When Systemically Important Banks SIBs were in danger of failure in the past only one model of rescue had been followed which was government capital injectionsbailouts and guarantees to keep the financial system stable while shareholders lost out as a result of dilution in shareholding. The D-SIB framework requires the Reserve Bank to disclose the names of banks designated as D-SIBs starting from 2015 and place these banks in appropriate buckets depending upon their Systemic Importance Scores SISs.

Pin On A Data Pin Do Embedpin Href Http Www Pinterest Com Pin 401946335464277269 A

The other two such banks are State Bank of India SBI and ICICI Bank.

What is domestic systemically important banks (d-sibs). OSFI is of the view that increased transparency will support banks. Domestic Systemically Important Banks D-SIBs Subject. The disorderly failure of these banks has the potential to cause significant disruption to the essential.

Such banks have been termed as domestic-systemically important banks D-SIB. This has warranted the need for enhanced supervisory measures for D-SIBs which current regulatory policies. The D-SIBs Assessment Framework aims to assess the degree to which banks are systemically important to the local financial system and domestic economy.

D-SIB means that the bank is too big to fail. Canada currently has six D-SIBs. Banks that cross-jurisdictional activities and complexities and do not have any substitute or replacement are called systematically important banks.

Framework for Dealing with Domestic Systemically Important Banks D-SIBs Introduction Some banks due to their size cross-jurisdictional activities complexity lack of substitutability and interconnectedness become systemically important. The Royal Bank of Canada RBC and the Toronto-Dominion Bank TD have also been designated as G-SIBs. RBI issued guidelines for Domestic Systemically Important Banks D-SIBs.

Accordingly the assessment focuses on the impact of a banks failure within the financial system. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context. A starting point for the development of principles for the assessment of D-SIBs is a requirement that all national authorities should undertake an assessment of the degree to which banks are systemically important in a domestic context.

Size takes into account all exposures Loans savings deposits commissions from mutual fund businesses of a bankA A bank is deemed more interconnected if it has borrowed or lent more money from other banks or financial institutions. The Royal Bank of Canada RBC and the Toronto-Dominion Bank TD have also been designated as G-SIBs. Each year in August RBI will disclose the names of banks designated as D-SIBs using two-step technical process that is not important for ordinary exams.

The rationale for focusing on the domestic context is outlined in paragraph 17 below. These banks are considered too big to fail which. Singapore 30 April 2015.

The Monetary Authority of Singapore MAS today published its framework for identifying and supervising domestic systemically important banks D-SIBs in Singapore and the inaugural list of D-SIBs. Last week the Reserve Bank of India RBI declared HDFC Bank Ltd to be a domestic systemically important bank D-SIB. SIB assessment methodology to domestic systemically important banks D-SIBs in October 2012.

A domestic systemically important bank D-SIB is a bank that could disrupt the domestic economy should it fail. According to the RBI some banks become systemically important due to their size cross-jurisdictional activities complexity and lack of substitute and interconnection. In August 2019 the Reserve Bank published a response to submitters feedback on the D-SIB framework which also details.

The Reserve Bank consulted on a framework for identifying Domestic Systemically Important Banks D-SIBs and consulted on additional capital buffer requirements for banks designated as D-SIBs during the first half of 2019. Domestic Stability Buffer OSFI is providing greater transparency to the market surrounding the Domestic Stability Buffer currently held by D-SIBs against Pillar 2 risks associated with systemic vulnerabilities. 2 D-SIBs are banks that are assessed to have a significant impact on the stability of the financial system and proper.

Canada currently has six D-SIBS. Framework for dealing with Domestic Systemically Important Banks D-SIBs on July 22 2014. What is a domestic systemically important bank and why is it important.

D-SIB in India 2014. The Reserve Bank had issued the. 13 Primary objective of the implementation of the D-SIBs framework is D-SIBs to hold higher capital buffers and to provide incentives to reduce their systemic importance on the domestic.

The rationale for focusing on the domestic context is outlined in SCO5010. A domestic systemically important bank D-SIB is a bank that could disrupt the domestic economy should it fail.

First Grade Spelling Words Worksheets First Grade Spelling Worksheets Spelling Words First Grade Spelling Spelling Worksheets

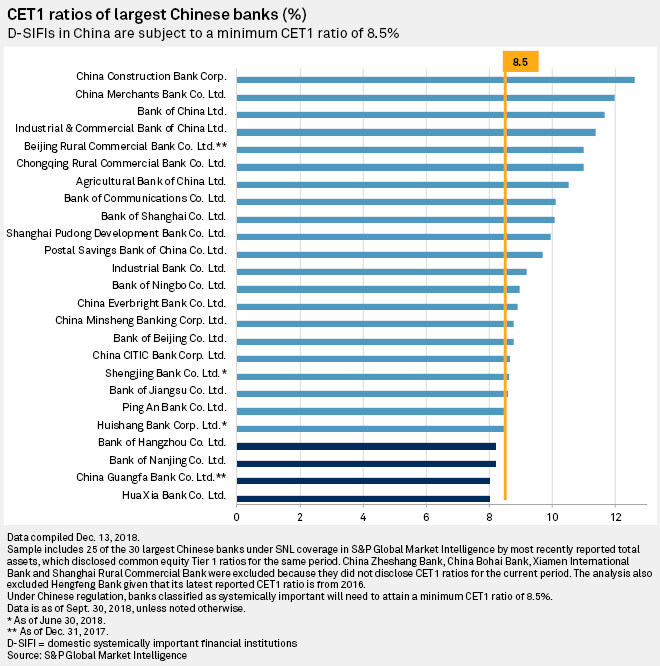

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

Domestically Systematically Important Banks Dsibs For Rbi And Nabard 2018 Youtube

Domestic Systemically Important Banks D Sibs Framework Flip Ebook Pages 1 23 Anyflip Anyflip

Domestic Systemically Important Banks D Sibs Framework Flip Ebook Pages 1 23 Anyflip Anyflip

Https Www Bis Org Publ Bcbs233 Pdf

Buckets Of Chinese D Sibs Download Table

China Bank Capital Adequacy Ratios 10 Domestic Systemically Important Banks Say Fitch

Domestic Systemically Important Banks D Sibs Empower Ias Empower Ias

Hdfc Bank Too Big To Fail Why This Crucial Tag Stamped On Just 3 Banks In India Read All About It The Financial Express

Finance Malaysia Blogspot What Is Domestic Systemically Important Banks D Sib

Domestic Systemically Important Banks D Sibs Framework Flip Ebook Pages 1 23 Anyflip Anyflip

Fast Simple Image Host Butterfly Cross Stitch Pattern Simple Image

As Local Systemic List Grows At Least 4 Chinese Banks May Need Fresh Capital S P Global Market Intelligence

Finance Malaysia Blogspot What Is Domestic Systemically Important Banks D Sib