Individual Income Tax Return including recent updates related forms and instructions on how to file. One big change especially for people in high-tax states is the 10000 cap on the amount of state and local property tax income tax and sales tax that can be deducted.

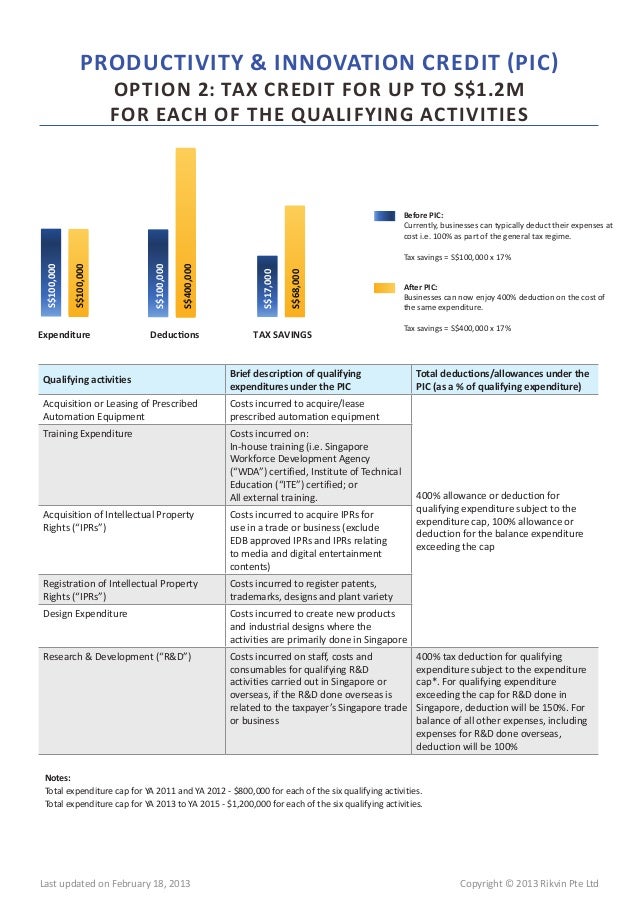

Singapore Corporate Tax Rates 2013

Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete Individual Partnership.

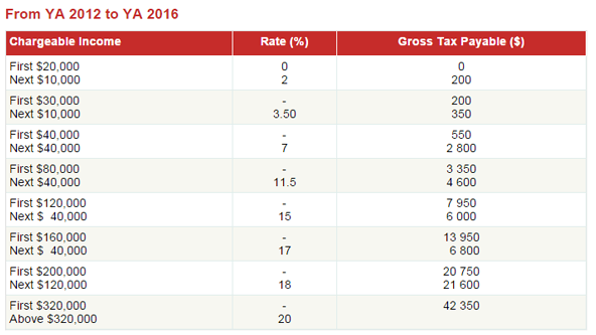

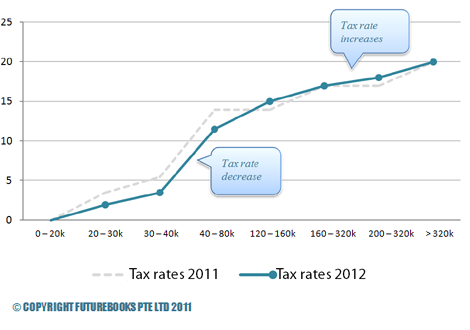

Personal income tax for ya2012. Everyone whose Massachusetts gross income is 8000 or more must file a. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 50 personal income tax rate for tax year 2020.

Your effective federal income tax rate changed from 1296 to 1281. Interest Relief on the Underpayment of 2020 Individual Income Taxes and Other Tax Relief to Individual Income Taxpayers New Important Notice. This is to maintain parity between the tax rates of non-resident individuals and the top marginal tax rate of resident individuals.

Applicable in addition to all state taxes. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate. The content is straightforward.

The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual Partnership Fiduciary and Limited Liability Company tax codes and regulations. Maybe due to the general election which had diverts our attention lately. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly below.

Form 1040 is used by citizens or residents of the United States to file an annual income tax return. Personal Income Tax for YA2012 Finance Malaysia hopes this article doesnt come late to give you some info on Personal Income Tax filling for year of assessment 2012. Chapter by chapter from Albania to Zimbabwe we summarize personal tax systems and immigration rules in more than 160 jurisdictions.

If youre a business or an individual who filed a form other than 1040 you can obtain a transcript by submitting Form 4506-T Request for Transcript of Tax Return. General Information about Individual Income Tax Electronic Filing and Paying Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. Certain capital gains are taxed at 12. From YA 2017 the tax rates for non-resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

The content is current on 1 July 2020 with exceptions noted. Information about Form 1040 US. The Missouri Department of Revenue received more than 238000 electronic payments in 2020.

2021 Standard Deduction and Personal Exemption. Your marginal federal income tax rate remained at 2200. Department of Revenue Offers Relief in Response to COVID-19 Outbreak.

List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Total Estimated 2020 Tax Burden. For tax year 2020 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income.

Keep up-to-date on significant tax developments around the globe with EYs Global Tax Alert library. Taxes on Directors fee Consultation fees and All Other Income. Your federal income taxes changed from 9787 to 9675.

Federal Income Tax - Minimum Bracket 10 Maximum Bracket 396. Information and online services regarding your taxes. Impact of the American Rescue Plan Act of 2021 on the 2020 North Carolina Individual Income Tax Return COVID-19 Updates.

Please note that each Account Transcript only covers a single tax year and may not show the most recent penalties interest changes or pending actions. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax.

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Foundations In Taxation Pdf Free Download

Foundations In Taxation Pdf Free Download

Simplifying The Foreign Credit Pooling System In Singapore

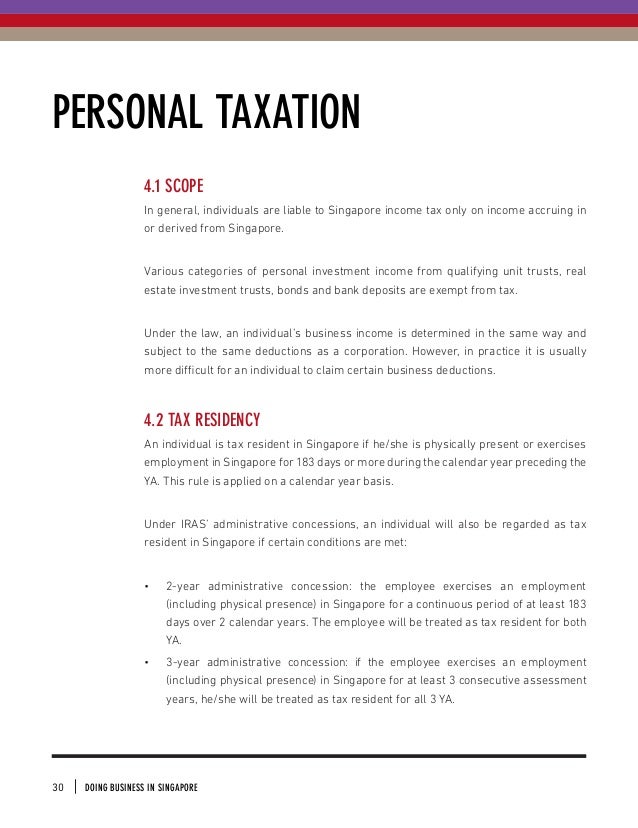

Doing Business In Singapore 2015 2016 By Mazars

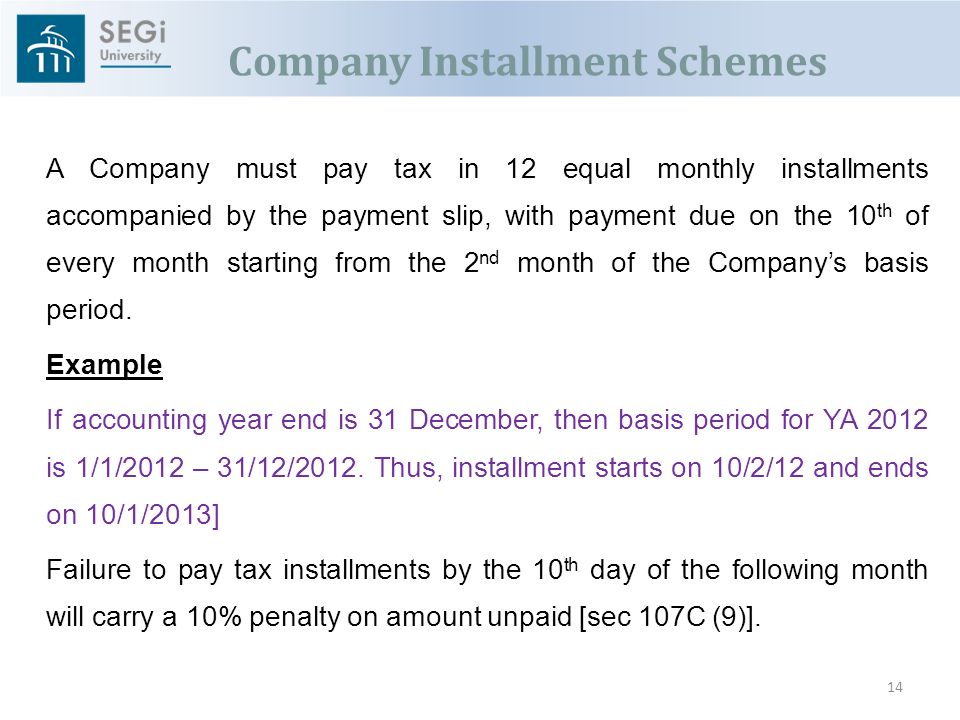

Basis Periods By Associate Professor Dr Gholamreza Zandi Ppt Download

Zakat And Tax Treatment Hj Musa Bin Othman Honorary Secretary Malaysian Association Of Tax Accountants M A T A Pdf Free Download

Ktps Consulting Personal Reliefs It S Time To File Your Facebook

Corporate Tax Planning Presentation For Kocham By Wong

Ktps Consulting Personal Reliefs It S Time To File Your Facebook

5 April 2012 Dear Sir Mdm Simplified Income Tax Filing For Small

Why Are Singapore S Taxes So High Most Of Which Being Indirect Taxes Or Hidden Quora

Tax Administration Of Self Assessment System Ppt Video Online Download

Singapore Personal Income Tax Guide Tassure Asia Group

Annex B 2 Research And Development R D Tax Measures

Singapore Personal Income Tax Rates For 2012

Basis Periods By Associate Professor Dr Gholamreza Zandi Ppt Download