You may begin submitting the Income Tax Return Form starting on 1 March 2021. Its that time of the year again where you scramble to get your receipts in order for personal income tax filing.

Lhdn Income Tax Ya 2020 Iproperty Com My

Recent Posts See All.

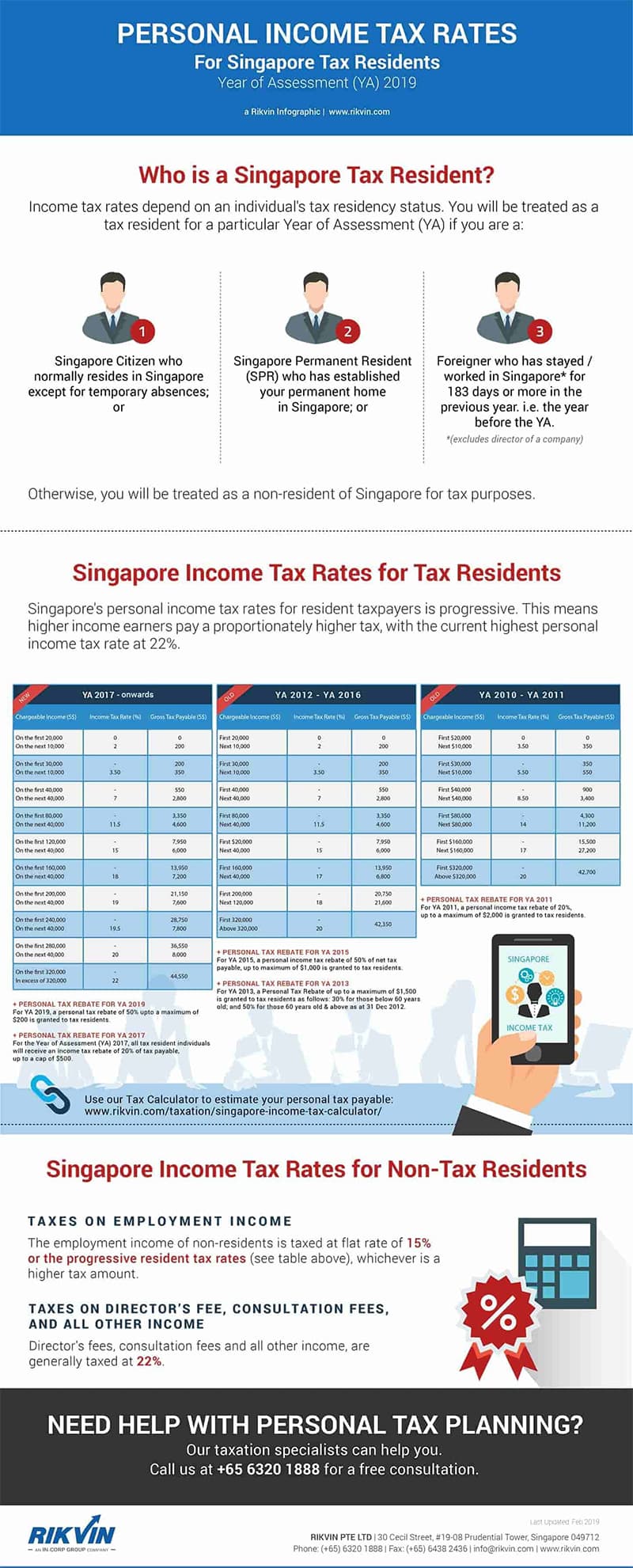

Personal income tax relief for ya2020. Personal Tax Relief for YA2020 and YA2021. For YA 2020 and YA 2021. Given that tax filing can be a tedious process for most taxpayers the Inland Revenue of Singapore IRAS has made it relatively easy for you to file your income tax by auto populating your earned income from your employer as well as the reliefs that you are eligible for such as your Earned Income Relief NSman Relief and CPF Relief.

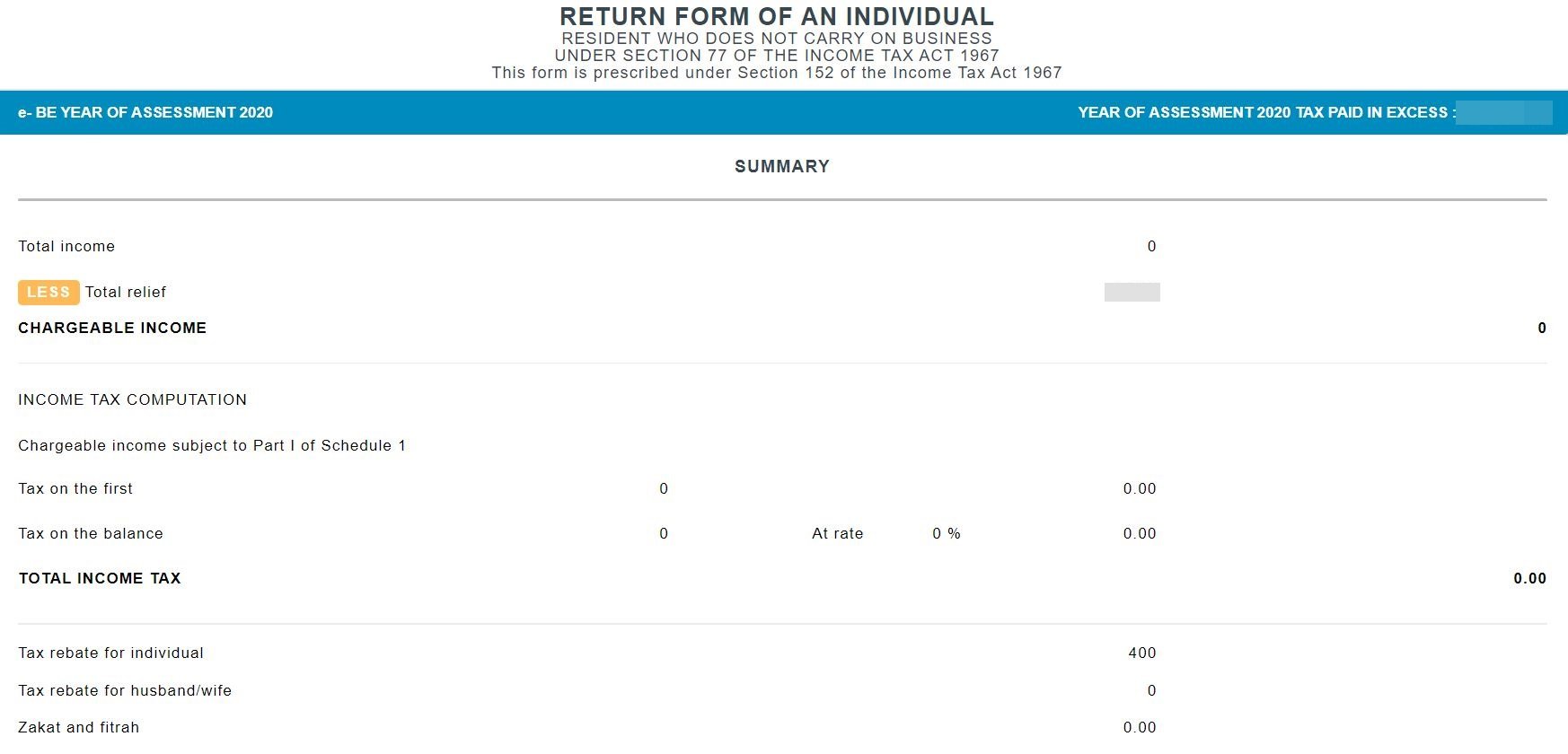

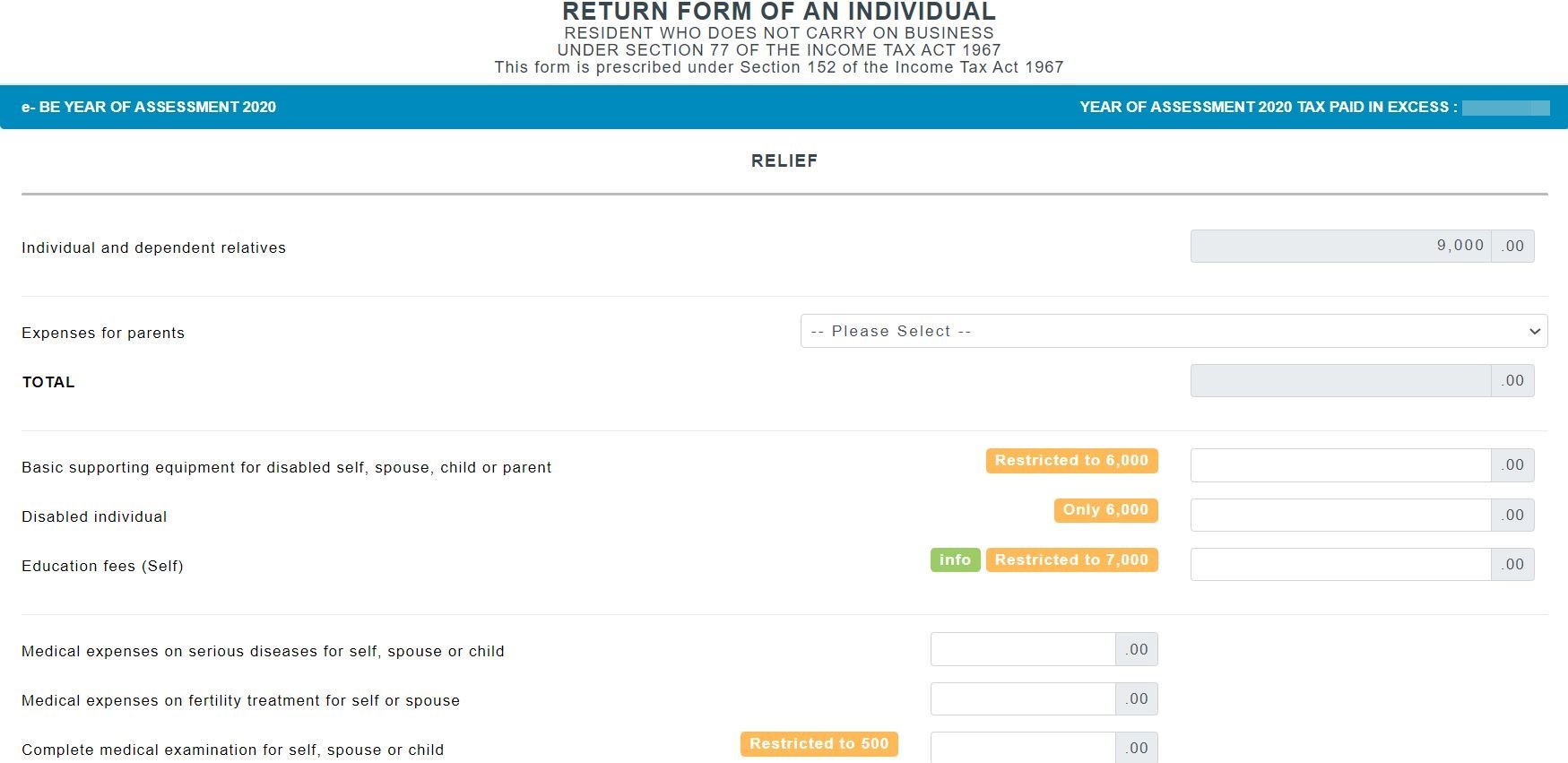

The chargeable income is nil and no income tax is payable for that YA. 154 views 0 comments. Below is the list of tax relief items for resident.

This article will highlight key tax reliefs in Singapore that are able to increase savings on your final tax bill for YA2020. Previously the relief was limited to RM1000 in YA 2019. For the year of assessment YA 2020 the government has extended the income tax exemption limit.

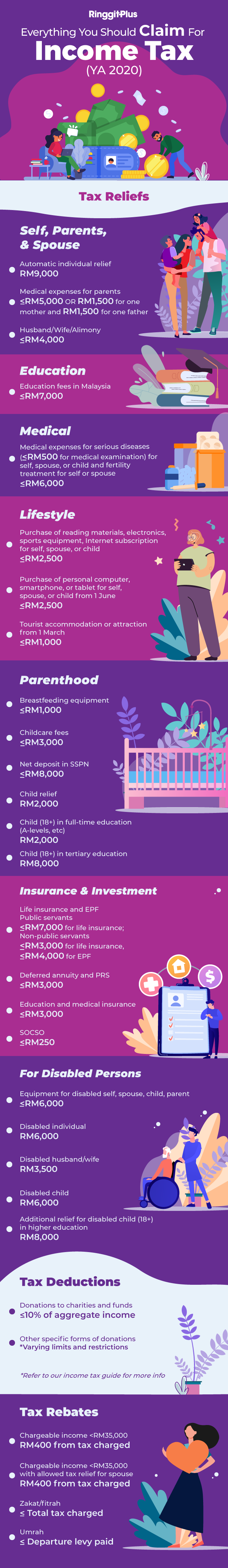

Tax Relief for Fees Paid to Child-Care Centres or Kindergartens. Coming to you this year is the additional lifestyle relief. This is in addition to the existing lifestyle relief of RM2500 which is.

Hence the tax relief is claimable by resident individuals for YA2020 and YA2021. Moreover the accommodation premises must be registered with the Commissioner of Tourism to be eligible for the relief. 23 Zeilen Personal tax relief Malaysia 2020.

28 Zeilen The maximum income tax relief amount for the lifestyle category is RM2500. The prime minister announced that personal income tax relief in the amount of MYR 1000 on travel expenses incurred from 1 March 2020 to 31 August 2020 is to be extended to 31 December 2021. Tax reliefs which can be claimed by resident individuals in Malaysia for YA 2020 and 2021.

39 Zeilen The administrative concession will thus be removed with effect from YA 2021. Post not marked as liked. Post not marked as liked 18.

Starting from 1 March 2021 the Inland Revenue Board of Malaysia IRBM will open the e-Filing portal once again for submission of various Income Tax Return Forms for the Year of Assessment YA 2020 ie. In the event the total relief exceeds the total income the excess cannot be carried forward to the following YA. 2 If you are a new parent the Parenthood Tax Rebate.

The payments must be made between 1 March 2020 and 31 December 2020 to qualify for tax relief in YA 2020. A recent addition for the year of assessment 2020 where you can make another claim of up to RM2500 for the purchase of laptops personal computers smartphones and tablets. Therefore take a look at whats new when it comes to filing your income tax for YA2020 compared to the year before.

If you already reached this cap taking further steps to boost personal reliefs will not reduce your tax bill. Taxpayers from the age of 55 to 59 are entitled to. This is a new tax relief introduced as part of the response to the Covid-19 pandemic.

Taxpayers below the age of 55 are entitled to SGD1000 relief. Note that this cap only applies to personal reliefs. An additional relief of RM2500 can be claimed for the purchase of personal computers smartphones or tablets for purchases made between 1 June 2020 until 31 December 2020.

You should continue to claim the personal reliefs if you have met the qualifying conditions. However please evaluate whether you would benefit from the tax relief and make an informed decision. CCS Library Year 2021 LHDN.

Additional RM2500 relief for personal computer smartphone or tablet You can claim up to RM2500 in lifestyle relief for the purchase of a personal computer smartphone or tablet made between 1 June 2020 and 31 December 2020. For expenses incurred between 1 March 2020 until 31 December 2021. Forms E BE B P BT M MT TF and TP.

A new policy that took effect from YA 2018 is the Personal Income Tax Relief Cap which limits the total amount of personal reliefs an individual can claim to 80000 per YA. If the total amount of reliefs claimed exceeds the relief cap the tax reliefs will be capped at. For e-Filing 2021 YA 2020 you can claim up to 18 types of personal income tax relief including travel expenses SOCSO and lifestyle.

All taxpayers that derive income from employment pension trade business profession or vocation are eligible for earned income tax relief. This claim is limited to purchases made between the 1st of June 2020 and the 31st of December 2020. Every Company Must Appoint Auditor for auditing the companys Financial Statements.

A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment. Updates On The Operation of Accounting Firms During Total Lockdown.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Deadline To File Income Tax 2019 Malaysia

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

You Can Claim These Tax Reliefs For Year Of Assessment 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2021 Homage Malaysia

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

Personal Income Tax Malaysia Guide For Ya2020 Excel Template Included Life Of A Working Adult

Malaysia Personal Income Tax Guide 2021 Ya 2020

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Malaysia Personal Income Tax Guide 2021 Ya 2020

2021 Personal Income Tax Relief Inviter Network

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Ttcs Tax Reliefs Ya 2020 Thannees

Pin On Dndfinancialservices Org

Malaysia Personal Income Tax Guide 2021 Ya 2020

Maximising Your Individual Tax Reliefs Crowe Malaysia Plt

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt