As the virus continues delays in return-to-work can be expected. To better serve our community our offices are open to the public with certain limitations due to COVID-19.

Companion legislation sponsored by state Sen.

Covid 19 tax relief for first responders. The First Responders Childrens Foundation COVID-19 Emergency Response Fund will make an immediate impact in the lives of our EMTs Paramedics and Firefighters who are on the front lines of this. This exemption was approved by Florida voters in the November 2016 general election and was finalized by the Florida Legislature and Governor spring 2017. COVID-19 isnt just a health and safety risk for your company however.

In late March Congress authorized 100 billion to pay for COVID-19-related health care expenses in what Senate Minority Leader Chuck Schumer had earlier described as a. To assist first responders in conducting activities as safely and efficiently as possible we are providing links to authoritative resources to help inform and guide your actions. These are some tax relief measures for Covid-19.

The COVID-related Tax Relief Act of 2020 extends the tax credits available to Eligible. Bill Huizenga R-Mich will introduce the Helping Emergency Responders Overcome Emergency Situations HEROES Act of 2020 on Friday that would provide a four-month federal income tax. Increased maximum EITC of 1512 for those without children called the childless EITC which is now open to anyone age 19 and above For tax year 2021 only Taxpayers with children whose children fail EITC eligibility requirements can claim the childless EITC For tax year 2021 and beyond.

In order for you to qualify for the following additional exemptions you must have a homestead exemption on your property. Telemedicine can step to keep recovery on track. Our main priority continues to be the safety and well-being of the public.

Guidance for first responders - GOVUK. Bills Propose Tax Relief For COVID-19 First Responders Law360 May 1 2020 159 PM EDT -- Michigan lawmakers have proposed two tax relief measures for first responders amid the COVID-19. The HEROES Act would provide a four month federal income tax holiday for medical professionals and first responders in counties with at least one positive COVID-19.

Many businesses that have been severely impacted by coronavirus COVID-19 qualify for employer tax credits the Credit for Sick and Family Leave the Employee Retention Credit and. Heres how you can protect your employees. In March Florida Governor Ron DeSantis proposed a one-time relief payment of 1000 to Floridas first responders and educators for their sacrifices and.

Lawmakers in both parties are rallying behind new tax incentives to reward first responders health care providers and other key workers as part of a new relief package aimed at ensuring delivery. For essential workers like first responders preventing COVID-19 is key. It provides ad valorem tax relief equal to the total amount ad valorem taxes owed.

The Heroes Act would allow a 500 above-the-line tax deduction for 2020 for the uniforms supplies and equipment of COVID-19 front-line employees and first responders. The Homestead Exemption saves property owners thousands of dollars each year. What is the National First Responder COVID-19 Grant Relief Program.

The Grant Programs primary goal is to provide one-time critical health and wellness support to first responders and their families during the COVID-19 pandemic so that they are able to continue providing safety services without sacrificing the wellbeing of self or family. A total of R30 billion has been allocated to a special National Disaster Benefit Fund which will pay Unemployment. DHS recognizes that first responders at the Federal State and local level are on the front lines of providing support to their communities during the COVID-19 pandemic.

Florida First Responders Exemption. Advice for first responders as defined by the Civil Contingencies Act and others where close contact may be required as part of their normal duties. Then estimators figured providing exemptions to all disabled responders would cost other taxpayers some 10 to 14 cents a year.

The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19 for periods of leave from April 1 2020 through March 31 2021. Tax Exemptions for Disabled First Responder and their Surviving Spouse.

House Republicans Pitch 1 000 Bonus For Cops Ems Firefighters Ohio Capital Journal

We Need Help First Responders Ask For Mental Health Aid As Part Of Pandemic Response Wisconsin Public Radio

Emergency Preparedness Illinois Health And Hospital Association

San Diego Tax Roll Hits Record High 627 Billion Despite Covid 19 S Impact Kpbs

Https Docs Legis Wisconsin Gov Misc Lc Issue Briefs 2020 Covid 19 Ib Fmla Msk 2020 27 03

Covid 19 Update Carroll County Ga Official Website

Http Www Wcoomd Org Media Wco Public Global Pdf Topics Facilitation Activities And Programmes Natural Disaster Covid 19 Covid 19 Categorization Of Member Input Edition 3 En Pdf La En

Want To Stop The Covid 19 Stress Meltdown Train Your Brain The American Institute Of Stress

Guidance Issued For Families First Coronavirus Response Act Harding Shymanski Company P S C Certified Public Accountants

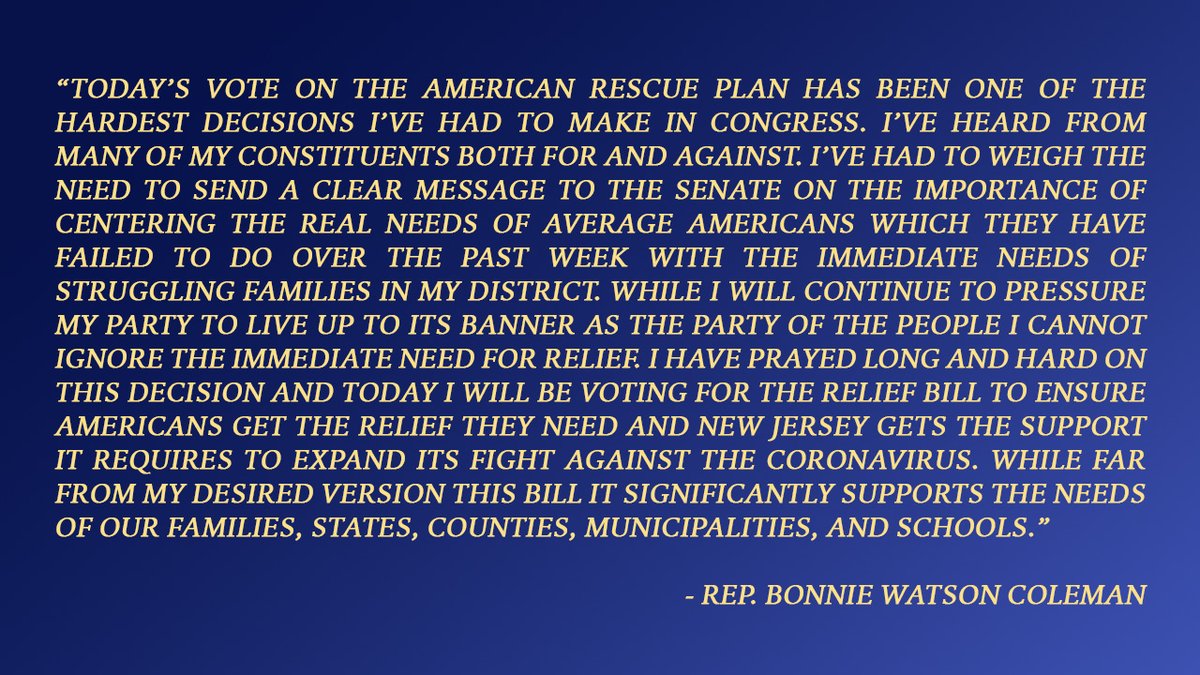

U S House Passes Covid 19 Relief Bill Insider Nj

Https Www Kirklandwa Gov Files Sharedassets Public City Council Agenda Documents 2021 April 29 2021 4 American Recovery Plan Act Pdf