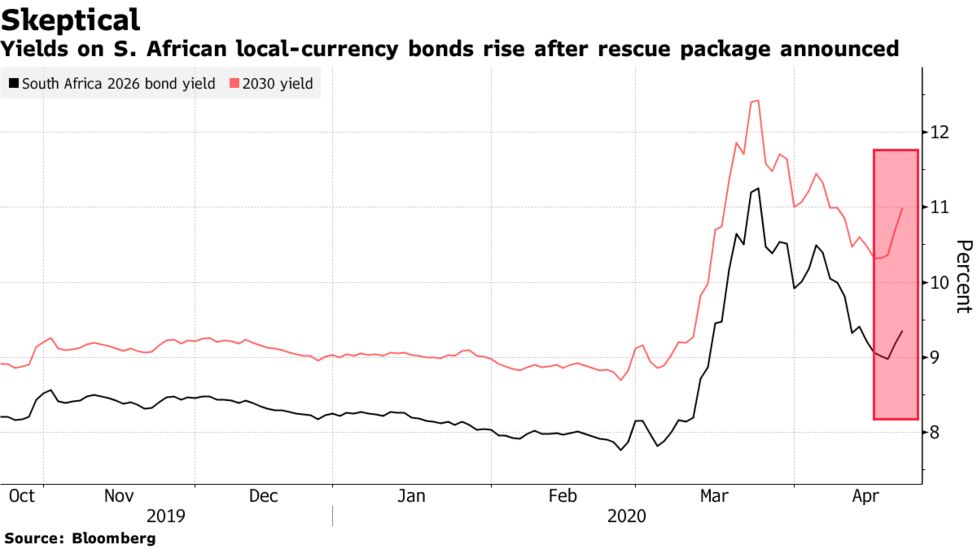

Due to the downgrade South Africas government bonds will be excluded from the FTSE World Government Bond Index. Both SP Global and Fitch have since further downgraded South Africa while all three agencies currently have a negative outlook for the country.

Ftse Russell Confirms Chinese Sovereign Bonds To Join Wgbi Index Nikkei Asia

It comprises sovereign debt from over 20 countries denominated in.

Ftse world government bond index south africa. The South Africa Government Bond 10Y is expected to trade at 903 percent by the end of this quarter according to Trading Economics global. The FTSEJSE Fixed Income Index Series represents the performance of South African bonds. South Africa lost its last investment grade rating in March forcing it to be excluded from the World Government Bond Index WGBI on Thursday.

Domestically-issued South African government state-owned and corporate bonds. If a bond is not rated by SP but it is rated by Moodys Investor Service Inc Moodys the SP equivalent of the Moodys rating is assigned. South Africa Joins the Citi World Government Bond.

The Fund aims to invest as far as possible and practicable in the fixed income FI securities such as. South Africa Government Bond 10Y - data forecasts historical chart - was last updated on June of 2021. Index quality is defined to be the rating assigned by Standard and Poors Financial Services LLC SP when it exists.

So from a technology perspective its as good as were going to get Randall adds. The Ashburton World Government Bond ETF aims to provide investors with exposure to investment grade sovereign bonds across developed and emerging markets through the purchase of a JSE listed ETF representing the FTSE World Government Bond Index WGBI. That means some large overseas.

The same technology platform that FTSE Russell uses to calculate the WGBI is now going to be used to calculate our indices the same software and the same systems. South Africa Index Quality. Benchmark FTSE World Government Bond Index Domicile South Africa Reporting currency Rand Pricing Daily Available on website Income distributions Quarterly Rebalancing frequency Monthly JSE code ASHWGB ISIN ZAE000254413 Regulation 28 No Management company Ashburton Management Company RF PTY LTD Investment manager Ashburton Fund Managers.

One of the biggest bond indices in the world is the FTSE World Government Bond Index WGBI he points out. FTSE World Government Bond Index WGBI A broad index providing exposure to the global sovereign fixed income market the index measures the performance of fixed-rate local currency investment-grade sovereign bonds. Methodology of flagship FTSE government benchmarks including the investment grade FTSE World Government Bond Index WGBI.

Covid-19 puts Eskoms integrated resource plan at risk. Thando Maeko-Moodys could hold decision on SA downgrade for now. As within the equity framework a Watch List of countries on the cusp of reclassification will be published and maintained with status updates provided each March and September.

FTSE Russell as of June 30 2018. Past performance is no guarantee of future results. 06022020 The Fund aims to achieve a return on your investment through a combination of capital growth and income on the Funds assets which reflects the return of the FTSE World Government Bond Index the Funds benchmark index.

Analysts estimate up to R200 billion worth of SA government bonds. The downgrade also means that South Africa will be removed from key investment-grade global government indices such as the FTSE World Government Bond Index WGBI. FTSE Russell also.

The countrys debt was officially ejected on April 30 from the FTSE World Government Bond Index -- which tracks investment-grade debt and is followed by 3 trillion of funds --. Historically the South Africa Government Bond 10Y reached an all time high of 2069 in August of 1998. If a bond is split-rated that is rated.

FTSE Russel said that for avoidance of doubt this means that South Africa would remain in the WGBI even in the event of a downgrade by Moodys until the end of April. Inclusion of a market on the Watch List signals FTSE Russells intent to engage with. The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds.

The rating agency added that progress on. The series includes the FTSEJSE All Bond Index ALBI which comprises the top 20 conventional-listed vanilla bonds with fixed semi-annual coupons and the FTSEJSE Inflation-Linked Index CILI. The WGBI is a The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a variety of currencies and has more than 30 years of.

A comprehensive range of sector and maturity sub-indexes are available for both the. Latest articles on FTSE World Government Bond Index. The indexes are The indexes are produced in partnership with the Johannesburg Stock Exchange who FTSE.

.png)

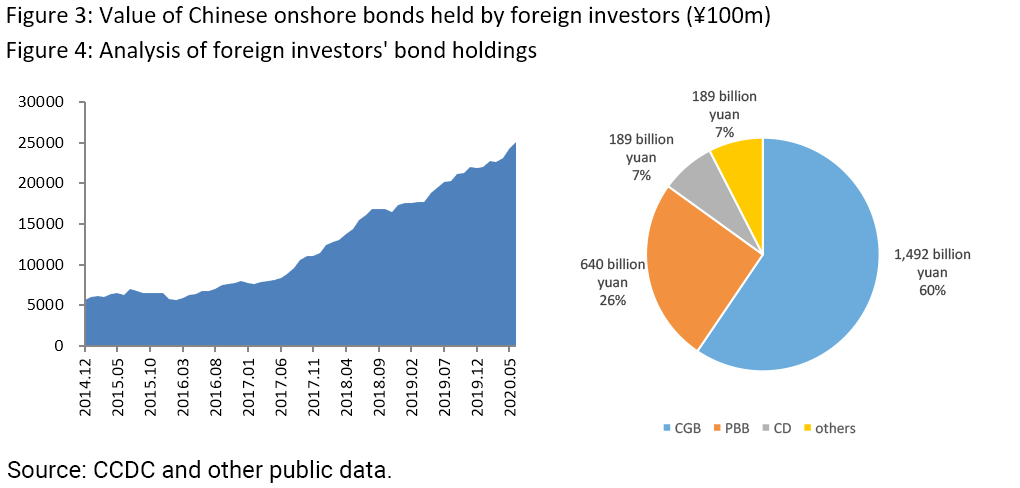

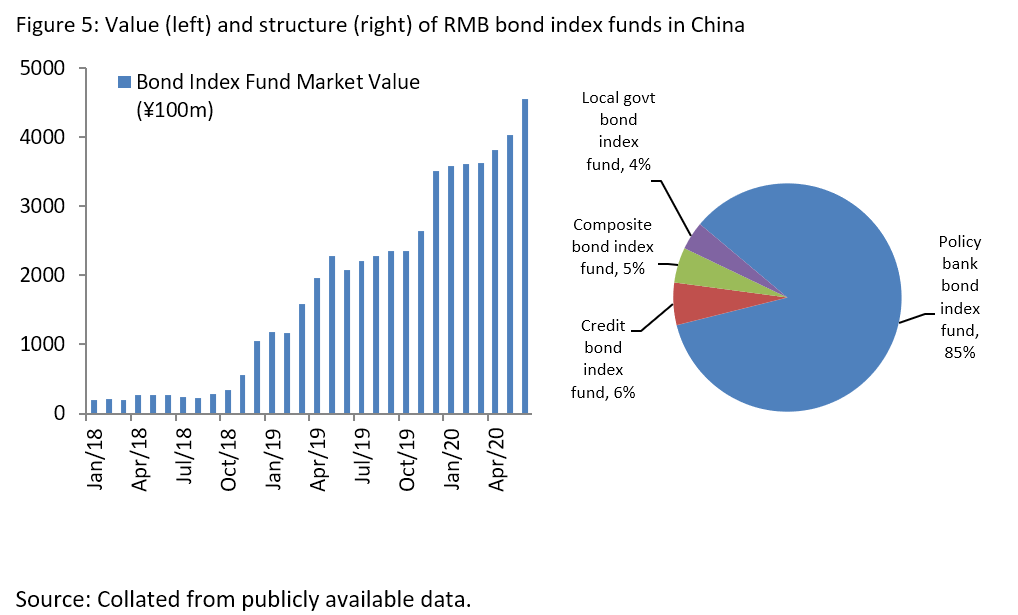

Indexed Investment A New Perspective On Investing In China S Bond Market The Asset

Indexed Investment A New Perspective On Investing In China S Bond Market The Asset

Insight/2020/04.2020/04.16.2020_SouthAfrica/Rand%20exchange%20rate.png?width=1519&name=Rand%20exchange%20rate.png)

The Inevitable Downgrade For South Africa

Ftse Russell And Jse Launch Fixed Income Indexes Ftse Russell

Chinese Government Bonds A High Yield Market In A Low Yield World Ftse Russell

China Insight Implications Of Cgb Inclusion In The Wgbi

Economic Sensitivities Of The Nasdaq 100 Index Nasdaq

Chinese Government Bonds A High Yield Market In A Low Yield World Ftse Russell

South Africa News Debt And Coronavirus Latest Updates Bloomberg

China S Bond Market What And Why And When Asi

Chinese Government Bonds A High Yield Market In A Low Yield World Ftse Russell

Ftse Russell 2000 Stock Market Index Capital Market Shares Outstanding

Why Global Bonds Should Be Part Of Your Portfolio

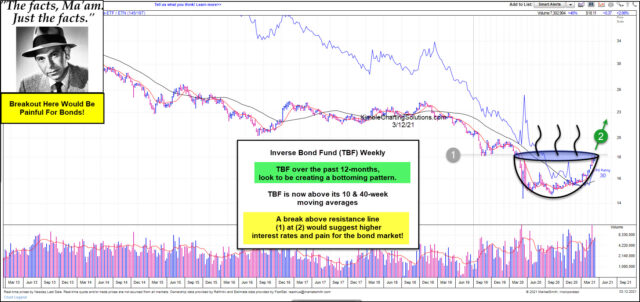

Five Key Charts For Investing In 2021 Schroders Global Schroders

Even At These Yields Bonds Still Work Blackrock Blog

Indexed Investment A New Perspective On Investing In China S Bond Market The Asset

Major Asset Classes Move Into The Red Investing Com

Government Bond Bear Market About To Get Worse Investing Com

.png)

Indexed Investment A New Perspective On Investing In China S Bond Market The Asset