If you want to withdraw more You can set aside the Basic Retirement Sum BRS which is half of the FRS with sufficient property chargepledge. Upon turning age 55 a CPF member can withdraw cash from his CPF OA and SA.

Epf Introduces Akaun Emas For Withdrawal At Age 60 The Edge Markets

Not an easy task.

How much can i withdraw from epf at age 55. Although the EPF corpus can be withdrawn only after retirement early retirement is not considered until the person reaches 55 years of age. All information and figures are accurate as at 1 February 2020. When your father reaches 55 years of age he can withdraw in cash his EPF funds with the Insolvency Department by submitting a bankruptcy declaration letter.

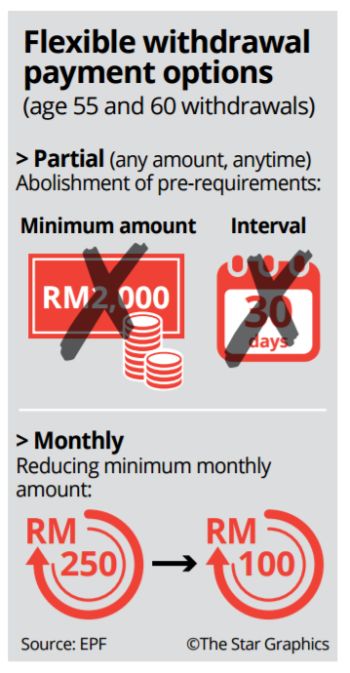

The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. Here are the main amendments to EPF withdrawal rules- 90 of the EPF balance can be withdrawn after the age of 54 years After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment EPF Withdrawal before 5 years of Service.

Now you can withdraw all your EPF at age 55 while you are still working with someone else if you choose to retire at later years say at age 60. The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings from 55 to 65. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

How Much Can You Withdraw From Your CPF At 55. EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. Please DO NOT refer to the submission information in Employees Provident Fund KWSP website.

The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2.

This rule says that you can withdraw about 4 percent of your principal each year so you could withdraw about 400 for every 10000 youve invested. The amount you can withdraw from age 55 depends on how much you set aside in your RA. How much can I withdraw.

Though the EPF amount can be withdrawn only after retirement that is at the age of 55 early retirement is not taken for consideration. The CPF withdrawal rules are. Some of that 400 would have to go to taxes.

If you set aside the Full Retirement Sum FRS You can withdraw your remaining OA and SA savings. How To Withdraw EPF Money Reaching 50 Years Old. If this is the only way youre looking at how much you can spend in retirement youre doing it.

However EPFO permits 90 withdrawal of EPF amount one year before retirement on condition that the person should not be less than 54 years of age. But you wouldnt necessarily be able to spend it all. 5000 OR your OA and SA savings above the Full Retirement Sum FRS whichever is higher.

This is a very tricky calculation since you dont know what youll earn in any given year nor what the rate of. Retirement sum figures are applicable to members turning 55 in 2020. Withdraw via i-Akaun plan ahead for your retirement.

However you may voluntarily choose not to withdraw your retirement fund at KWSP if you dont need that. You can withdraw from CPF at least 5000 and anything above your Full Retirement Sum or Basic Retirement Sum at the age of 55. Withdrawals of CPF savings from 55.

You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. 0 found this helpful.

Rethink The Epf Withdrawal Scheme Bait Al Amanah

Epf Withdrawals Before Maturity Personal Finance Retirement Withdrawn

Retirement Planning Calculator What Do The Numbers Tell Unovest

Why Epf Wants To Raise The Withdrawal Age Kinibiz

No Cash For Investment You Can Withdraw Money From Your Epf Savings To Increase Saving For Retirement Members Can Invest 30 Of The Total Savings From Account 1 Into Investment Schemes Approved

National Pension Scheme And Atal Pension Yojana Main Differences Pensions National Schemes

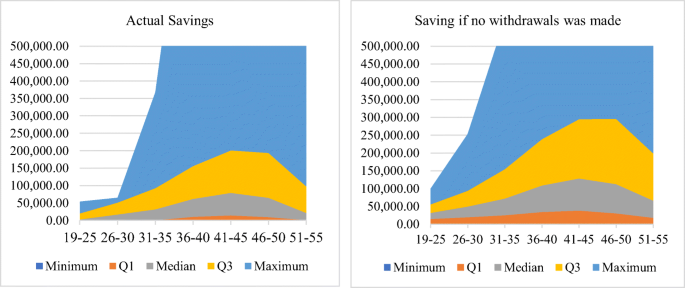

Average Savings Of Epf Members At 54 Years Of Age Download Scientific Diagram

Average Savings Of Epf Members At 54 Years Of Age Download Table

Ccrcs Vs Independent Living Choosing Your Best 55 Community Option Life Insurance For Seniors Preparing For Retirement Senior Health

Is Your Retirement Saving Enough For Your Retirement After Age 55 In Malaysia Life Beside Edge

Full Epf Withdrawal Not Allowed 4 New Changes Of Epf Withdrawal Changing Jobs New Rules Change

Date Of Leaving Is Less Than 2 Months From Today Or Age Should Be 55 Years Or More Ssm Smart Tech Youtube

Examining Withdrawal In Employee Provident Fund And Its Impact On Savings Springerlink

Tax On Epf After Resign Retire Or Terminated Basunivesh

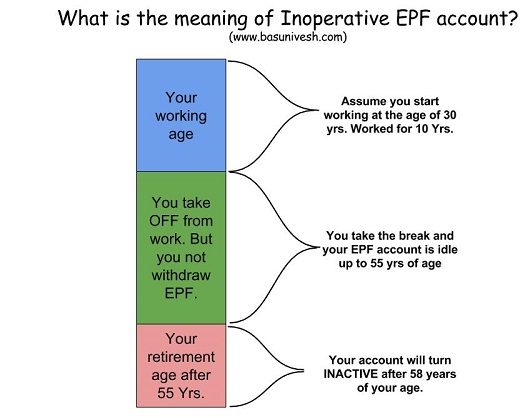

Interest On Inoperative Epf Accounts Up To 58 Yrs Of Age Basunivesh

Easier Epf Access For Over 55s The Star

No Cash For Investment You Can Withdraw Money From Your Epf Savings To Increase Saving For Retirement Members Can Invest 30 Of The Total Savings From Account 1 Into Investment Schemes Approved