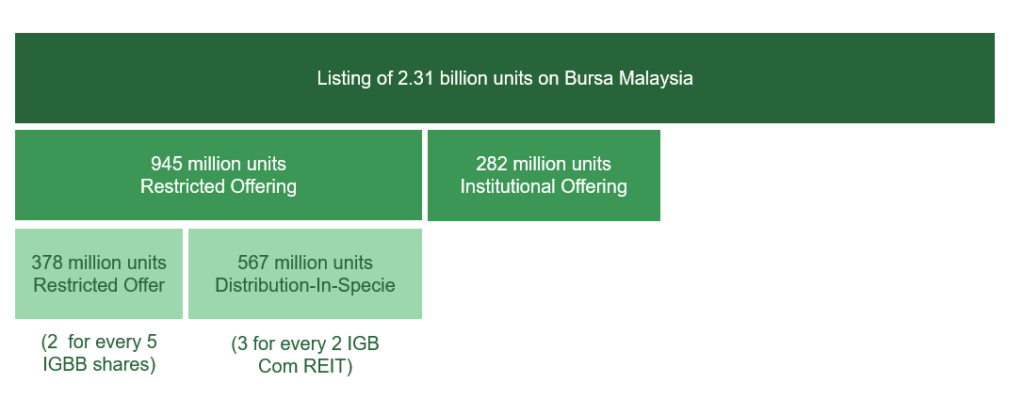

IGB Reit IGB REIT comprises of Mid Valley Megamall retail. IGB Commercial Real Estate Investment Trust IGB Commercial REIT will see the listing of 23 billion units on Bursa Malaysias Main Market via an initial public offering IPO.

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

I 469000000 OFFER UNITS MADE AVAILABLE FOR APPLICATION BY MALAYSIAN AND FOREIGN INSTITUTIONAL INVESTOR AND SELECTED INVESTORS AT THE INSTITUTIONAL PRICE BEING THE PRICE PER OFFER UNIT TO BE PAID BY THE INVESTORS WHICH WILL BE DETERMINED.

New ipo igb reit. KUALA LUMPUR June 10. IGB Commercial REIT IGB Berhad IGB Commercial REIT will be the latest office REIT to IPO on the Malaysia IGB Commercial REIT IPO - 8 Things You Need To Know Real Property Insiders Saturday July 3 2021. Assuming KrisAssets closing price of RM915 as at 30 Aug 2012 and that the proposed cash payment is unchanged the IGB REIT pricing arrived at is RM128.

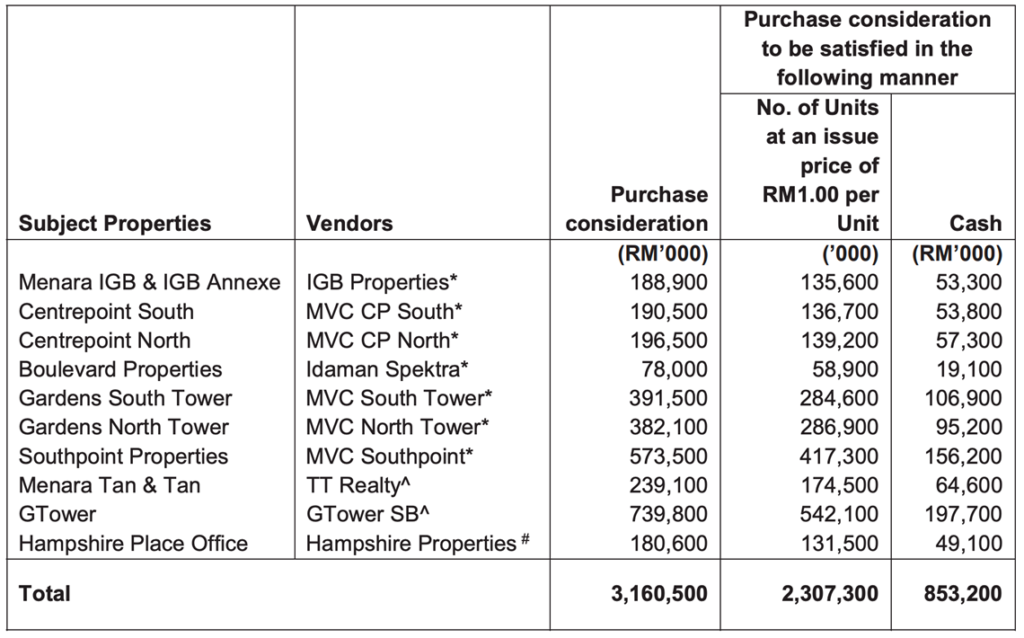

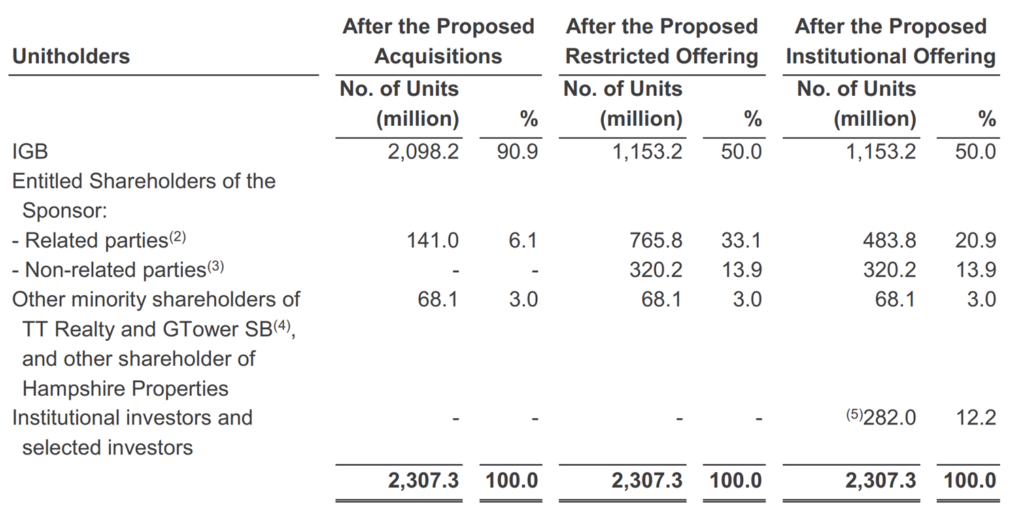

172m sf NLA and the Gardens Mall retail. IGB Commercial Real Estate Investment Trust IGB Commercial REIT said today its initial public offering IPO will involve the listing of 231 billion units on Bursa Malaysias Main Market under a corporate exercise which comprises a restricted offering of up to 945 million units and an institutional offering of at least 282 million units in the property trust. Currently Mid Valley Megamall is 998 occupied and the Gardens Mall is 997 occupied.

Euscilyn KUALA LUMPUR. IGB going ahead with commercial REIT IPO. Based on its number of units to be issued of 2307 billion IGB Commercial REIT shall have as much as RM.

Hence it is cheaper to subscribe to the IGB REIT unit for a retail price of RM125. 082sf NLA with a total appraised value of RM46b. IGB Reit IGB REIT comprises of Mid Valley Megamall retail.

IGB Commercial REIT delays IPO listing cuts size of institutional offering. REITs that focus more on malls are usually the retail REITs. IGB Real Estate Investment Trust REIT has priced its initial public offering IPO to institutional investors at the top of an indicative range in a deal that will raise about US260mil in the buoyant Malaysian market according to sources.

IGB Bhd announced today that its proposed commercial real estate investment trust REIT will be established by the end of this year with the group set to raise up to RM123 billion through the disposal of 10 properties to the trust. IGB Reit IGB REIT comprises of Mid Valley Megamall retail. KUALA LUMPUR May 30.

KUALA LUMPUR June 11. EdgePropmy May 30 2020 Updated 10 months ago. Currently Mid Valley Megamall is 998 occupied and the Gardens Mall is 997 occupied.

Although IGB remains tight-lipped on the schedule for the planned initial public offering IPO sources say it could be as early as November. Based on the IPO price of RM125 IGB REITs market capitalization would be RM43bn making it the largest pure retail M-REIT. Currently Mid Valley Megamall is 998 occupied and the Gardens Mall is 997 occupied.

IGB to list commercial REIT by year-end raising up to RM123 bil. 172m sf NLA and the Gardens Mall retail. Malaysia reports 6982 new Covid-19 cases with Selangor and KL accounting for more than half.

On 10 June 2021 IGB Commercial REIT released its IPO Prospectus and as such is extending an invitation to subscribe its units at RM 100 per unit. Although IGB remains tight-lipped on the schedule for the planned initial public offering IPO sources say it could be as early as November. 082sf NLA with a total appraised value of RM46b.

082sf NLA with a total appraised value of RM46b. 172m sf NLA and the Gardens Mall retail. UEM Sunrise sells Mersing land for RM45m to Lagenda Properties.

IGB Reit IGB REIT comprises of Mid Valley Megamall retail. Initial public offering of 670000000 new units in igb reit offer units comprising an offer for sale of. The Covid-19 pandemic and its economic fallout may have spooked many companies into putting their business plans on the back burner but not IGB Bhd The Edge reported today.

082sf NLA with a total appraised value of RM46b. Commercial REITs are REITs that usually invest in office buildings. Yes the plans are still on for IGBs planned commercial REIT listing and would include the same list of assets announced to Bursa Malaysia in November IGBs head of group strategy and risk Tan Mei Sian tells The Edge without providing.

Barring any unforeseen circumstances and subject to all requisite approvals being obtained the proposed REIT establishment and listing is expected to be completed by the fourth quarter of 2020 it said. The property developer is marching ahead with plans to spin. 172m sf NLA and the Gardens Mall retail.

Following closely behind IGB REIT in terms of market capitalization size is Pavilion REIT RM408b Sunway REIT RM402b and CMMT RM302b. It will join its sister REIT IGB REIT to be listed in a market that seems to be REIT-shy. IGB Commercial REIT will be the latest office REIT to IPO on the Malaysia stock exchange.

The IPO was priced at RM125 per share said sources with direct knowledge of the deal who were not authorised to speak publicly. Currently Mid Valley Megamall is 998 occupied and the Gardens Mall is 997 occupied. Yes the plans are still on for IGBs planned commercial REIT listing and would include the same list of assets announced to Bursa Malaysia in November IGBs head of group strategy and risk Tan Mei Sian tells The Edge without providing.

IGB REIT Management Sdn Bhd an indirect wholly-owned subsidiary of IGB is the proposed management company for the new REIT while MTrustee Bhd is the proposed trustee.

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

Igb Commercial Reit Opens Ipo Applications

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

Igb Commercial Reit Stock Ipo Analysis Kaya Plus Not So Late Night Show 20210617 Youtube

Financial Management Solutions Fortune My Investing Reit Financial Management

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

8 Things I Learned From The 2021 Igb Reit Agm

Igb Commercial Reit Delays Ipo Listing Cuts Size Of Institutional Offering The Edge Markets

Igb Commercial Reit To Have Market Cap Of Rm2 3b On Listing The Star

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

Igb Reit Crunchbase Company Profile Funding

Igb Commercial Reit Stock Ipo Analysis Kaya Plus Not So Late Night Show 20210617 Youtube

Financial Management Solutions Fortune My Investing Reit Financial Management

Igb Commercial Reit Opens Ipo Application Says Bursa Listing On July 30

Igb Commercial Reit Ipo 8 Things You Need To Know Kaya Plus

Igb Commercial Reit To Be The Largest Standalone Office Reit By Net Lettable Area When It List Next Month

Key Things You Must Know About Igb Real Estate Investment Trust Before Investing