PA-8453 -- 2010 Pennsylvania Individual Income Tax Declaration for Electronic Filing. State Changes to Individual Income Taxes.

Historical Delaware Tax Policy Information Ballotpedia

Repealed personal and dependent exemptions which equalled4150 for each taxpayer spouse and eligible dependent in 2017.

Personal income tax 2010 residential. Personal Income Tax 2010. 59 5 cl. Property tax relief credit from RI-1040H line 15 or 22attach form RI -1040H.

A resident who is required to file a Hawaii individual income tax return must file Form N-11 Individual Resident Income Tax Return or Form N-13 Individual Resident Income Tax Return Short Form whichever is applicable. She would pay federal income tax of 468125 plus 25 on her income over 34000. Residential property means a house condominium unit.

State Individual Income Tax-By School District Y2. Information and online services regarding your taxes. Oregon voters on January 26 approved Measure 66 by a margin of 54 to 46 ratifying an income tax increase retroactive to January 1 2009.

R-540INS 110 request for efund of louisiana Citizens Property insurance Corporation Assessment Louisiana Revised Statute 476025 allows a refundable tax credit to reimburse citizens who paid between January 1 2010 and. PA-8879 -- 2010 PA e-file Signature Authorization. The personal and the property tax credit gradually phase out at higher income levels.

Increased the credit from 1000 to 2000 per. REV-413 F -- 2010 Instructions for Estimating PA Fiduciary Income Tax for Estates and Trusts Only. January 22 2009.

If you missed this current year deadline you have until Oct. Military are subject to the income tax but since 2007 active-duty military salaries have been exempt from the state. 240 108 amending GL.

Ordinary taxable income brackets for use in tax planning and filing 2010 tax returns due April 18 2011 the later date is due to a federal holiday in Washington DC. The basic exemption limit for resident individuals who are 60 years of age or more but less than 80 years of age at any time during the tax year is INR 300000. RHODE ISLAND 2010 RESIDENT INDIVIDUAL INCOME TAX RETURN First Name Spouses First Name.

REV-276 -- Application for Extension of Time to File. Personal income tax rates. New Mexico residents are subject to the states personal income tax.

The 25 amount covers taxes calculated on income only within the 25 bracket. 2010 tax rates Tax rate. Regular military salaries of New Mexico residents serving in the US.

2010 estimated tax payments and amount applied from 2009 return. Available for individual not related to employer who is hired after February 3 2010 and before January 1 2011 Individual must certify under penalties of perjury he or she was not employed for more than 40 hours in the 60-day period ending on the day the employee begins employment Amount of forgiveness for first quarter 2010 treated. Below are key changes that states made to their tax systems during 2010.

With effective from Year of Assessment YA 2009 Malaysian resident who acquired any residential property are given the specially designed tax relief of up to RM10000 a year for 3 consecutive years from the first year the interest is paid. 15 to e-File current year Tax Returns however if you owe Taxes and did not e-File an extension by. The total state and local tax burden on Alaskans including income property sales and excise taxes is just 516 of personal income the lowest of all 50 states.

Individual Income Tax Increases. 59 5 cl. For amended return mark this box.

2010 Property Taxation and School Funding PDF Taxable Property Values by School District Taxes Levied and Tax Rates for Current Expenses and Average Property Values per Pupil DTE13DTE14 SD1. Instructions on how to file a 2010 IRS or State Tax Return are outlined below. Additionally the personal income tax applies to nonresidents who work in the state or derive income from property there.

You can no longer e-File a 2010 Federal or State Tax Return anywhere. However no property except property entitled to a pollution control abatement or a cogeneration facility 30 megawatts or less in capacity will be exempt if it is used in the manufacture or generation of electricity and it has not received a manufacturing. RI 2010 income tax withheld from Sch W line 21 please attach forms W-2 1099 etc18A.

Individual 2010 income Tax For address change mark this box. Lowered income tax rates at all levels of taxable income except the lowest bracket and lowered the income range for upper brackets. For example a single person earning 50000 would be in the 25 tax bracket in 2010.

A personal tax credit ranging from 1 to 75 of the tax due is available to all categories of filers up to certain income levels. Also by Hawaii may claim a credit for income taxes paid to the other state or foreign country if certain conditions are met. The new brackets are 108 on income over 125000 and 11.

The 468125 covers taxes calculated on income that falls in the 10 and 15 brackets. Exceptions to Requirement That Vermont Filing Status Must Mirror Federal Filing Status. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Disallowance of Bonus Depreciation Provisions of Federal Economic Stimulus Act of 2008. Prepare and e-File your current Tax Year Taxes by these tax dates and deadlines. For resident individuals who are 80 years of age or more it is INR 500000.

Individual income tax changes all of which expire after 2025. The slab rates applicable to individuals for FY 202021 are as follows.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

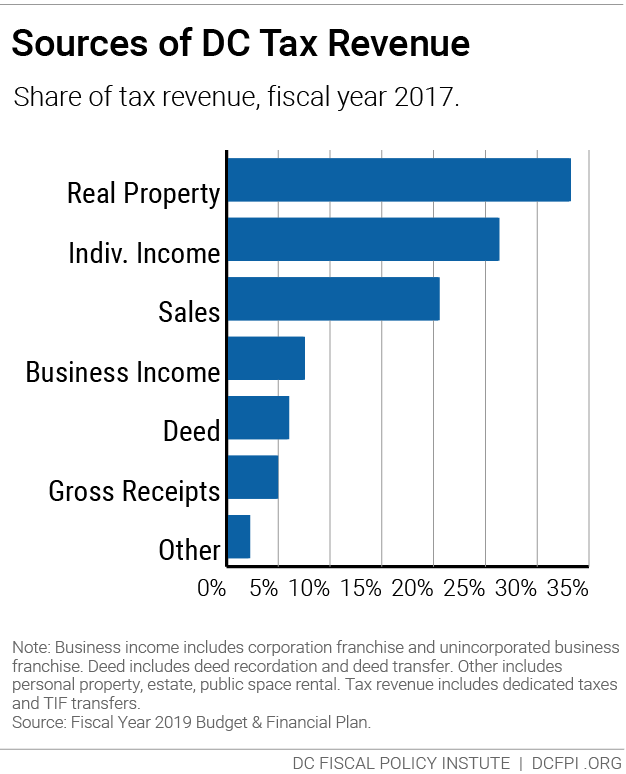

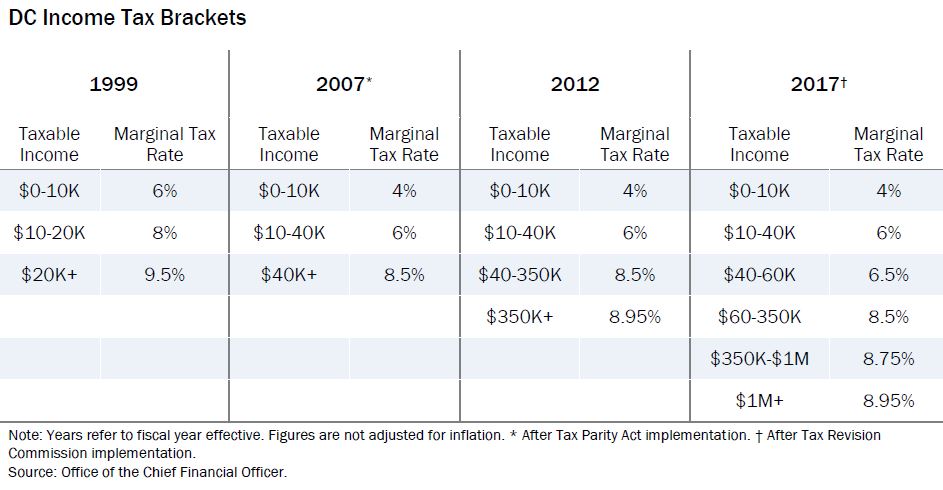

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

What Are Itemized Deductions And Who Claims Them Tax Policy Center

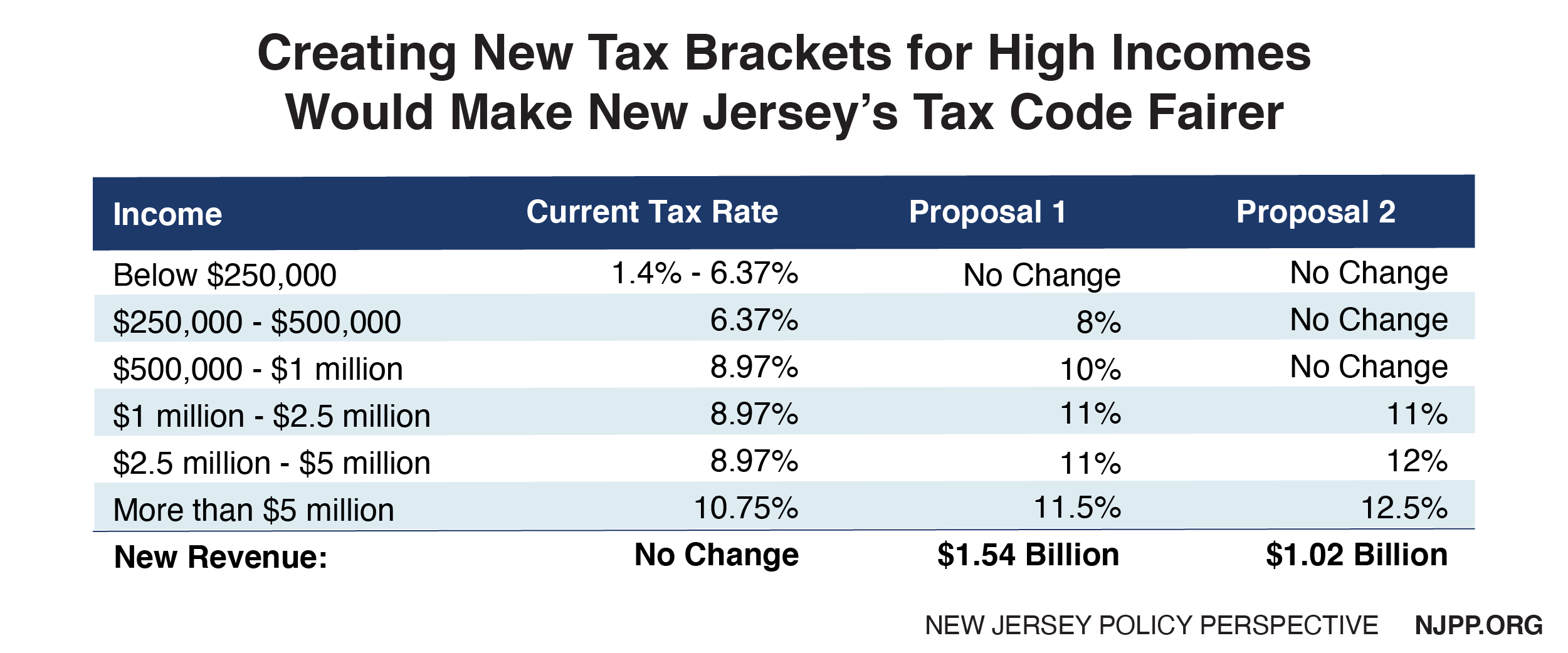

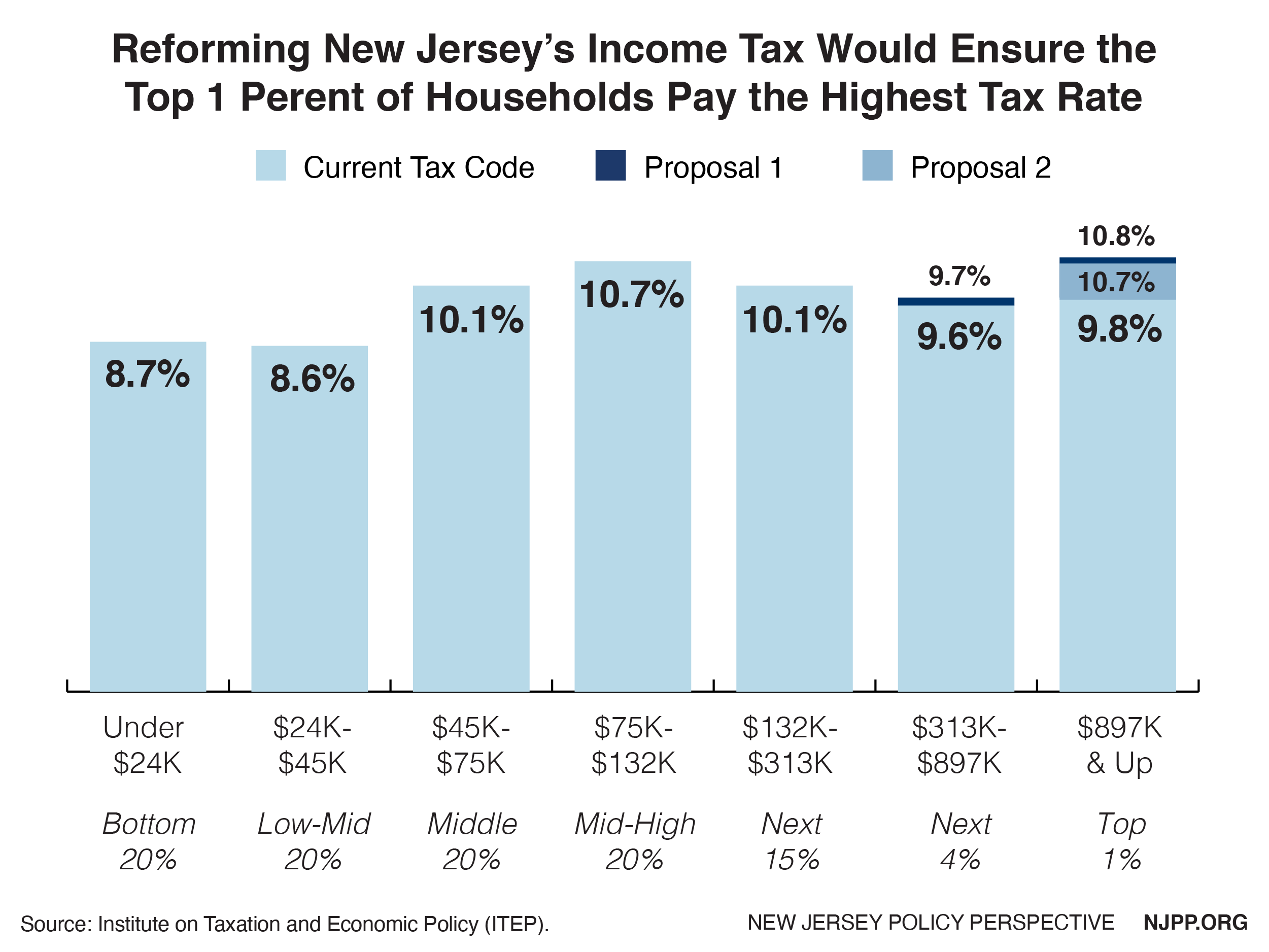

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

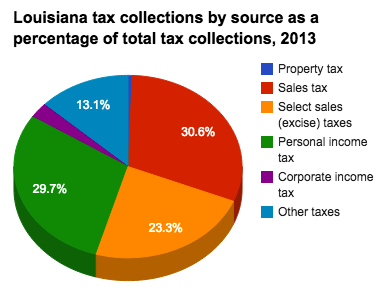

Historical Louisiana Tax Policy Information Ballotpedia

Using The Tax Structure For State Economic Development Urban Institute

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Victoria News

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

No Income Tax But Watch Wait Until You Experience Toll Road Monopoly Moving To Florida Florida Florida Life

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

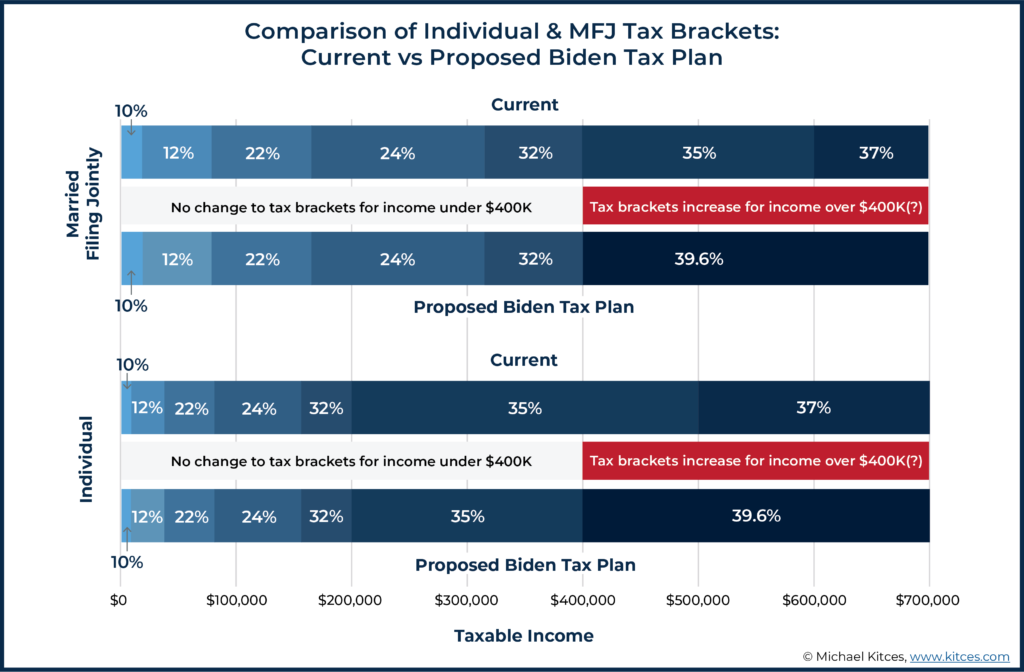

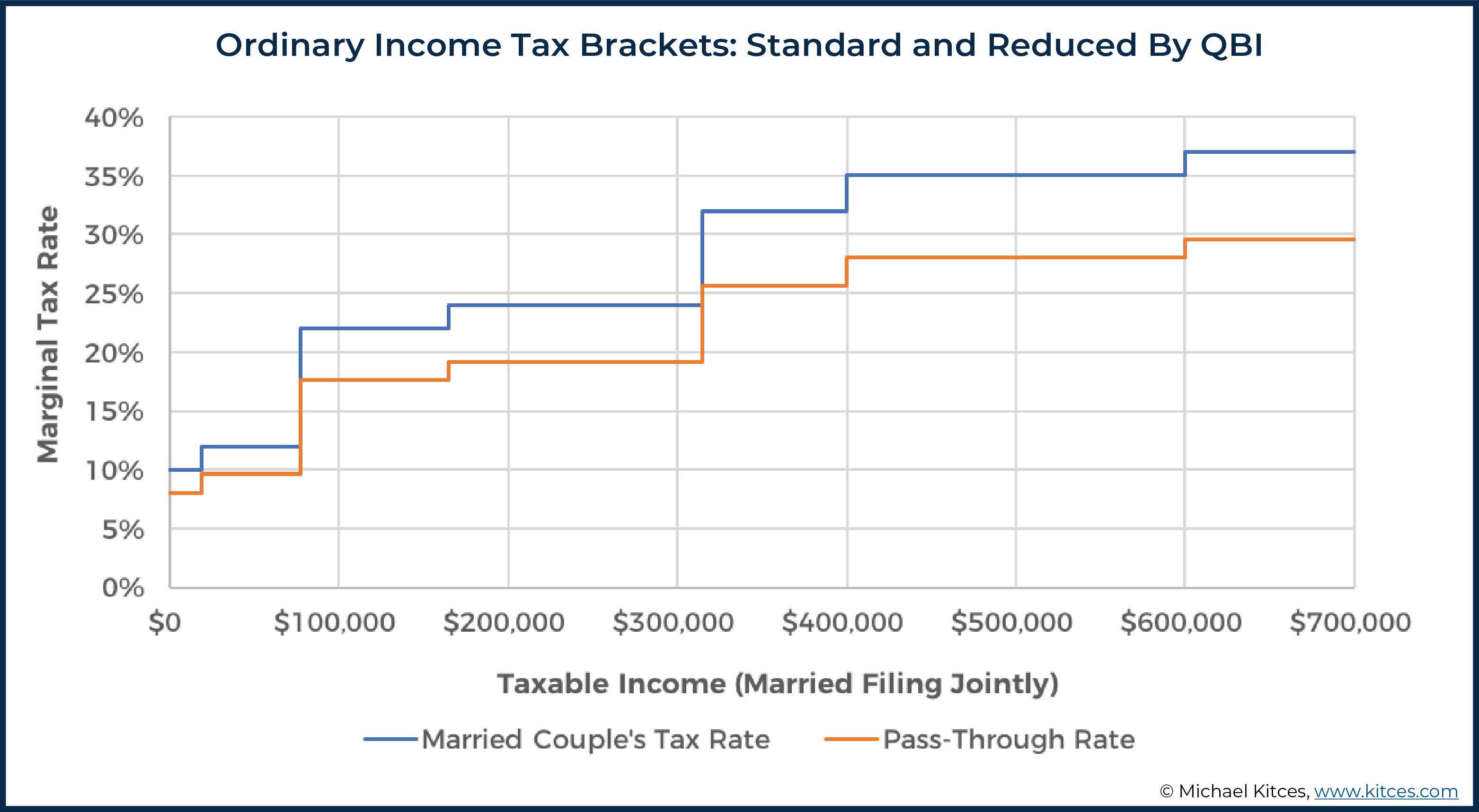

Biden Tax Plan And 2020 Year End Planning Opportunities

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Biden Tax Plan And 2020 Year End Planning Opportunities

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Doing Business In The United States Federal Tax Issues Pwc

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s