It assigns a Market Accessibility Level of 0 1 or 2 with 2 representing the highest level of accessibility for foreign investors. Malaysia will be removed from the FTSE Russell Watch List for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond Index WGBIIn its FTSE Fixed Income Country Classification Announcement for March 2021 released yesterday index provider FTSE Russell.

Malaysia Bond And Sukuk Quarterly Report 1q2021 Bix

Malaysia will be removed from the FTSE Russell Watch List for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond Index WGBI.

Ftse world government bond index malaysia. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a. In its FTSE Fixed Income Country Classification.

This also confirms the countrys retention in the FTSE World Government Bond IndexI. KUALA LUMPUR March 30. Malaysia is on the verge of being removed from the World Government Bond Index WGBI with local government bonds facing a potential rating downgrade raising the risk of capital.

March 30 2021 0738 am 08. KUALA LUMPUR March 30. FTSE Russell is pleased to announce that Chinese Government Bonds will be included in the FTSE World Government Bond Index WGBI with inclusion scheduled to start in October 2021.

Malaysias market accessibility level is in danger of being downgraded under the FTSEs global classification framework. KUALA LUMPUR March 30. Malaysias exclusion from world bond index unlikely says RHB.

KUALA LUMPUR March 30. - A A. - A A.

The index said Chinas debt would be added to its flagship World Government Bond Index and will start in October 2021. In its FTSE Fixed Income Country Classification. ON March 29 FTSE Russells in its semi-annual country classification review for fixed income announced that Malaysia will be removed from the watchlist for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond index.

Financial Markets Association of Malaysia sees the FTSE Russells conclusion of the Fixed Income Country Classification review as a positive moveMalaysia is now removed from the market accessibility Watch List. Economic Viewpoint 31 March 2021 PP7004022013031762 Page 1 of 2 Expect short term inflows On 29th MarchFTSE Russell removed Malaysia from its Watch List for potential exclusion keepingMalaysian bonds includedin the FTSE World Government Bond Index WGBI Following its inaugural fixed income country classification review in April 2019 FTSE Russell announced that. March 30 2021 0738 am 08.

A minimum of 2 is required for the FTSE World Government Bond Index WGBI a widely used metric for global fixed-rate local currency investment grade government bonds markets that covers 22 markets. This will see Malaysia fall out of the World Government Bond Index. Be taken before global index provider FTSE Russell makes a final decision to withdraw local government bonds from the FTSE World.

By iFAST Research Team. Malaysia will be retained on the Watch List of the FTSE World Government Bond Index WGBI as of the September 2020 review for possible reclassification from Market Accessibility Level 2 to 1In the classification published Sept 24 FTSE Russell acknowledged the additional initiatives instigated by Bank Negara Malaysia BNM over the last twelve months to. KUALA LUMPUR Sept 25.

Country eligibility is determined based upon market capitalization and investability criteria. March 30 2021 0738 am 08. The FTSE World Government Bond Index WGBI is a market capitalization weighted bond index consisting of the government bond markets of the multiple countries.

Malaysia retained in FTSE Russells World Government Bond Index WGBI On the 29 th March 2021 FTSE Russells in its semi-annual country classification review for fixed income announced that Malaysia will be removed from the watchlist for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond index. Malaysia will be removed from the FTSE Russell Watch List for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond Index WGBI. According to Waqas Samad chief executive officer of FTSE.

The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds. In its FTSE Fixed Income Country Classification. Malaysia continues to be included in the FTSE World Government Bond Index WGBI but will remain on the FTSE Russell Fixed Income Watch List for a potential downgrade.

FTSE Russell today published the results of the annual Country Classification Review for countries monitored by its global equity and fixed income indexes. Malaysia will be removed from the FTSE Russell Watch List for potential reclassification of its market accessibility level from 2 to 1 and will retain its membership in the FTSE World Government Bond Index WGBI. - A A.

Achieving Scale In Active Ownership And Engagement Through Index Investing Seeking Alpha

Malaysia Bond And Sukuk Quarterly Report 1q2021 Bix

Https Www Dbs Com Sg Sme Aics Pdfcontroller Page Pdfpath Content Article Pdf Aio 032021 210330 Insights Asiarates Pdf

India Starts The Long Trek To Global Bond Index Asia Times

Bursa Battered On Several Fronts The Edge Markets

Malaysia Bond And Sukuk Quarterly Report 1q2021 Bix

Vietnam Is Asia S Best Stock Market Performer In May Tim

Malaysia Bond And Sukuk Quarterly Report 1q2021 Bix

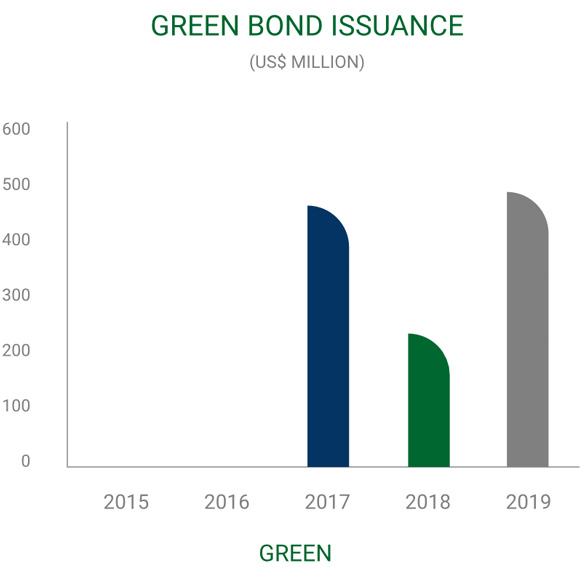

Sustainable Finance State Of Market In Malaysia Msfi

Malaysia Bond And Sukuk Quarterly Report 1q2021 Bix

Http Www Epra Com Media Ftse Epra Nareit Global Real Estate Index Series V7 1480928442664 4 Pdf