Personal Tax Relief for YA2014 April 25 2015 Get link. Any amount paid to Non-Resident individuals in respect of any employment with or services rendered to an employer who is resident in Kenya or to a permanent establishment in Kenya is subject to income tax charged at the prevailing individual income tax rates.

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Course fee relief.

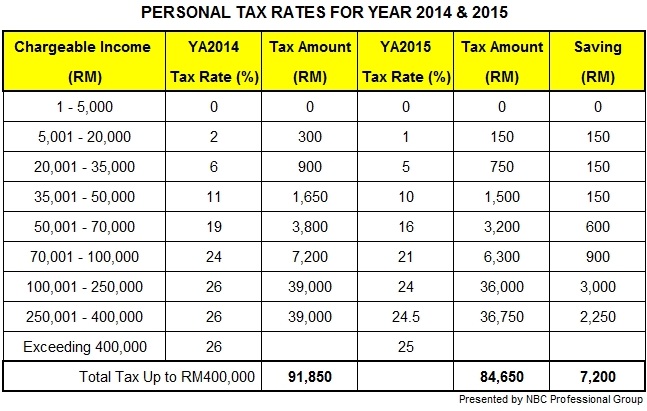

Personal tax relief for ya2014. Not much changes from YA2013 except on the following items. For more details on the partial tax exemption scheme please refer to Common Tax Reliefs That Help Reduce The Tax Bills. The total tax relief is slightly less than my tax relief for the assessment year 2017 which was RM24335.

Personal Relief of Kshs. Personal Tax Relief for YA2014. The Start Your Own Business scheme gives relief from income tax for 2 years if you are a long-term unemployed person who starts a new business.

A further 50 exemption on the next 290000 of normal chargeable income. Tax Relief For Companies That Pay Off Employees Ptptn Loans Borneo Post Online. Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

Smallvilles fixed relief amount for tax year 2006 and every subsequent year would be 2315789 percent of 950 million or 22 million. No tax relief is available for non-tax residents. 28 rijen The maximum income tax relief amount for the lifestyle category is RM2500.

My estimated tax relief for YA 2018 is RM2146085 RM1846085. Not much changes from YA2013 except on the following items. Personal Tax Relief for YA2014 Dapatkan link.

23 rijen Individual Relief Types Amount RM 1. Not much changes from YA2013. Deferment of course fee relief is allowed which depends on situations and scenarios have been provided in the IRAS website.

Companies are not entitled to reliefs and rebates. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Other than the above three common tax reliefs there are many other reliefs tax payers in Malaysia can maximise.

Any course fees paid up to maximum of 5500 can be claimed for YA 2014 if criteria are met according to IRAS. The Gobear Complete Guide To Lhdn Income Tax Reliefs Gobear Malaysia. Working from home and tax relief Practical information on how employees working from home during the COVID-19 emergency period can claim tax relief on home expenses.

April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. 75 exemption on the first 10000 of normal chargeable income.

Finance Malaysia Blogspot Personal Tax Relief For Ya2014. Personal Tax Reliefs in Malaysia. Personal Tax Relief for YA2014 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

So the estimated total amount of my personal tax relief for YA 2018 is RM2146085 RM1846085. 3 Corporate Income Tax. Individual and dependent relatives.

Taxation for Non- Residents Employment Income. Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference. All information pertaining to total income and net worth is confidential and not open for.

2020 Personal Income Tax Relief 2019 Bless Property Development Malaysia. Methods for apportioning relief to individual taxpayers. Here S How To Maximise Your Education Income Tax Relief.

28800 per annum Kshs. Individual personal tax relief is only available for individuals who are considered tax resident in Malaysia. There are some other rules a person can be qualified as tax resident in Malaysia.

A further 50 exemption on the next 190000 of normal chargeable income. Generally rule is a person is a Malaysia tax resident if heshe stays more than 180 days in Malaysia. However with the self dependent tax relief of RM9000 life insurance EPF relief at RM6000 his total chargeable income is now RM69300 hence he would only be taxed about 8 of his chargeable income.

75 tax exemption on the first 10000 of normal chargeable income. Not much changes from YA2013 except on the following items. YA 2010 to 2019.

Orgfinance or at the Real Estate Assessments Office. Personal Property Tax Relief Guide Model Ordinance 5 EXAMPLE. Personal Tax Relief for YA2014.

April 25 2015 Coming to the last weekend of personal income tax e-filing if without any extension period here is the updated list of various tax relief granted for your reference.

Apple Announced Ios 8 With Many New Features Including Big Announcements About Mac Os X Yosemite And A New Programming Language Called Swi Ios 8 Apple Pay Sms

How To Save On Taxes In Singapore For Tomorrow Start Today

Irb Guidelines For Income Tax Treatment Of Mfrs 5 Pages 1 7 Flip Pdf Download Fliphtml5

Question 3 5 Needs Help To Be Answeredquestion Chegg Com

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Personal Tax Guide For Ya 2014

Job In Income Tax Department On Contract Basis Job Retro

Acura Tl 2012 8500 Hialeah Negocialo Ya Acura Tl Acura Hialeah

Guidelines On Tax Treatment Related To The Implementation Of Mfrs 121 Or Other Similar Standards Pdf Free Download

Personal Tax Guide For Ya 2014

Enhancing The Double Tax Deduction For Internationalisation Scheme 1 April March 2016 1 Background Pdf Free Download

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Tutorial 1 And 2 Cia 2005 Individual Income Tax Tutorial 1 Tutorial 2 1 What Is Tax Explain The Characteristics Of Tax 2 How Do Tax Payments Course Hero

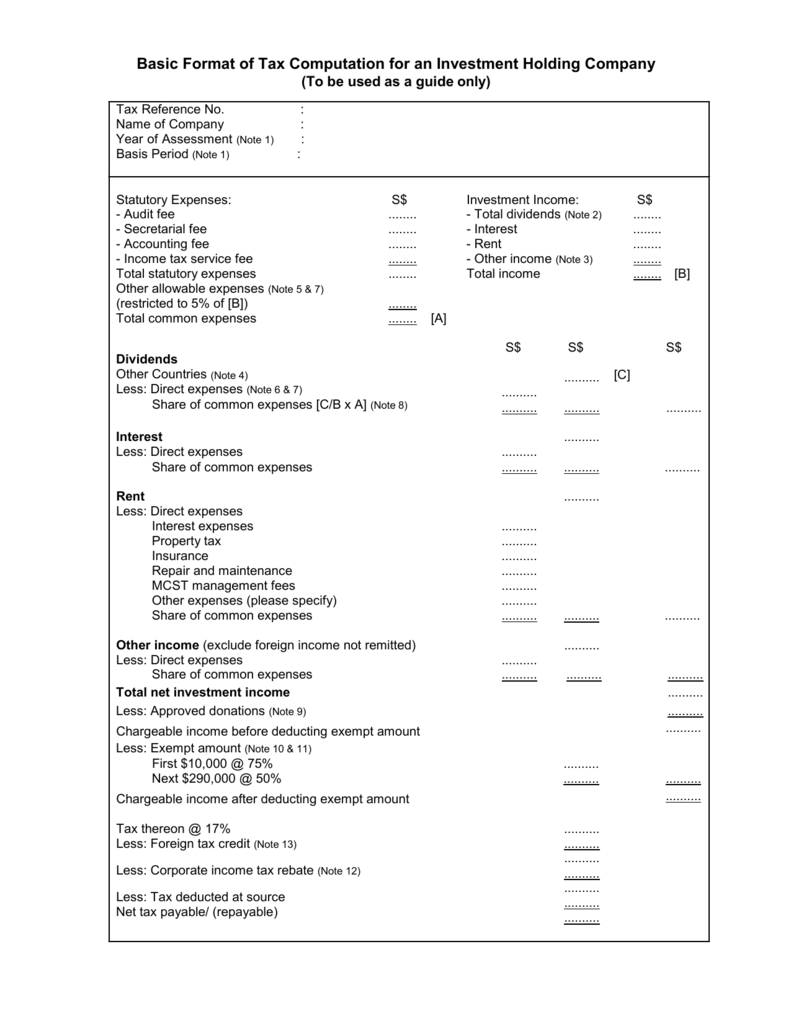

Basic Format Of Tax Computation For An Investment Holding Company

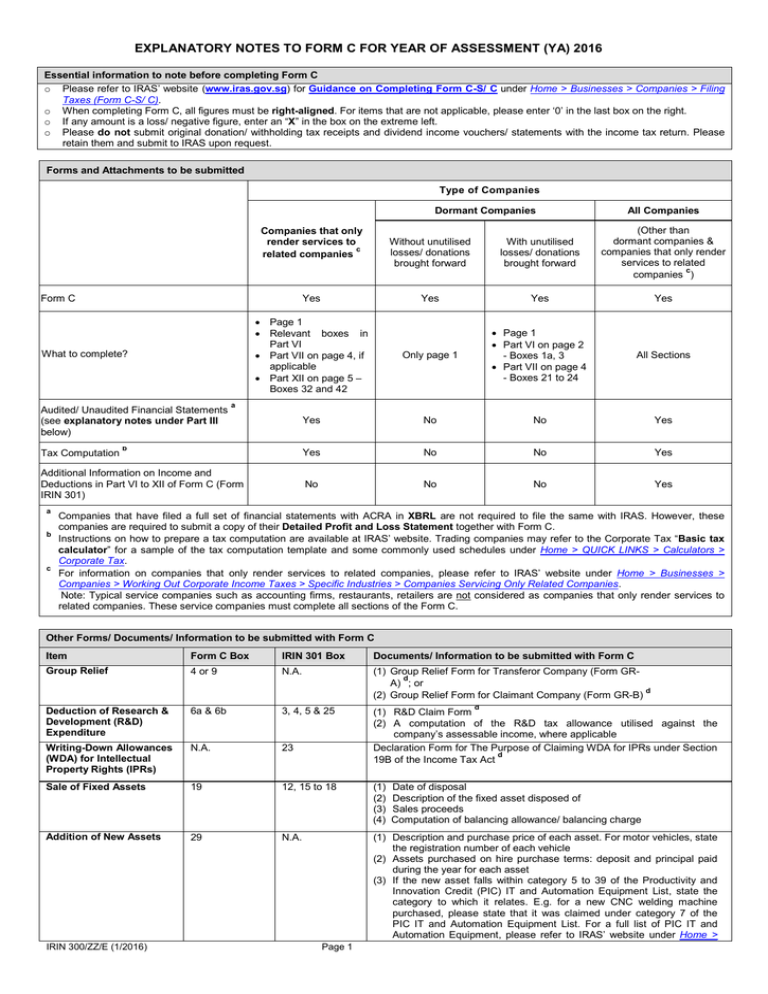

Explanatory Notes To Form C For Year Of Assessment Ya 2016

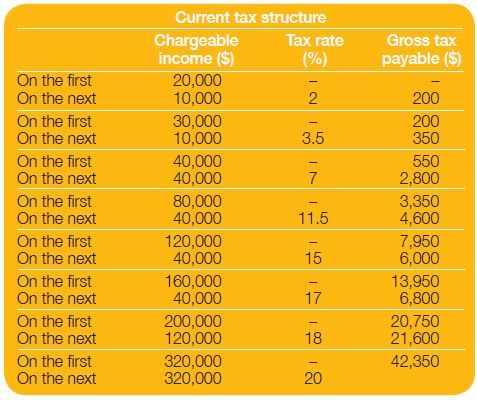

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News