What is a Private Retirement Scheme PRS. It is a reflection of the worth of the PRS fund youre investing in and could fluctuate from time to time.

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Who what when where why and how.

How private retirement scheme prs works. How PRS Works To start your PRS savings you may choose to make contributions directly to the PRS Provider or through their registered distributors. A complete guide to everything you need to know about the private retirement scheme PRS Malaysia. If you are.

To start you may choose to make contributions directly to the PPA portal PRS Provider or through their. Private Retirement Schemes PRS are becoming increasingly popular in Malaysia. Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement savingsregardless of whether you are an EPF member Complements your EPF savings.

Under the scheme you can invest in. PRS is a voluntary investment scheme to help you save for retirement. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Investing in Private Retirement Schemes PRS is eligible for a tax rebate of up to RM3000 until the year of assessment YA 2021. A voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement.

Ill be writing this piece in a 5Ws and 1H approach ie. Private Retirement Scheme was launched in 2012 to complement EPF initiative. Once you have successfully started your PRS savings you are automatically given a PRS account.

Complements the mandatory contributions made to EPF. What is Private Retirement Scheme PRS. The PRS funds are managed by 8 providers namely the Affin Hwang Asset Management.

First we must know that PRS is a voluntary scheme for the purpose of retirement saving. Its open to Malaysian citizens aged 20 to 30 years but youll need to hurry if you want to take advantage of this scheme as it is valid until the 31 December 2018. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

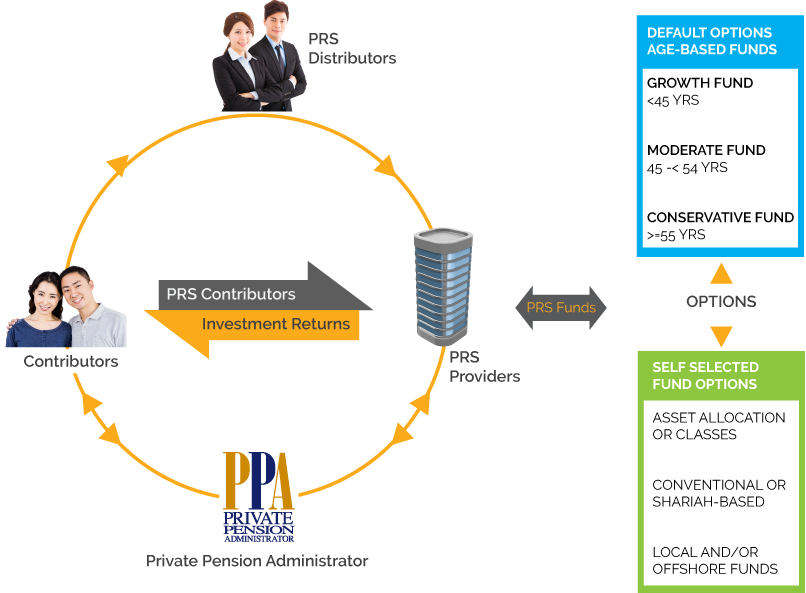

As the PRS objective is to help individual accumulate savings for their retirement an eight 8 per cent tax penalty is imposed on any amount of contribution withdrawn by an individual from a private retirement scheme before reaching the age of 55 subject to item 1 above existing Part XVI of Schedule 1 of the Income Tax Act 1967 3. For ease of understanding let us look at the picture above which explain the process into two parts. A voluntary scheme for individuals above the age of 18 A way to boost retirement savings whether youre a member of the EPF or not.

It was as flexible as normal unit trust investments shown in upper part. The PRS complements the EPF offering individuals the ability to build another fund that they can tap into when they retire rather than relying on EPF alone. The PRS is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Initially contributions were made by us into the PRS fund that we select. Funds under PRS are neither capital guaranteed nor capital protected. How it works is that if you contribute a minimum of RM1000 into your PRS account the government will top up another RM1000 into your account.

What is the Private Retirement Scheme PRS. This is a one-off offer though. Have You Ever ImagineHow to Continue your Lifestyle throughout your Retirement YearsFor many of us picturing ourselves in retirement may be difficult.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Heres what a PRS is in a few bullet points. A Private Retirement Scheme PRS is an investment scheme designed to help employees and self- employed workers to accumulate savings for retirement through voluntary contribution It is administered by the Private Pension Administrator PPA whose trustees holds the PRS assets for the benefit of contributors.

The unit price of PRS works in the same way as a share price. It is because most Malaysians do not have sufficient savings for retirement due to inflation rising cost of living and healthcare costs. The PRS is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

The government recently extended the PRS tax relief up to. Whats a Private Retirement Scheme PRS. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment.

Prs Malaysia 2019 Review Should You Really Invest

A Not So Boring Guide To Your Private Retirement Scheme

Save More With Private Retirement Schemes

3 Places To Get 0 Sales Charge For Prs Funds Private Retirement Scheme Ringgit Oh Ringgit

Structure Of Private Retirement Schemes Prs Private Pension Administrator

Can You Survive Living On Your Retirement In Malaysia Visual Ly

Private Retirement Scheme Prs Epf Endowment Plan Home Facebook

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Epf And Prs Your Retirement Guide In Malaysia Syncwealth

A Guide To The Private Retirement Scheme Prs

Prs Malaysia 2019 Review Should You Really Invest

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Private Retirement Scheme A Complete Guide To Prs And How I Choose The Best Fund

Finance Malaysia Blogspot How Private Retirement Scheme Prs Works Actually

Epf Savings And Your Retirement Employees Provident Fund Pdf Free Download

How To Get Your Prs Tax Relief Statement From Ppa April 2013

Infographics Private Retirement Scheme Prs Investing For Retirement Infographic Retirement