If you applied with a good credit score you may be given a low-interest on the credit card. Most Bankruptcy Filings Are Motivated by Credit Card Debt.

Why Are Interest Rates On Credit Cards So High

The higher the likelihood a borrower cant cover his debt the higher the interest rate goes to help offset the cost of unpaid bills.

Why is the interest rate on my credit card so high. While car house and school loans tend to have interest rates in the single digits credit card APRs typically fall in a range between 12-29. The reason for the seemingly high rates. Such cards may offer a lower rate of interest than that being paid on a current credit card.

It is like loan sharking right. Each month you carry a balance over from the previous month youll have a finance charge added to your balance. If someone is in financial turmoil financial disaster why are there not laws limiting interest rates on what they can borrow just like you cannot price gouge during natural disasters.

A balance transfer can significantly reduce total interest payments during the balance transfer period. Credit cards are unsecured loans. They are also more difficult to obtain and often require a higher credit score.

Perhaps the number one reason why credit card interest rates remain high is because they are unsecured loans. Heres a question with a seemingly complex answer. There is a higher chance of delinquency in credit cards than other loans.

There are several factors that play a role in determining how high a credit card interest rate will be and a majority of these factors have nothing to do with your personal creditability as a borrower. Consumers have all of the power in terms of when and how to use their allotted credit. Capitalism and the need for jobs took over.

So why are credit card interest rates so high. My best analogy is. There are a number of reasons people point to for the stickiness of credit card rates.

Furthermore it does not influence the pricing of consumer lending or credit cards interest rates. Is there are 0 credit card interest rate. Charge-offs and defaults are typically higher on credit.

With car loans home loans rates are 5 percent or less for buyers with good credit. Your credit card issuer will charge interest whenever you carry a balance beyond the grace period. Factors that Influence Credit Card Interest Rates and Fees.

On the other hand if you have always paid your account on time and one slip-up resulted in an increased interest rate you may be able to talk your card issuer into lowering your interest rate. The loans are unsecured. Loan sharking is illegal right.

Lenders attempt to compensate. Generally credit card rates will always be higher than those of other loan types because credit card debt is unsecured says Robert Hammer founder and. Below CNBC Select breaks down three reasons why your credit card interest rate is so high and what you can do to avoid ever having to worry about it.

It all depends on your credit score. Unsecured lines of credit tend to come with higher interest rates than secured LOCs. An interest-free period from purchase to payment depending on the card as long as the balance is paid in full when owing.

So how did this lead to such high interest rates for credit cards if all states have usury laws capping the amount of interest that can be charged. The CBA says there are several factors that influence credit card interest rates and fees including. How can a bank charge 29 interest on a revolving unsecured credit account.

The short answer. How to Tell if Your Interest Rate Is Too High. A more complete answer is that banks charge interest based on the perceived risk of lending money.

Why is my credit card interest rate high while others are low. If your interest rate increased because of a delinquency or default on your part you may not be able to get the interest rate decreased even if it was with a different credit card. If the person with this type of loan fails to pay on it the lender can always repossess the car or the house.

As a bankruptcy attorney I can tell you the number reason why most people seek the protection of filing for bankruptcy is credit card debt. Credit card interest isnt a one-time thing either. But the credit card companies cant do this.

Credit card interest rates might seem outrageous some stretching beyond a 20 annual percentage rate far higher than mortgages or auto loans. In comparison mortgages are secured by houses and car loans by automobiles. Credit card issuers charge as much as they can in order to be as profitable as possible.

According to the Federal Reserve Bank the average interest rate for all credit card accounts is just over 12 while the accounts that were assessed interest had slightly higher rates of between 13 and 14 over the last yearSo if your credit cards standard interest rate is below that amount then you have a rate that is better than average. A bad score on the other hand will only give you a higher interest rate. After all when banks pay consumers interest the rate is a fraction of 1.

Lending standards are much lower for credit cards. Why is my credit card interest rate so high.

What Is The Average Credit Card Interest Rate

4 Reasons Why You Should Use A Credit Card Instead Of A Debit Card

What Is A Good Apr For A Credit Card Rates By Score

Why Are Credit Card Interest Rates So High Nerdwallet

Credit Card Interest Rates Types Current Rates

What Is The Average Credit Card Interest Rate

What Is The Average Credit Card Interest Rate

The Average Credit Card Interest Rate By Credit Score And Card

:strip_icc()/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg)

How Your Credit Limit Is Determined

:max_bytes(150000):strip_icc()/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png)

How And When Is Credit Card Interest Charged

:max_bytes(150000):strip_icc()/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How And When Is Credit Card Interest Charged

What Are Interest Rates How Does Interest Work Credit Org

Why Are Credit Card Interest Rates So High Nerdwallet

8 Alternatives To A Credit Card Cash Advance

Average Credit Card Interest Rates Valuepenguin

How To Get Lower Interest Rates On Credit Cards Chase

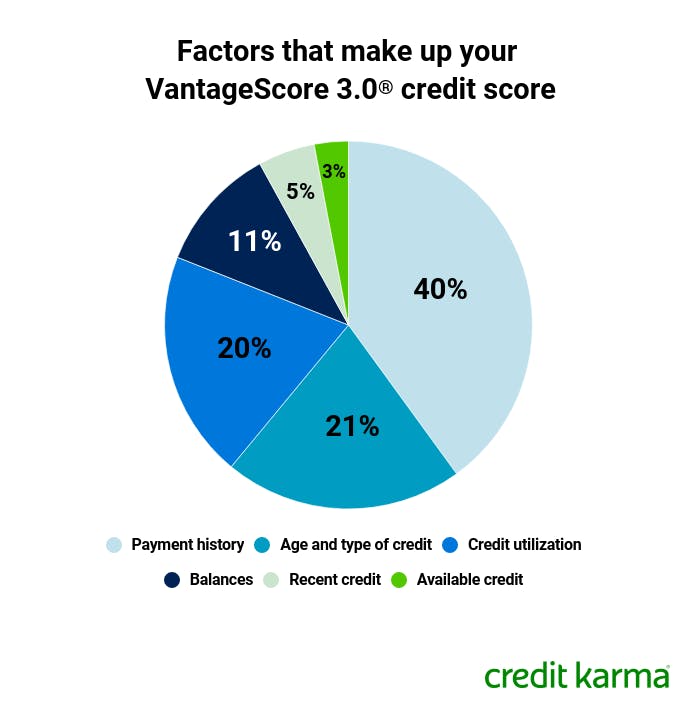

How Credit Card Utilization Affects Credit Scores Credit Karma

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)