Target price may mean. Advantages of Target Pricing It is a dynamic method of price determination that takes into account and responds to market factors of demand and.

Ren Crypto Price Prediction New Price Target Revealed In 2021 Predictions Reveal New Price

A stock valuation at which a trader is willing to buy or sell a stock Target pricing The price at which a seller projects that a buyer will buy a product This disambiguation page lists articles associated with the title Target price.

What is target price mean. It results in higher profitability for business by way of reducing cost as the selling price is already. Target prices are used by brokers and analysts in reports to show how they expect a share in a particular company to perform. This involves estimating future earnings potential by.

Target prices can be used to evaluate stocks and may be even more useful than an equity analysts rating. If it cannot manufacture a product at these planned levels then it cancels the design project entirely. The Jones-Smith analyst studies the industry Company XYZs competitors Company XYZs products and management etc.

Key Takeaways A target price is an estimate of the future price of a stock. Price targets tell a story about how Wall Street feels about a stock but often not much more. The product of desired rate of return and the capital invested gives the required.

Price targets reflect what the analyst believes a stock will be worth at the end of a certain time period usually one year or 18 months depending on the broker. The first step is to determine a stocks fair value. Analysts consider numerous fundamental and technical factors to.

Target marketing involves breaking down the entire market into various segments and planning marketing strategies accordingly for each segment to increase the market share. A price target is an analysts projection of a securitys future price one at which an analyst believes a stock is fairly valued. Target costing is a system under which a company plans in advance for the price points product costs and margins that it wants to achieve for a new product.

The target profit is typically derived from the budgeting process and is compared with the actual outcome in the income statement. The target price is. Target profit is the expected amount of profit that the managers of a business expect to achieve by the end of a designated accounting period.

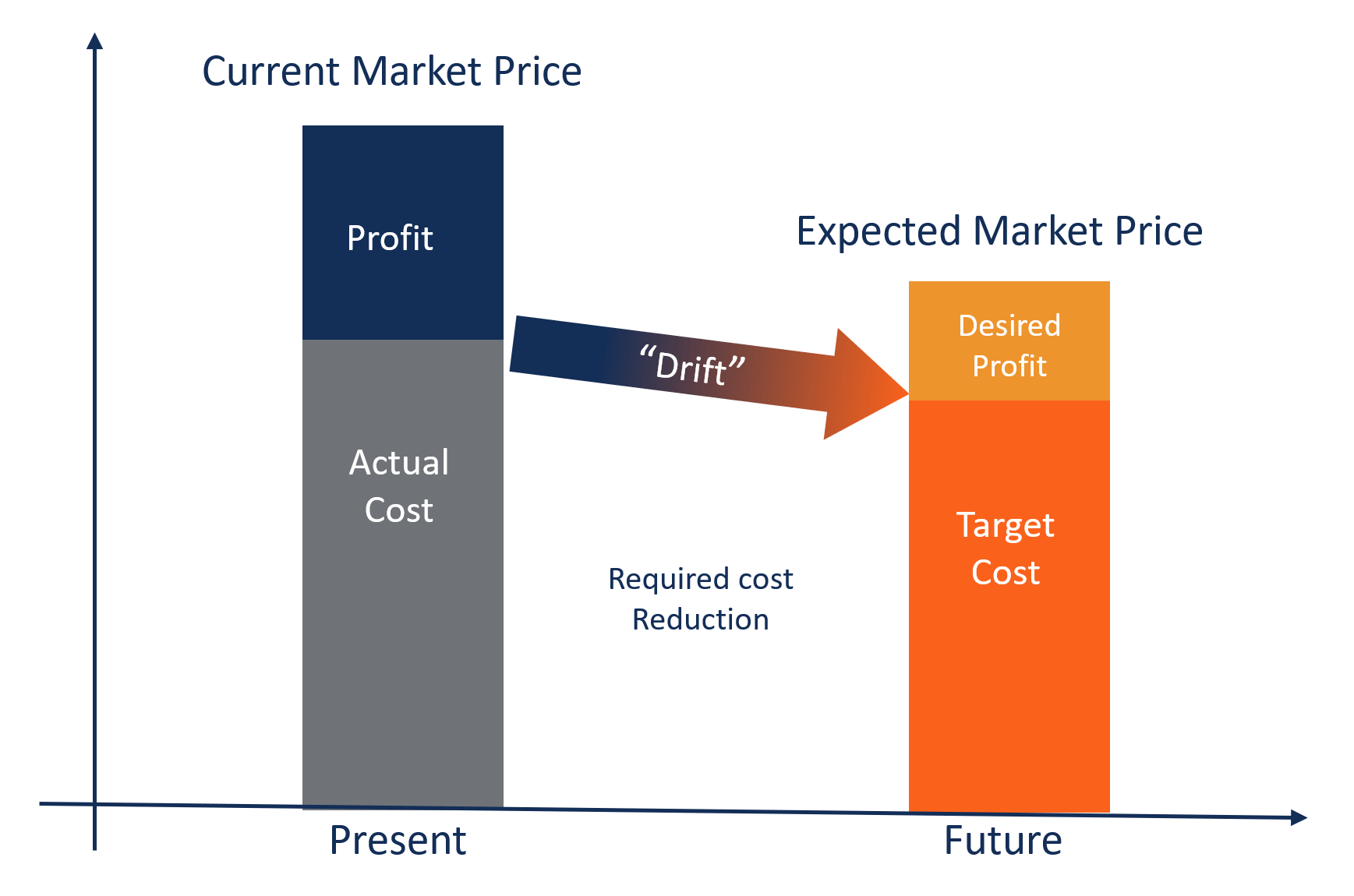

What is Target Costing. Target prices are based on earnings forecasts and assumed. A target cost is the maximum amount of cost that can be incurred on a product however the firm can still earn the required profit margin from that product at a particular selling price.

How Does a Price Target Work. In industries such as FMCG Fast Moving Consumer Goods construction healthcare and energy competition is so intense that prices are determined by supply and demand in the market. Producers cant effectively control selling prices.

Target market is the end consumer to which the company wants to sell its end products too. The ROI can be calculated as Gain from investment cost of investment cost of investment. Investors could set buy and sell price points around target prices to maximize returns.

Here the desired return is the desired return on investment also known as ROI. For example someone buying an XYZ 50 call for a premium of 200 could have a target. Still knowing something about target price formation and valuation can make you a better investor.

A price target is an analyst s expectation for the future price of a security. For example lets assume that the Jones-Smith investment bank provides research reports about Company XYZ stock. The Target-Return Pricing is a method wherein the firm determines the price on the basis of a target rate of return on the investment ie.

Definition of Target Market Definition. Marc Shoffman of This is Money replies. Target price is on which Investor want to sell the securit.

I would take an example. What Is a Price Target. Target costing decomposes the target cost from product level to component level.

Target return price unit cost desired return invested capital unit sales. CIMA defines target cost as a product cost estimate derived from a competitive market price Target Costing Selling Price Profit Margin. What the firm expects from the investments made in the venture.

Price of the underlying security after which a certain option will become profitable to its buyer. Buying PriceBid Price - 470 Market Price - 500 Target Price - 510 Stop loss price - 450 So Market price that is actually reflecting on the stock exchange.

Mean Reversion Supply Demand How To Remove Stop Loss And Take Profit Levels How To Remove Demand Profit

Target Costing Key Features Advantages And Examples

Online Courses Coupons Listing Forex Pattern Meaning Trading Strategies

Target Bands Indicator Trend Following System Trading Charts Swing Trading Trading Indicators

Tradingaxis Free Daily Forex Signals Trading Charts Stock Trading Learning Forex Trading Quotes

Long Wick Candle Forex Trading Price Action Mt4 Chart Forex Forex Trading Trading

Mean Girls Christmas Graphic Tee Mean Girls Christmas Mean Girls Graphic Tees Vintage

Pin On Acronyms Internet Slang 7 Esl

Pin On Unitedhealth Group Incorporated

Eurusd Break Above 1 1170 To Target 1 1450 Daily Price Action In 2020 Setup Forex Target

Technical Analysis Ppt Technical Analysis Technical Analysis Tools Analysis

Sale Price Codes Shopping Hacks Saving Money Budgeting Money

Diamond Pattern Trading Charts Diamond Pattern Technical Analysis Charts

What Does Price Earnings Ratio Mean Stock Market Investing Stock Market Investing

Hyperinflation History May Provide Valuable Lessons For Fed S Target How To Memorize Things Geometric Mean Chart

What The Numbers On Target S Clearance Tags Mean Target Clearance Target Sales Target Clearance Schedule

7 What To Do When Your Crochet Business Has Two Target Customers In 2020 Crochet Business Handmade Business Target Customer