The relevant legislation for the tax reduction was passed by the Legislative Council and gazetted on 7. You should continue to claim the personal reliefs if you have met the qualifying conditions.

Year Of Assessment 2013 Guide On Filing Of Form B Iras

This may sound too late for you but Im sure there are many of you out there are last-minute taxpayers.

Ya2013 special tax relief. The total exempt amount is 100000. Tax incentives Special deductions Tax treatment of income from rehabilitating abandoned projects Stamp duty exemption. De trs nombreux exemples de phrases traduites contenant special tax relief Dictionnaire franais-anglais et moteur de recherche de traductions franaises.

The exemption available on Amount Receive From Benevolent Fund and exemption av. RM3000 Tax Relief - Personal Computer new definition for YA2013 It is important for taxpayers to take note that with effect from the Year of Assessment YA 2013 there will be a new definition of personal computer for the purpose of claim for personal relief for personal computer by an individual. This special relief is given to those with chargeable income of less than RM96000.

This may sound too late for you but Im sure there are many of you out there are last-minute taxpayers. Assuming your chargeable income for YA 2020 is 150000 you will claim 75 tax exemption on the first 100000 and 50 on the next 50000. Many translated example sentences containing special tax relief Spanish-English dictionary and search engine for Spanish translations.

There are some other rules a person can be qualified as tax resident in Malaysia. However please evaluate whether you would benefit from the tax relief and make an informed decision. Under the IRASs CPF Top-Up Relief programme Singaporeans and Permanent Residents can decrease their tax payable by an amount equal to the cash top-up made to their Special Account under 55 years old or Retirement Account aged 55.

Amount RM 1. YA2013 Special Tax Relief. Corporate Tax 2014 Eective from Proposals YA 2013 YA 2015 Refer Table 1 YA 2015 Special tax relief of RM2000 be given to tax payers with a monthly income up to RM8000 Non-resident individuals income tax rate is reduced by 1 from 26 to 25 Reduction in income tax rates by 1 to 3 Individual income tax structure will be reviewed.

The public rulings are available for download on IRBs website at wwwhasilgovmy Laws and Regulations. No tax relief is available for non-tax residents. It explains the tax treatment of a rescuing contractor or developer including.

Special tax relief for purchase of handphones computers or tablets. Even said so for those of you already filed for your 2013 personal income recently do you realized that there is this Special Relie f. The Corporate Income Tax rebate was based on 30 of the tax payable up to a maximum of 30000 per YA.

The special three-year corporate income tax rebate 30 of tax payable up to a maximum of SGD 30000 per year of assessment YA that originally was available for YA 2013 to YA 2015 would be extended for an additional two years YA 2016 and YA 2017 but the maximum rebate would be reduced to SGD 20000 per YA. Personal Income Tax Effective from Proposals YA 2013 special tax relief of RM2000 be given to tax payers with a monthly income up to RM8000 YA 2015 Refer Table 1 Reduction in income tax rates by 1 to 3 Individual income tax structure will be reviewed. I know I know.

The Financial Secretary proposed a one-off reduction of profits tax salaries tax and tax under personal assessment for the year of assessment 202021 by 100 subject to a ceiling of 10000 per case. As part of the 2013 Budget Transition Support Package to relieve business costs a special Corporate Income Tax rebate was granted to companies from YA 2013 to YA 2015. You cannot carry forward the difference of 25000 125000 - 100000 to YA 2021 or any other subsequent YAs.

Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia. The following are some of the key proposed changes in tax in the 2014 Budget- 1. Generally rule is a person is a Malaysia tax resident if heshe stays more than 180 days in Malaysia.

If youre earning less than that for sure youre entitle for this special relief. This works out to be RM8000 average monthly income. This relief is applicable for Year Assessment 2013 and 2015 only.

Tax incentives offer relief from payment of direct or indirect tax partially or fully. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. Medical expenses for parents.

5000 Limited 3. I know I know. YA2013 Special Tax Relief.

Self and Dependent Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Many translated example sentences containing special tax exemption German-English dictionary and search engine for German translations. Even said so for those of you already filed for your 2013 personal income recently do you realized that there is this Special Relief.

In this lecture we will study imported exemption from paper point of view.

Https Www Mayerbrown Com Media Files Perspectives Events Publications 2015 07 Asia Tax Bulletin Files Asi Taxbulletin Summer2015 Fileattachment Asi Taxbulletin Summer2015 Pdf

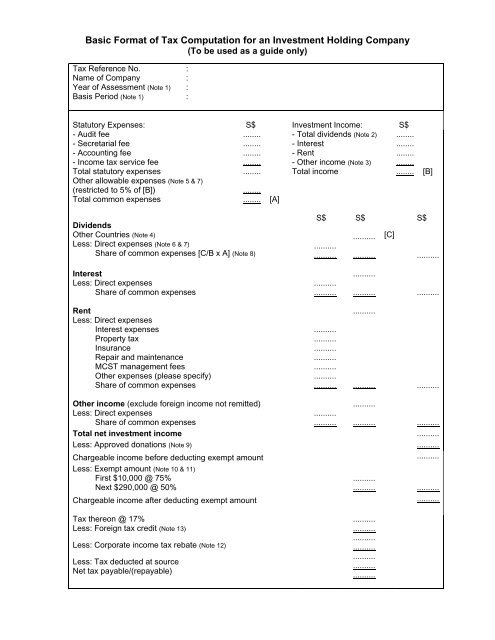

Basic Format Of Tax Computation For An Investment Holding Iras

Finance Malaysia Blogspot Ya2013 Special Tax Relief

5 April 2012 Dear Sir Mdm Simplified Income Tax Filing For Small

Capital Allowances Write Off Interest

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Quick Links Explanatory 20notes 20to 20form 20c S 20ya 202013 Pdf

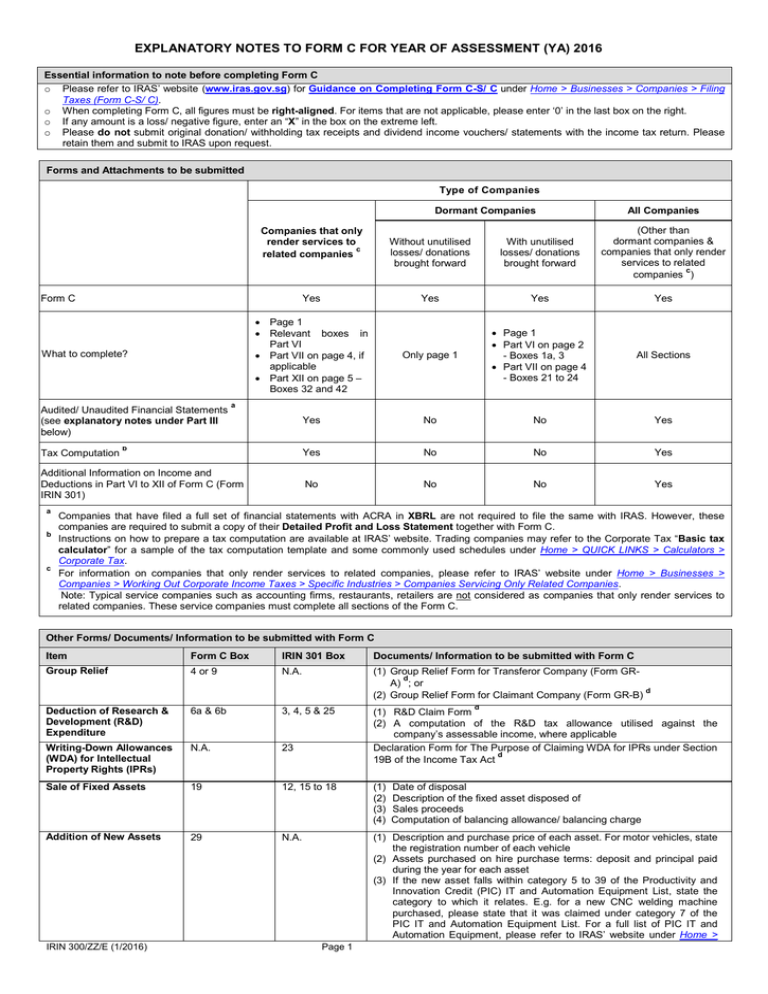

Explanatory Notes To Form C For Year Of Assessment Ya 2016

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Do You Know That You Get A 30 Corporate Tax Rebate For 3 Years From Ya 2013 To Ya 2015 Learn More Here H Singapore Business Corporate Tax Rate Tax Rebates

Productivity And Innovation Credit Scheme In Singapore This Infographic Will Help You Understand How Your Company Can Enjoy U Innovation Singapore Infographic

Irb Guidelines For Income Tax Treatment Of Mfrs 5 Pages 1 7 Flip Pdf Download Fliphtml5

Enhancing The Double Tax Deduction For Internationalisation Scheme 1 April March 2016 1 Background Pdf Free Download

Tax Incentives Mines Wellness City

Annex B 2 Research And Development R D Tax Measures Pdf Free Download

Singapore Does Not Need To Emulate Nordic Type Welfare

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Schemes Pic 20illustration 20 20training Pdf

Https Www Iras Gov Sg Irashome Uploadedfiles Irashome Businesses Foreign 20tax 20credit Worked 20example Pdf