The US debt is soaring and the country has kicked the can down the road so many times on entitlement spending. In 1939 the US debt was at 40 billion and by the end of the Second World War this rose to 271 billi.

8 Easy Steps To Erase Your Debt Money Habits Money Saving Tips Money Management

Most of us associate debt with lousy management and commercial handling.

What if us failed to increase debt. The rate of new debt additions dwarf any rate of growth the economy can possibly achieve. Sometimes tax cuts are justified in order to spur the economy out of a recession. Whether this is a temporary downturn or a full-blown recession two things will happen.

Routine and ongoing government expenses can only be paid as incoming tax revenues are received. Debt is created by either excessive spending or deep tax cuts. Although it might have some negative impact on our household and personal financing in business it can be considered a good thing albeit risky.

The level of political instability implied by a congress that does not raise the debt ceiling is a level of political instability that makes all financial transactions riskier. Wages may be garnished tax liens imposed on property and credit ruined hindering future borrowing ability. WASHINGTON AP Treasury Secretary Janet Yellen told a congressional panel Wednesday that failing to raise the federal debt ceiling would have catastrophic consequences that could bring on a.

Although failure to pay a debt is not a criminal offense it has many consequences depending on on the debtors situation. A mortgage default will lead to foreclosure and an unpaid car loan can result in repossession of the car. It is as if they are using their Visa Card to make an American Express payment.

However before the court can order the incarceration of the debtor it will conduct an enquiry on the means or capacity of the debtor to determine if indeed he is unable to pay or is failing to. Simon Goldenberg a New York City attorney who specializes in debt. When a country does this its known as a sovereign default.

Failure to reach a compromise on a US. The result will be higher deficits. Inflation benefits borrowers at the expense of lenders.

Depending on the state where you live your debts may stay in effect for four years or more. Here are seven of the most immediate and severe side-effects if lawmakers fail to raise the debt ceiling in time to avoid default. Studies have shown that public debt grows around two-thirds in the years after a crisis while a crisis in a rich country can rapidly change capital flows in peripheral countries.

This is when the country cannot repay its debt which typically takes the form of bonds. Debt ceiling increase could result in an unmitigated economic disaster one so unprecedented government and private analysts cant even accurately pinpoint. International investors should keep these points in mind when analyzing potential investments around the world.

When you hear the word debt youll likely have some negative connotations in terms of financial health and stability. Treasury is unable to issue or auction any more Treasury bills bonds or notes. However these write-offs are picked up by debt collection agencies which continue to contact debtors through letters and phone calls.

A slight increase in interest rates would significantly increase these payments and leave the US with even more debt than it already has increasing their trillion dollar per year deficits. They must borrow money to repay prior debts. Eventually private borrowing will be crowded out if the governments debt continues to grow and interest rates will rise.

At some point action will have to be taken to rein in the deficit. Tax revenues will fall as peoples income drops and Federal spending will rise. If the dollar collapses and runaway inflation results it may get easier to pay off existing debt but its also going to be extremely difficult and costly to engage in any new borrowing.

Unless however your debts are for tax evasion or failing to pay child support. An increasing number of charged-off cards occurred after the 2008 financial crisis for a couple of years. This is a scenario whereby the US could default just as Argentina did in the early 2000s.

If the debt ceiling is reached and not raised the US. Government is in what is known as a debt death spiral. A debtor who fails or refuses to pay a judgment debt is liable to imprisonment for 90 days or any lesser period at the discretion of the court.

So if the US were to default it would. Without the ability to expand beyond tax revenues the Treasury Department must decide which debts to pay and postpone.

The Real Owner Of The Us Debt Will Surprise You

Uk Personal Debt Photo And Video Personal Debt Instagram Photo

There Are Many Myths About Filing For Bankruptcy Some People See It As A Sign Of Failure But The Truth Is Some Of The Bankruptcy Successful People Attorneys

What Is Universal Basic Income A Brief History David Croen Pulse Linkedin Universal Basic Income How To Apply Brief

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

Debt To Equity D E Ratio Definition And Formula

Dcbl Bankruptcy Requirements Tip A Discharge Of A Debt That Would Normally Be Granted May Be Denied If The Bankruptcy Child Support Quotes Child Support Laws

How To Get Out Of Debt 10 Practical And Mindset Tips The Curious Frugal Get Out Of Debt Debt Free Living Debt

Model Predicts Which Delinquent Credit Card Holders Will Pay Ut News Credit Card Holder Credit Card Financial Decisions

Passive Income Ideas How To Make Passive Income Passive Income Income Money Making Machine

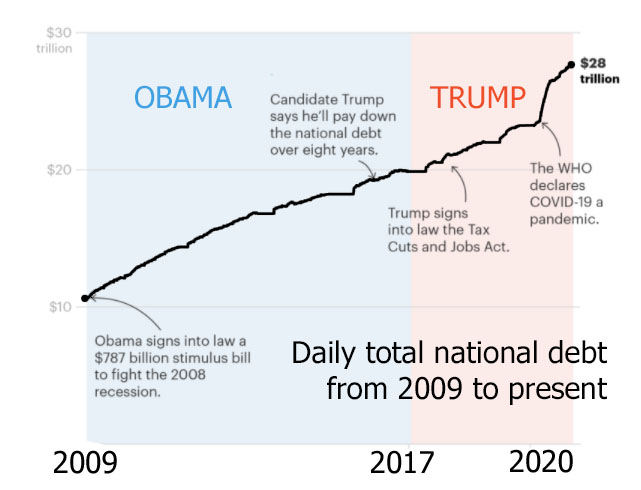

Donald Trump Built A National Debt So Big Even Before The Pandemic That It Ll Weigh Down The Economy For Years

Same In The Uk Yeah There May Be A Waiting List But If Its An Emergency You Get Seen And You Don T End Up Thousands In Debt T Words The More You Know Feminism

Pin On Ninjatrader Trading Updated By Ninza Co

6 Common Debt Causes And How To Avoid Them City Girl Savings Debt Finance Tips Debt Repayment

5 Easy Ways To Stop Being Poor Being Broke Money Habits Managing Your Money

Cbo Consequences Of A Growing National Debt Committee For A Responsible Federal Budget

7 Proven Ways To Pay Off Credit Card Debt Payoff Lift Paying Off Credit Cards Budgeting Money Loan Payoff

4 Tips To Preventing Bad Debts Debt Nirvana Debt Collection Bad Debt Debt Collection Agency

Inaccessible Boot Device In Windows 10 Windows Windows 10 10 Things