When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. That is totally not right.

Epf Withdrawals Before Maturity Personal Finance Retirement Withdrawn

The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings from 55 to 65.

How to withdraw epf at age 55. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. Edited Dec 28 2016 at 0626 When your father reaches 55 years of age he can withdraw in cash his EPF funds with the Insolvency Department by submitting a bankruptcy declaration letter. This is the most common form of EPF withdrawal.

You were able to withdraw the 100 EPF corpus amount after the retirement at the age of 55. Do I need to withdraw my CPF savings at 55 years old. The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time.

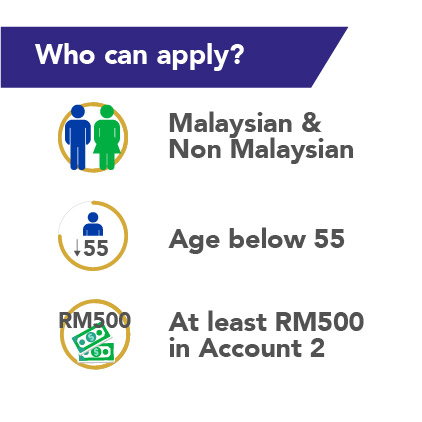

You can withdraw all or part of the savings from this account at any time. EPF withdrawal for age below 55. The EPF assures members that no such steps on raising the withdrawal age.

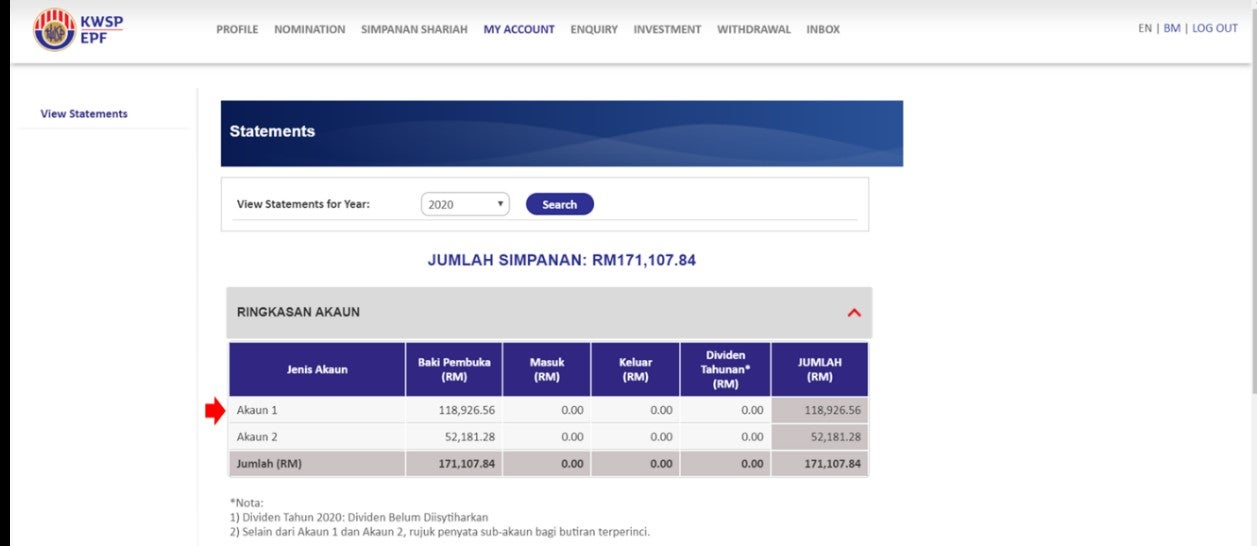

KUALA LUMPUR 26 June 2020. At age 55 your Account 1 and Account 2 will be consolidated to become Account 55. All you need to submit your application for Age 50 Years Withdrawal are.

As of the writing of this post there are several conditions or situations where you are permitted to withdraw your Employee Provident Fund EPF for Malaysians. GoalsMapper automatically withdraw all the money from your Account 55 at age 55. Upon reaching age 55 the contributions made to your Account 1 and Account 2 will be consolidated into Account 55.

All this while many of us still think that the EPF withdrawal is only eligible when you reach 55 or 60 years old and above. However if you do not wish to do this you can disable this by changing the option under Advance Settings in your clientspouse profile. The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time.

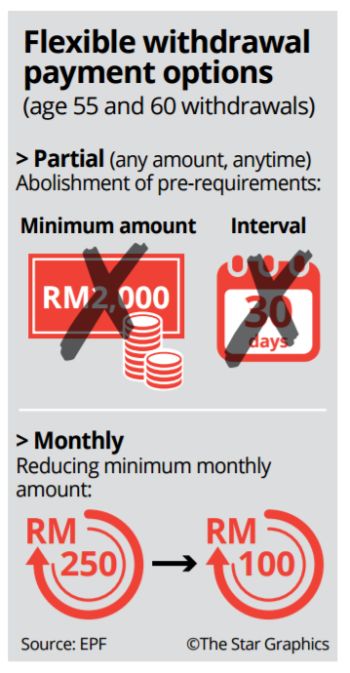

Now you can withdraw all your EPF at age 55 while you are still working with someone else if you choose to retire at later years say at age 60. The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings from 55 to 65. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January.

Your Identity Card IC 2. KUALA LUMPUR June 26 The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time. Till today 90 EPF.

8 Zeilen The EPF assures members that the current Age 55 Withdrawal will remain. Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account. Should you choose to continue working after the age of 55 all further contributions you make will be credited in your Akaun Emas to be withdrawn only upon reaching age 60.

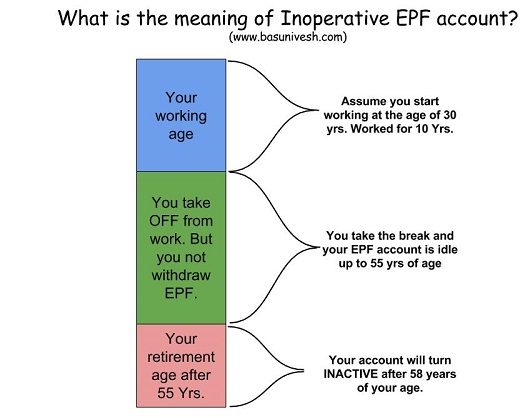

When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime. But members should also know that as long as an individual still has savings in EPF even. But now you would not be able get the entire EPF balance corpus amount before the retirement at the age of 58 years.

Age 505560 Withdrawal. They can perform a lump sum withdrawal monthly withdrawals or partial withdrawal. The Employees Provident Fund EPF takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65.

However you may voluntarily choose not to withdraw your retirement fund at KWSP if you dont need that. This withdrawal rule was beneficial for those employees who prefers early retirement. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Increasing the Age Limit For 90 EPF Amount Withdrawal. Withdraw via i-Akaun plan ahead for your retirement. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when. FULL WITHDRAWAL AT AGE 55 REMAINS.

Easier Epf Access For Over 55s The Star

Epf Withdrawal Step By Step Guide To Withdraw Money Online Information News

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Ccrcs Vs Independent Living Choosing Your Best 55 Community Option Life Insurance For Seniors Preparing For Retirement Senior Health

General Information Epf I Invest Via I Akaun Principal Asset Management

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Epf Introduces Akaun Emas For Withdrawal At Age 60 The Edge Markets

Property123 Do You Know How To Withdraw Kwsp To Buy Facebook

Key Players In The Capital Market Capital Market Raising Capital Initial Public Offering

Interest On Inoperative Epf Accounts Up To 58 Yrs Of Age Basunivesh

Full Epf Withdrawal Not Allowed 4 New Changes Of Epf Withdrawal Changing Jobs New Rules Change

Epf Withdrawal Process How To Withdraw Pf Online Updated

National Pension Scheme And Atal Pension Yojana Main Differences Pensions National Schemes