Get to know four ways that you can use to increase your credit limit. Balance transfers made within 120 days qualify for the intro rate and fee of 3 then a BT fee of up to 5 min.

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How Your Credit Limit Is Determined

Opt-out of the Higher Rate When your interest rate increases youll typically have an opt-out period allowing you to reject the interest rate change.

/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

Higher credit card financing rates. The Jasper Credit Card offers solid rewards too. These cards have 0 APR offers on balance transfers which afford you the chance to pay off your balance without. The chart below shows the difference in the prime rate versus credit card interest rates from 2000 through today.

Among the highest interest credit cards is HSBCs which will leave customers paying 299 interest every year. Americans are now paying the highest level ever on credit card interest rates and that could have a negative impact on consumer spending and US. News and World Report the average annual percentage rate APR for all credit cards in their database is 1556 to 2287.

Purchase APR is 2999. As of May 2019 nearly five years later the average credit card rate. Louis Fed the average credit card annual percentage rate APR reached a low of 1182 in August 2014.

In the first half of 2019 the average credit card interest rate. A higher credit limit for your credit card may require some effort on your part but it can be worth pursuing. Cardholders also receive access to Citi Private Pass which gives special access to purchase thousands of events annually including presale tickets and VIP.

Mr Pallas has suggested pegging credit card interest rates to the official cash rate current rules cap credit card rates at 48 per cent annually. But credit card rates are not high compared with payday loans which can run well over 100 APR. Americans now pay their banks an average 169 interest on credit cards.

Revolving credit works differently than. Consumers may be spending less as a result which could be a drag on economic growth. Revolving credit card accounts can also be eligible for credit-limit increases on a regular basis.

According to the St. The best high limit credit card for average credit is the Jasper Cash Back Mastercard because it offers a credit limit of up to 5000 has a 0 annual fee and accepts applicants with a fair credit score. For example an individual with a 2500 balance paying an APR of.

0 intro APR for 15 months from account opening on purchases and qualifying balance transfers then a 1499 to 2499 variable APR. According to a recent survey by US. Credit card interest rates hit a record high According to the New York Federal Reserve many credit card consumers were paying an average interest rate of 17 on credit cards in.

The Citi Diamond Preferred Credit Card gives new cardholders 18 months of interest-free financing on purchases and balance transfers but boosts its ongoing APR after the intro period to a slightly high 1599 to 2599 range. Interest rates are typically higher than personal loans. But if youre looking at credit cards with high credit limits because you want to transfer balances then a more cost-effective choice might be a balance transfer card.

Existing cardholders should see their credit card agreement for their applicable terms. A balance transfer can significantly reduce total interest payments during the balance transfer period. Subject to credit approval.

Minimum Interest Charge is 2. We believe that consumers should not be exposed to an unreasonable or unfair burden as a result of excessive rates he said. Finance expert at Moneyfacts Rachel Springall said Countless borrowers could well be relying on credit cards to make ends meet as the cost of living continues to rise.

The typical bank card interest rate continues to hover around 20 annually and department store cards are closer to 30. As long as you can stick to your budget though credit cards with high limits can be useful money management tools.

Average Credit Card Interest Rates July 14 2021 Creditcards Com

What Is A Credit Utilization Rate Experian

Credit Card Interest Rates Types Current Rates

8 Alternatives To A Credit Card Cash Advance

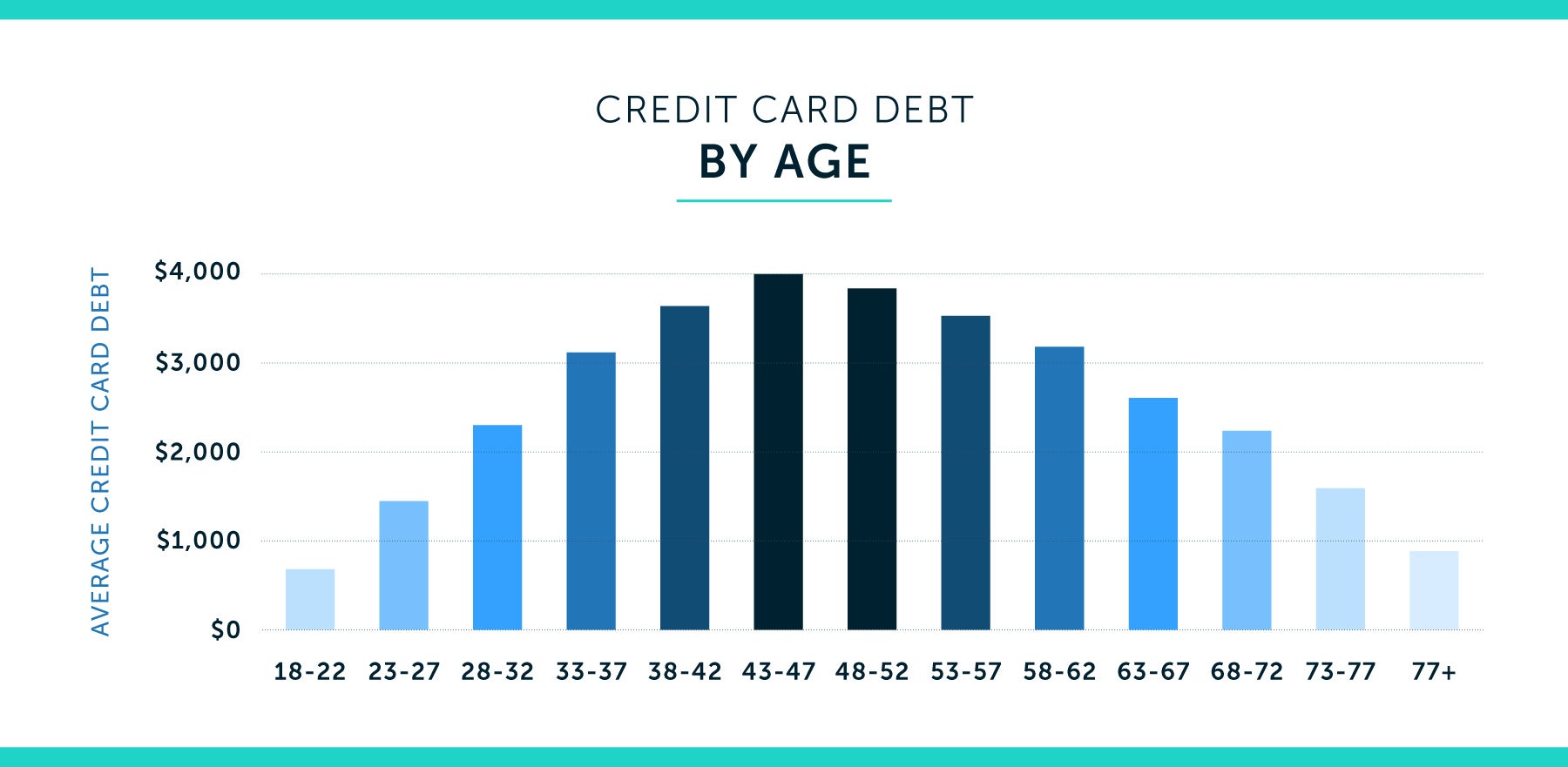

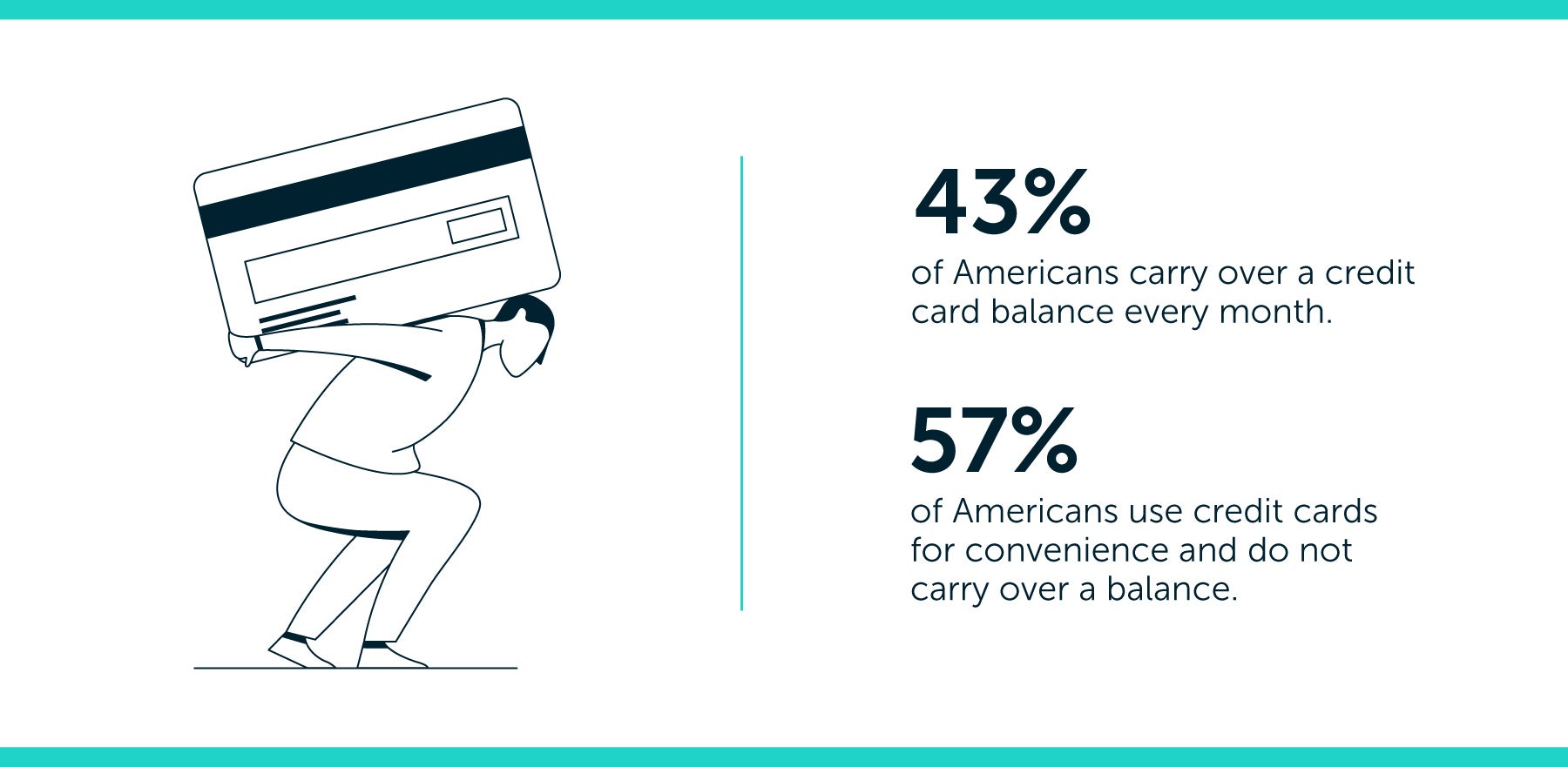

2020 Average Credit Card Debt Statistics In The U S Lexington Law

What Are Interest Rates How Does Interest Work Credit Org

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

Average Loan Interest Rates Car Home Student Small Business And Personal Loans Valuepenguin

What Is The Average Credit Card Interest Rate

2020 Average Credit Card Debt Statistics In The U S Lexington Law

Credit Card Interest Rates Types Current Rates

Credit Card Statistics Updated February 2021 Shift Processing

How Do I Get A Higher Limit On My Credit Card Nerdwallet

What Is A Good Apr For A Credit Card Rates By Score

:max_bytes(150000):strip_icc()/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png)

How And When Is Credit Card Interest Charged

The Average Credit Card Interest Rate By Credit Score And Card

Average Loan Interest Rates Car Home Student Small Business And Personal Loans Valuepenguin

8 Alternatives To A Credit Card Cash Advance

Credit Card Statistics Updated February 2021 Shift Processing