We Connect Projects That Matter With People Who Care. You can expect good-performing individual peer-to-peer loans to offer you maybe 5-12 interest.

P2p Lending Through Murabaah Download Scientific Diagram

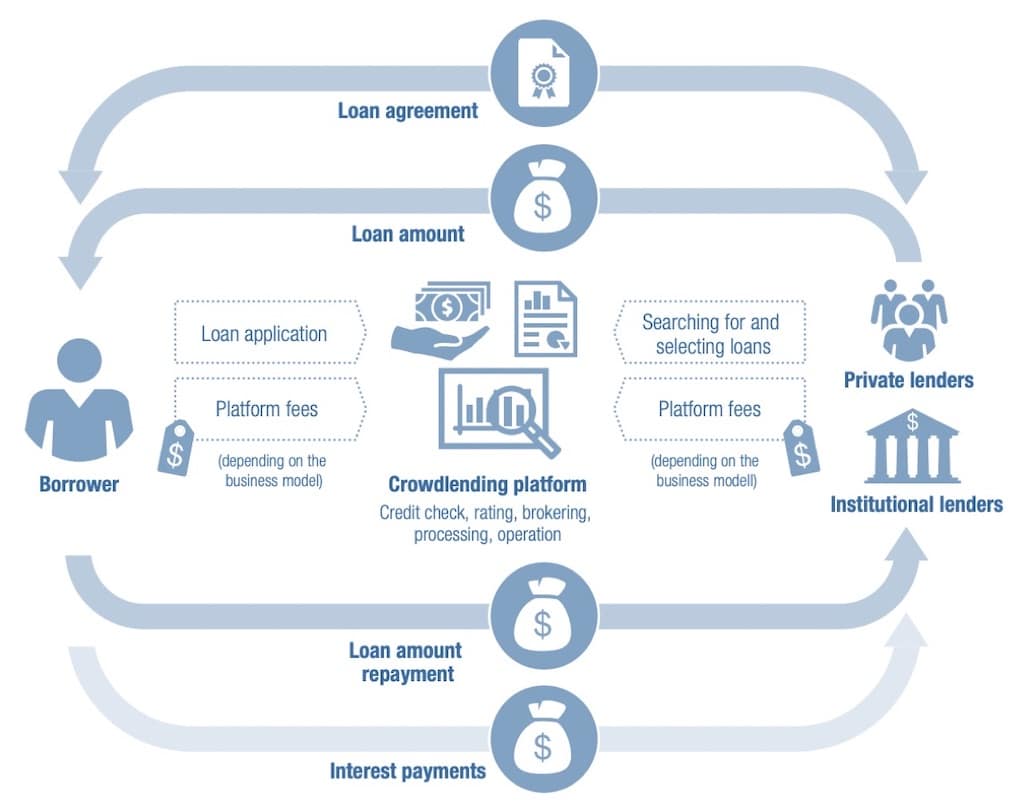

Peer-to-peer P2P financing is a web-based innovation that broadens the ability of entrepreneurs and small business owners to unlock capital from a pool of individual investors in small amounts and provides a quick turnaround time to obtain financing for their businesses through an online digital platform.

Crowdfunding what is p2p financing. Raising finance online from a number of people or investors who pool together. Prosper offers loans up to 40000 with a. This fact sometimes is the reason for their inappropriate usage in a business environment.

We Connect Projects That Matter With People Who Care. Despite being the opposite they are often mixed up. Ad Start Raising Money for Your Special Cause with a Stunning Wix Website.

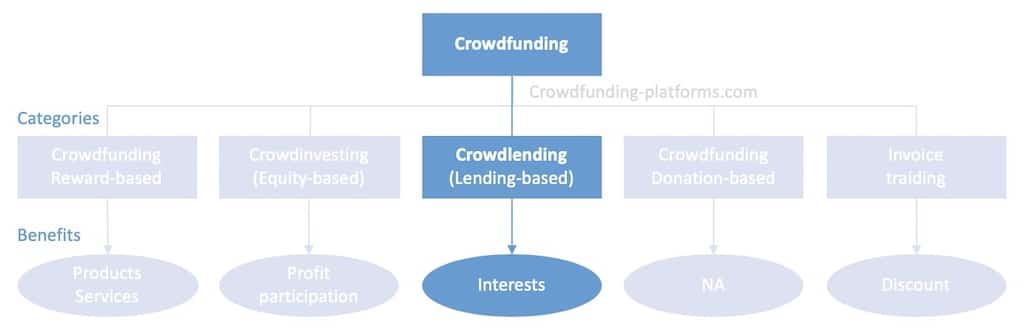

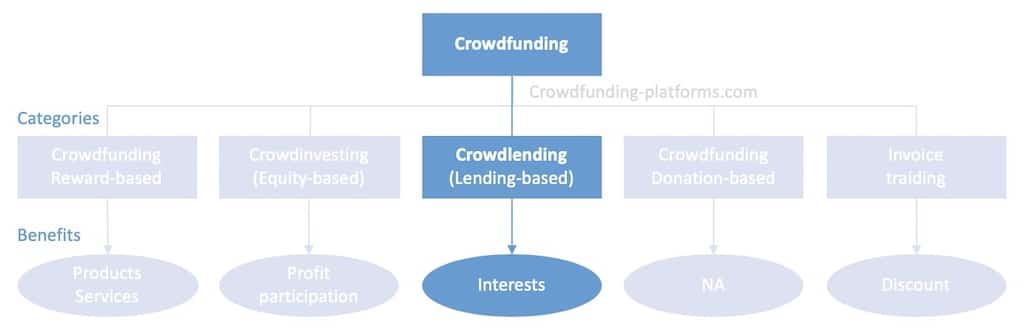

Together P2PCrowdfunding lending refers to platforms that raise funding for businesses in exchange for interest payments or equity shares. It has two types crowdfunding and peer-to-peer lending. Unlisted shares and donations ie.

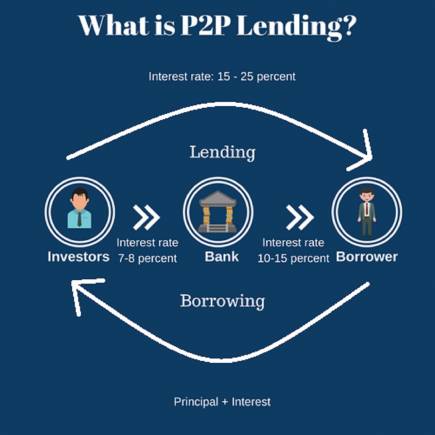

Ad Now With Zero Platform Fees You Can Keep More Of The Money You Raise. P2P Financing is already a well-established concept in the USA UK and China amongst. But in this case I think the very wide difference in hoped-for returns between typical P2P lending and equity crowdfunding is perfectly reasonable loosely correlating with the actual risks.

The sharing economy and progressive technologies have given the world an exciting thing alternative financing. The crucial difference between crowdfunding and P2P lending or marketplace lending as it is increasingly known is how to repay your investors. P2P lending also known as loan-based crowdfunding is where the crowd lend money to a borrower in return for repayment with interest over a period of time.

Ad Start Raising Money for Your Special Cause with a Stunning Wix Website. With all the opportunities in crowdfunding these days it can be interesting and rewarding to understand how peer-to-peer loans and investments work. Websites that facilitate P2P lending have.

Crowdfunding is the broad overarching term which includes Crowdlending and Peer to Peer Investing however Crowdfunding also includes the crowd providing money in return for goods ie. And to date says it has organized over 14 billion in P2P loans to nearly 900000 people. P2P business lending is also known as marketplace business lending and business crowdlending.

So were going to address three points of comparison. The earliest forms of peer. Crowdfunding or peer-to-peer lending might be suitable So for those who want to access money quickly and who may not meet the lending criteria of a bank or building society to buy a property then crowdfunding or peer-to-peer also known as P2P lending might be a suitable choice.

UKs 1 Crowdfunding Platform. Its the very first peer-to-peer lending platform in the US. Crowdfunding Takes Your Story Into Account More Than P2P Lenders Brand new startup businesses looking for outside funding usually try for crowdfunding because raising the money doesnt depend on the businesses current cash flow or profitability.

Both crowdfunding and P2P lending give your business money from individuals. But theres more to it than that. Ad Now With Zero Platform Fees You Can Keep More Of The Money You Raise.

Peer-to-peer P2P lending enables individuals to obtain loans directly from other individuals cutting out the financial institution as the middleman. Prosper is to P2P lending what Kickstarter is to crowdfunding. In the case of SMEs P2Pcrowdfunding can be a great alternative to traditional financing methods.

This type of debt-based crowdfunding is characterised by individuals or institutional investors providing secured or unsecured loans to a business. P2P lending and crowdfunding share one common principle. There are a number of different models but they revolve around the concept of using the internet to link people who have money to people in need of money.

Kickstarter parts of a business ie. This typically takes place through online platforms which act as substitutes for traditional banks. Also just about anyone can become a lender and you will need.

The primary difference is that P2P lending gives you a business loan that you have to pay back while crowdfunding gives you funds that you never have to repay. UKs 1 Crowdfunding Platform.

![]()

Crowdfunding And Peer To Peer Lending Everything You Need To Know Excel Capital Management

P2p Lending Risks And Business Models Corporate Compliance Insights

Crowdfunding Vs P2p 03 Iontuition Education Fintech

P2p Lending Explained Business Models Definitions Statistics

How To Build A Successful P2p Lending Platform Justcoded

Relationship Of P2p Lending Crowdfunding And Crowdsourcing Download Scientific Diagram

P2p Lending Explained Business Models Definitions Statistics

![]()

Crowdfunding And Peer To Peer Lending Everything You Need To Know Excel Capital Management

P2p Lending Explained Business Models Definitions Statistics

Crowdlending Guide How To Invest In P2p Lending Earn Money At Home

Crowdlending Guide How To Invest In P2p Lending Earn Money At Home

Relationship Of P2p Lending Crowdfunding And Crowdsourcing Download Scientific Diagram

P2p Lending Risks Is Peer To Peer Lending Safe Invest In Club

How To Earn Money With P2p Lending Crowdspace

What Is Peer To Peer Lending Invest In Club

1 P2p Lending In The Context Of Financial Return Crowdfunding Source Download Scientific Diagram

How Crowdfunding Works Complete Guide To Business Finance Xero Us

P2b And P2p Crowdfunding Vs Crowdlending What S The Difference