35000.

It is applicable to every establishment which employs 20 or more. Under EPF i-Invest eligible members can diversify up to 30 of the amount in excess of the basic savings in. According to EPF the basic savings refer to the amount that is considered sufficient to support members basic retirement needs for 20.

EPF-MIS Revised Basic Savings Table effective Jan 2019 Attention to all EPF members investment scheme MIS members once again EPF has just announced that they will be revising the basic savings threshold before a member can. The Benefits of Investing through EPF-MIS. The amount will be set as the minimum target EPF savings members should have when they reach age 55.

Opportunity to optimise your EPF savings. The latest EPF basic savings will take effect on Jan 1 2019. RM37000 - RM35000 x 30 RM600.

Increased Withdrawal Limits Basic Savings. The new quantum is benchmarked against the minimum pension for public sector staff which has been raised from RM820 to RM950 per month for 20 years upon reaching the age of 55. The Employees Provident Fund EPF today announces that the quantum for the Basic Savings will be revised from RM196800 to RM228000 effective 1 January 2017.

Employee Provident Fund EPF refers to the scheme which provides monetary benefits to the salaried class people upon retirementIt is governed by the Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF MP Act 1952. If you are 30 years old the Basic Savings is RM35000. EPF i-Invest is an initiative introduced by EPF in August 2019 to allow fellow EPF members to diversify their EPF savings into EPF-approved unit trusts under the Members Investment Scheme MIS all at the convenience of our very own devices.

Basic Saving Table from EPF website as of 9 March 2021 The minimum saving set by EPF will be updated from time to time. The Basic Savings in Account 1 is tabulated based on the minimum savings amount to ensure that the member will still be able to save up the minimum amount by the time he or. However the new quantum only refers to the basic savings considered sufficient to support a.

The amount will be set as the minimum target EPF basic savings members should have upon reaching age 55 the pension fund said in a statement today. Qualied EPF members can choose to invest into EPF-qualied unit trust funds with fund management institutions IPD appointed under the EPF-MIS. EPF account 1 value - required basic saving in account 1 based on your age x 30 Minimally you need to have RM1000 to start with MIS.

Diversify with selected overseas and domestic funds. Attention to all EPF members investment scheme MIS members EPF has just announced that they will revised the basic savings threshold before a member can withdraw for investment purpose effective Jan 2017. The EPF-MIS allows EPF members to withdraw a certain amount of money from Account 1 and invest into EPF-approved unit trusts provided the Basic Savings in Account 1 is met.

The Employees Provident Fund EPF announces that the quantum for the Basic Savings will be revised from the current RM228000 to RM240000 effective 1 January 2019. The Employees Provident Fund EPF will be revising the quantum for Basic Savings from the current RM228000 to RM240000 effective Jan 1 2019. Apart from that the basic savings schedule has also been revised up.

The quantum for the Basic Savings will be revised from.

Comparison Of Axis Bank And Sbi Personal Loan Interest Rates Loan Interest Rates Finance Investment Personal Loans

Latest Post Office Small Saving Schemes Interest Rates Jan Mar 2020 Post Office Interest Rates Investment In India

Post Office Interest Rate 2020 Oct Dec Nsc Ssy Ppf Scss Kvp Rd Mis Fd Savings Account Youtube

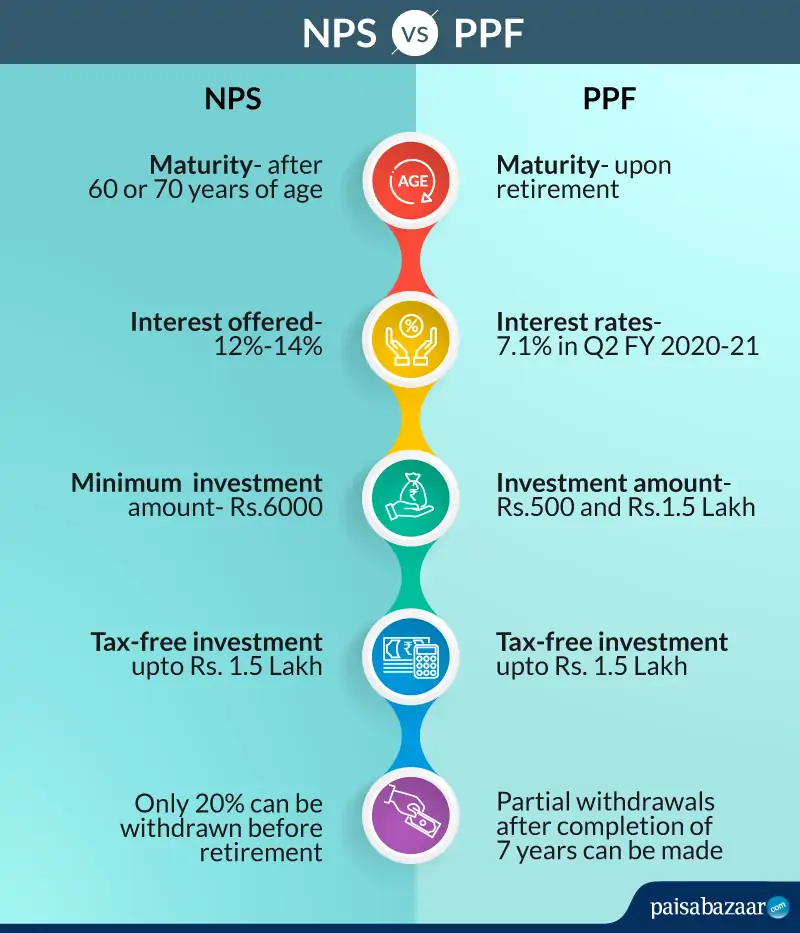

Nps Vs Ppf Comparison Returns Which Is Better

Post Office Saving Scheme Latest Interest Rate 2020 Post Office Rd Scheme Post Office Fd Ppf Youtube

Post Office Rd Plan 2020 Post Office Recurring Deposit Post Office Rd Interest Rate 2020 Youtube How To Plan Post Office Educational Videos

Post Office Saving Schemes Revised Interest Rates From 1 Apr 2014 Post Office Schemes Post

Small Savings Interest Rates Types Comparison Benefits Scripbox

Capital Gain For Different Kind Of Investors Capital Gain Income Tax Equity

How To Plan You Tax 5 Things To Know Financial Management Tax How To Plan

Post Office Small Saving Schemes Interest Rates Apr Jun 2020

4 Basic Saving Amount Download Table

Epf New Basic Savings Changes In 2019 Free Malaysia Today Fmt

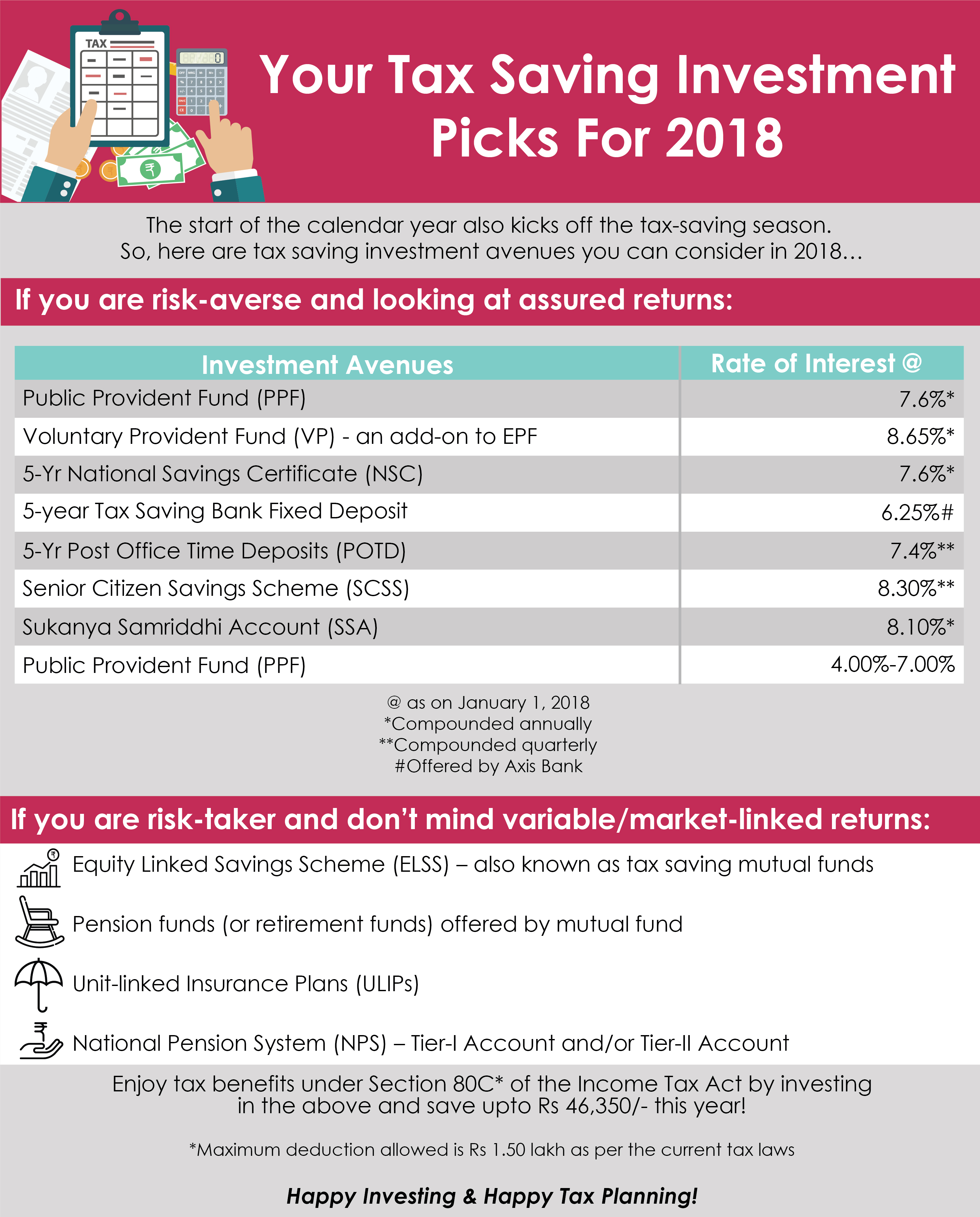

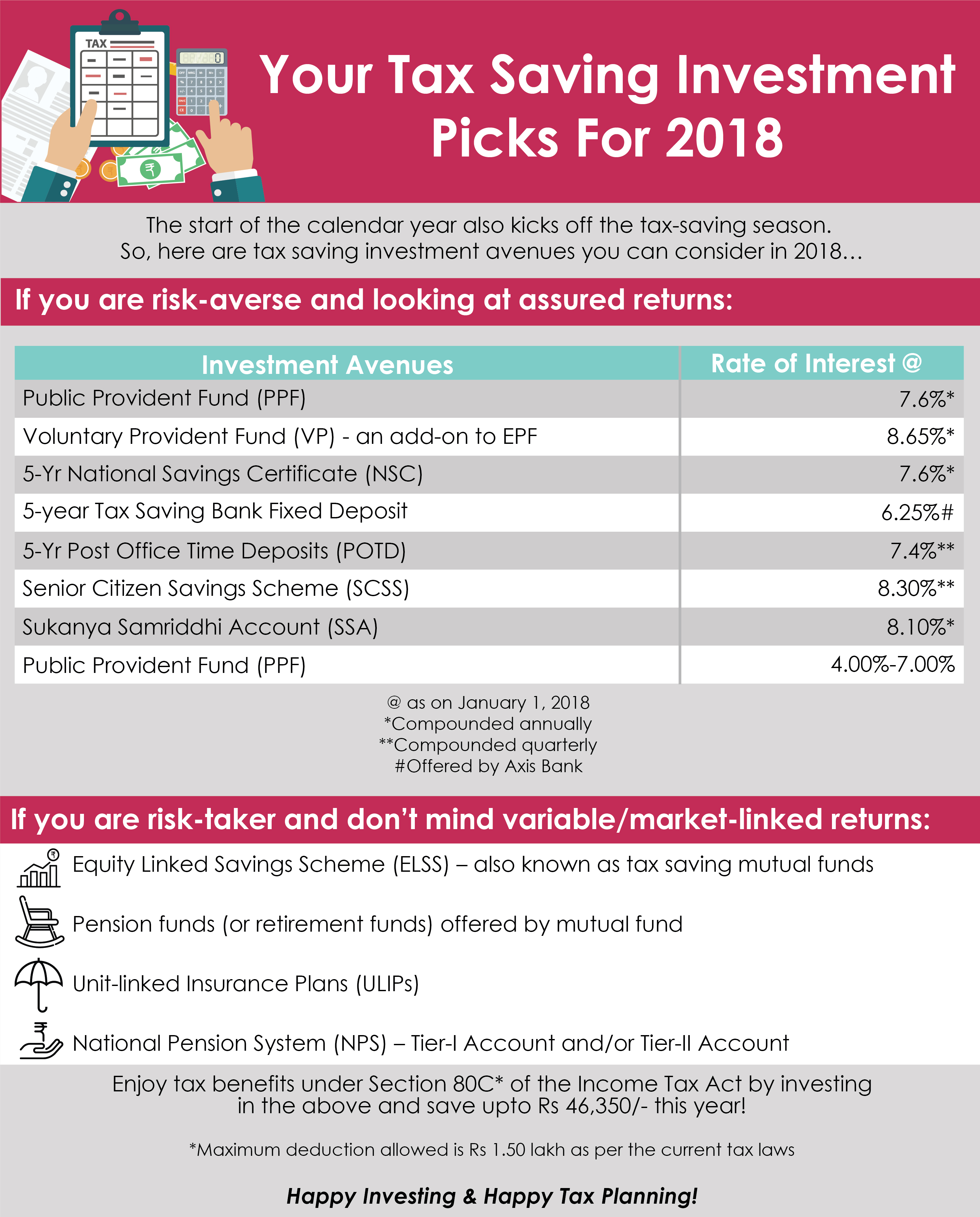

Tax Saving Investment Picks For 2018

Post Office Small Saving Schemes Interest Rates Jan Mar 2021

Tax And Income From Let Out House Property House Property Let It Be Property

Ppf Rates Remain Unchanged Sukanya Samriddhi Continues To Fetch 7 6

Post Office Saving Scheme Latest Interest Rate October 2020 Post Office Fd Ppf Post Office Rd Youtube