How To Withdraw EPF Money Reaching 50 Years Old When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2. An EPFO member can withdraw his 50 share with interest subject to completion of 7 years of service.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

No document is required for uploading at the site While applying for Education advance Also Read.

Can i withdraw my epf at 50. 880 Views Asked 10 Years Ago. I will also mention income tax that you need to pay in. You wont be eligible for this withdrawal facility before 57 and the main purpose of this withdrawal rule of EPFO is to keep the EPF amount for the old age days.

A member can claim PF advance for education only 3 times in his service life. TDS is deducted if the withdrawal amount exceeds 50000. A member can withdraw the full amount from their Akaun 2 when they turn 50.

PF Balance check without UAN Number Online. Withdraw via i-Akaun plan ahead for your retirement. In such cases the pension value is reduced to a rate of 4 per year until the employee reaches the age of 58 years.

Though the EPF amount can be withdrawn only after retirement that is at the age of 55 early retirement is not taken for consideration. I will be 50 soon. EPF withdrawal is taxable only if it is withdrawn before 5 years of continuous service.

At the time of retirement or resignation. In such cases you can claim for partial withdrawal in online. Partial withdrawal is not taxable.

EPF withdrawal at age 50. If you withdraw your EPF amount before completing 5 years of service then you will be liable for payment of TDS at 10. An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old and if they have made an active pension contribution in EPF for 10 years or more.

After reaching 57 years. When you reach a certain age owning your own home will be high on your list of things to do. But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount.

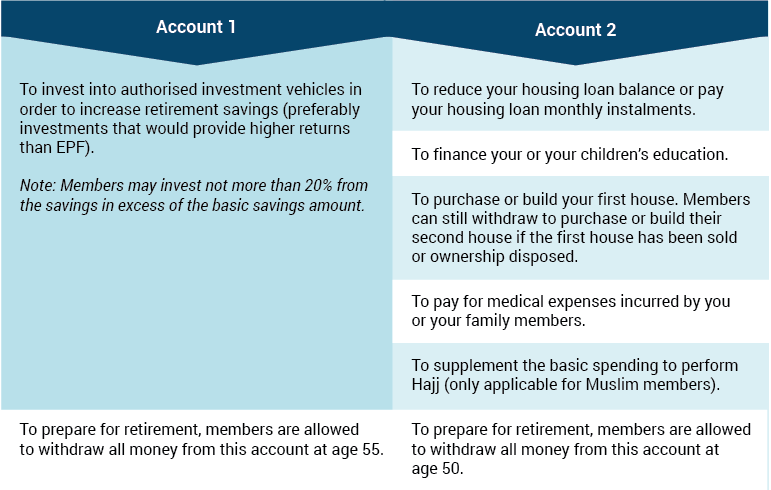

You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. I intend to bank into this account 1Can the banks which I owe money freeze my BSN account. Withdrawing PF balance and reduced pension age 50-58 over ten years of service You can only get pension after turning 50 years of age and have rendered at least 10 years of service.

Additionally if you have not provided you PAN at the time of withdrawal you will have to pay TDS at the rate of 30. However if the withdrawn amount is less than Rs. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends.

50000 no TDS will be deducted. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50.

Please DO NOT refer to the submission information in Employees Provident Fund KWSP website. You can apply for withdrawal through i-Akaun. EPF Withdrawals for Housing.

So these were the EPF withdrawal rules partial and full withdrawal in 2021. However EPFO permits 90 withdrawal of EPF. If your service period has been more than 10 years and you are between the age of 50 and 58 you may opt for reduced pension.

I have a BSN account which has not been active for a while. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Epf Members can withdraw funds from their provident fund account in 3 cases-During Employment for Emergency Needs.

For more details on types of withdrawal and how to go about checking their website is highly recommended. You can withdraw partial amount from your EPF account only for specific reasons such as medical emergency marriage housing and higher education. Asked on Sep 7 2010 at 2115 by.

2What is the best way to. I owe several banks cc loan and some are in legal stages but not bankruptcy stage yet. Let me explain the amount that you can withdraw in all these 4 cases and conditions that you need to satisfy.

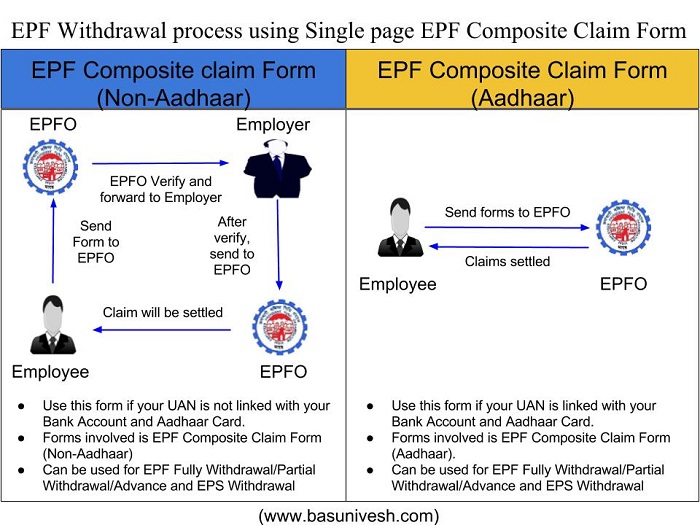

1 An EPFO member can withdraw up to 50 per cent of the money from the EPF kitty for his or her own marriage the marriage of his or her daughter son sister or. Kasturirangan says The lump sum complete withdrawal from EPF and EPS account provided number of years of service is less than 10 years can be done at the time of closing of account in the event of job-loss and remaining unemployed for over 2 months or at the time of retirement death or due to permanent and total disability of member. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

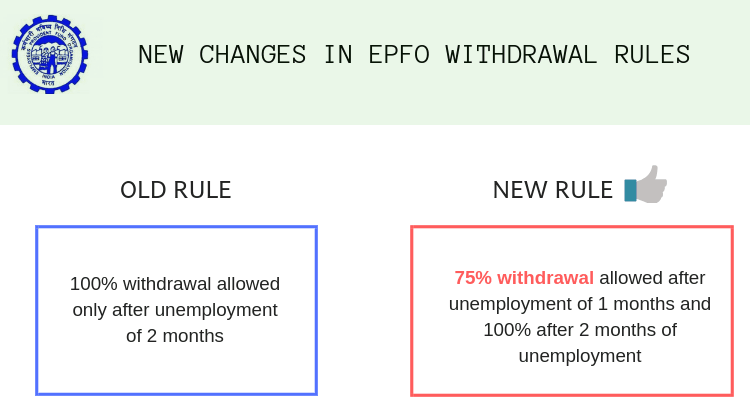

Unemployed for more than 1 month.

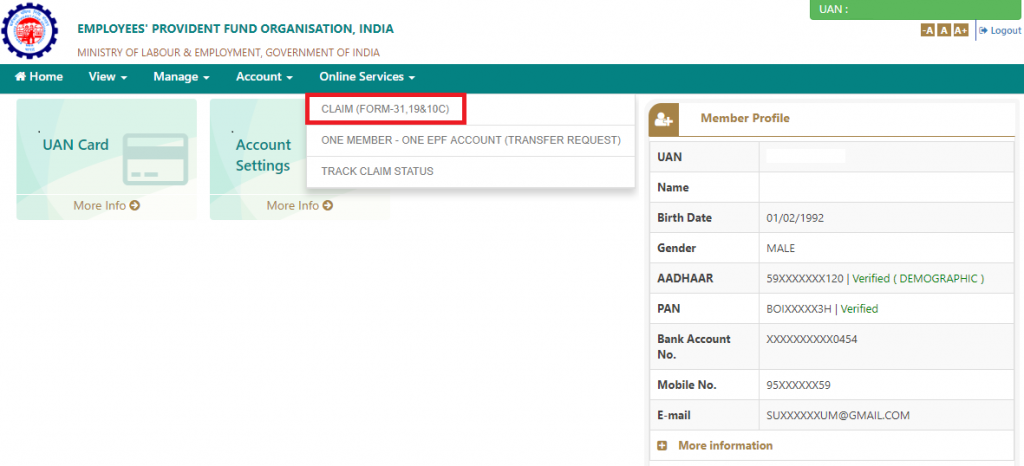

Epf Withdrawal Online Epf Withdrawal Procedure

How To Withdraw Epf And Eps Online Basunivesh

Pf Withdrawal Form Know Epf Withdrawal Procedure

![]()

Epf Withdrawal Online Epf Withdrawal Procedure Updated You

Epf Withdrawal Online Pf Withdrawal Process Eligibility Application

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Pf Withdrawal Form Know Epf Withdrawal Procedure

Epf Withdrawal From Account 1 2 What Can They Do For You

Pf Withdrawal After Leaving Job How To Apply

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

Kwsp Epf Partial Withdrawal Age 50

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Utilise The Savings Wisely Imoney

Withdraw Pf Without Leaving Job Of Current Company Planmoneytax

Epf Withdrawal Rules When And For What You May Withdraw Your Epf