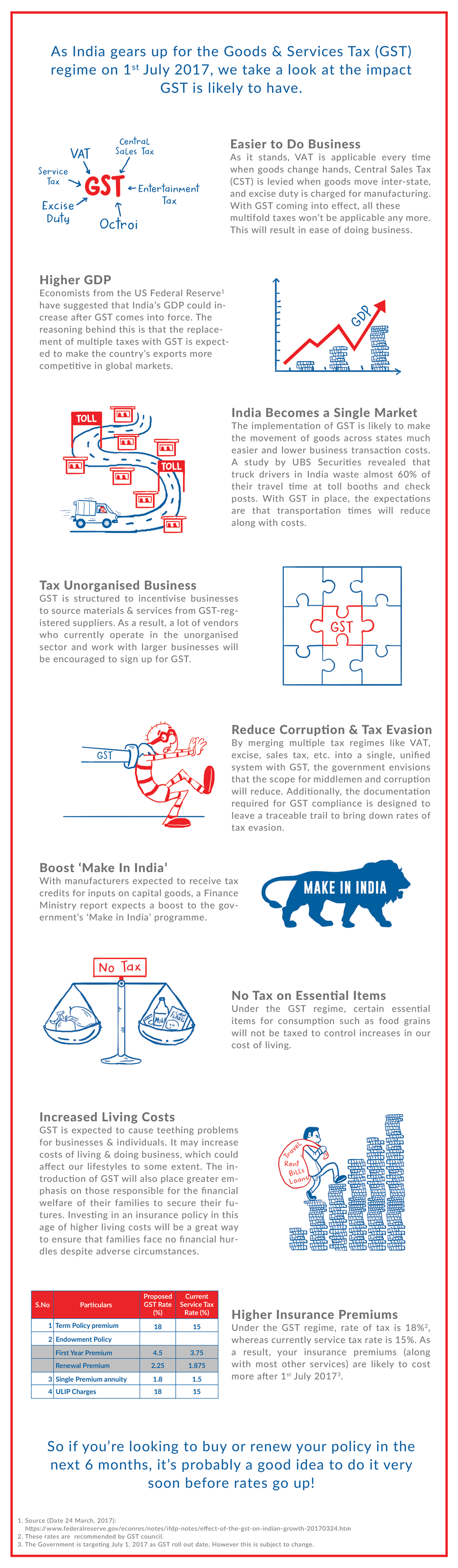

You cant claim a GST credit for any part of your insurance that relates to. Lets look at the impact of GST on your insurance premium.

Tumblr Train Booking How To Apply New Passport

GST rate will be 18 on fire insurance marine insurance plans as well.

Gst how it affects our life insurance. It could be pure life endowment child education medical and health personal accident or annuity plans. In order to attract buyers insurers are likely to lower the prices such as by cutting down on expenses related to policy issue and similar other factors that add to the cost of policy. It reflects a no.

All other insurance which will be referred to as general insurance is fully taxable at the GST rate of 10 per cent. GST works on the concept of One Nation One Tax. With the implementation of the GST the service tax became a part of GST.

Earlier the service tax was charged at 15. Input-taxed sales you make. Things you use for private or domestic purposes.

The latest GST is expected to freeze at 18 percent under the GST update. Life insurance these are input taxed health insurance policies these are GST-free. Therefore life insurance is treated in the same manner as other financial services under the GST.

Private health insurance is GST-free. I am a business person and feel I am standing right in the eye of GST Storm. This is a bad news for all the policyholders as this hike will impact adversely on the insurance sector typically in terms of insurance premiums.

How does GST impact the insurance sector in India. It could be pure life endowment child education medical and health personal accident or annuity plans. It depends on what type of life insurance policy you mention.

By admin Ever since the Goods and Services Tax GST Bill was passed in the Parliament it has created widespread confusion and speculation in the market as to how its introduction would impact each of us. Generally GST is charged on insurance policies other than. My business deals with beautiful Agro products and we enjoyed 0 VAT tax till now http.

The impact of GST on life insurance was to put it briefly that these policies will have a tax levied as per GST at 18. Despite the commotion surrounding the imminent price hike with GST the additional 6 charge will not affect insurance policy holders significantly. Life insurance reach in India has reduced from 46 percent in the year 2009 to 26 percent in the year 2016.

Unfortunately most of our life insurance policy coverage also will be subject to GST charges. Unfortunately most of our life insurance policy coverage also will be subject to GST charges. Life insurance is an industry which definitely has vast potential in India due to the financial cushion that it provides to individuals for taking care of their requirements at different stages of life.

This had a direct bearing on the insurance sector just like it did on the other sectors. This will result in marginal increase of 261 in your life insurance premium. This treatment is consistent with the general treatment of health services under the GST.

Now GST will be charged at 18. 1 Term Life Insurance Plans. However life insurance currently sees very low penetration in India considering which it could really benefit with a boost to not only create awareness but also increase its reach and coverage.

Impact of GST on the life insurance sector With the services sector accounting for 60 of the GDP the impact of GST on the service sector will run deep. Although GST will increase the overall price of the policy be it life or general insurance it will create a tight competition among insurance players. Moreover they will enhance the level of service with respect to purchase of insurance.

Just like life insurance sector GST has impacted the general insurance sector as well. For example if youre paying RM4800 for your yearly insurance premium a 6 increment would simply mean you would be paying an additional RM288 in a year or RM24 more in a month. 212 Zeilen The Goods and Services Tax GST is an integrated tax merging most of the existing indirect taxes such as Service tax VAT etc into a single system of taxation.

It depends on what type of life insurance policy you mention. Since term life insurance plans are pure risk cover and do not have any investment component GST will be charged on the entire premium. In most circumstances you must hold a valid tax invoice to claim back any GST youve paid.

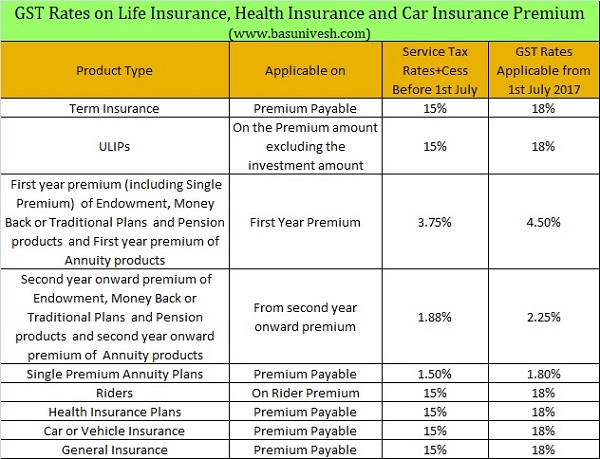

This is one of the biggest tax reforms in India since Independence and has been implemented from July 1 2017. Car health and travel insurance policyholders now have to pay 18 GST instead of the existing 15 service tax.

Seamless Filing With Hostbooks Gst Return Filing Software In 2021 Billing Software Accounting Software Indirect Tax

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Economics Lessons Economics Notes Indian Economy

Gst Rates On Life Insurance Health Insurance And Car Insurance Premium Basunivesh

Pin By Inbest On Finance Self Made Millionaire Risk Management Goods And Services

Making The Right Choice Will Save You Money And Give You And Your Family Peace Of Mind Life Cover Insurance Life Insurance Policy Life Insurance Companies

Points To Consider While Buying A Term Insurance Plan Term Life Term Insurance Life Insurance Calculator

Gst Bankingsector Servicecharges Goods And Service Tax Stock Market Finance Stock Market

Https Www Hrpub Org Download 20180630 Aeb6 11810972 Pdf

Different Gst Rates Are Applicable To Different Life Insurance Plans

Look At 4 Gst Slab Rates And Its Impact On Your Life Http Neodesig Com Look 4 Gst Slab Rates Imp Goods And Service Tax Goods And Services Business Software

Benefits Of Gst To The Indian Economy Indian Economy Indirect Tax How To Remove

Ripples Equity Blog Insurers Seek Merit Rate Category In Gst Tax Sops Goods And Services Goods And Service Tax Accounting Services

Www Internethappyworld Com 2017 07 Gst Me Career Kaise Banaye Html Business Tips Life Hacks Life

The Impact Of Goods And Services Tax Gst On India S Economy Income Tax Income Tax Return Online Taxes

How Gst Affects Your Insurance Premium Personal Finance Plan