Das Wichtigste in meinen Augen ist aber wie immer. Also because the value of mutual funds relies on the stock market theyre a much riskier investment than P2P.

Investing Vs Spending Mindset Differences Episode 67 Worth It Podcast What S The Difference Between Investing A Investing How To Be Outgoing Mindset

Target rates are often upwards of 6 which is generally higher than other more traditional methods of investment.

P2p investment what are differences. P2P investment also has several disadvantages. Peer-to-peer P2P investing marketplaces or peer to peer lending platforms are basically websites that allow you to lend money to individuals and businesses and earn interest when the money is paid back. Compared to mutual funds P2P investments have a higher degree of liquidity because you can sell an investment on a secondary market at anytime.

There are many exciting and new P2P lending sites in this sector. A network of individuals or companies lend money rather than invest it. There are some key differences though such as.

While the attraction of higher returns can tempt investors towards more risky investment types it is important to remember that all investments carry risk and you may not get back all of the capital invested. With P2P investment platforms like Grupeer you can choose the geography of loan deals what industries they are lending to what percentage rate they offer. Here we selected the two most popular platform and do a simple comparisons between them.

Because the SEC regards P2P lending investments as securities these types of investments are subject to a host of rules including Rule 415 of the. Peer to peer lending sites are literally booming not. There are many websites on the web that offer access to copyrighted content like movies music software or games through P2P networks due to the advantages of this technology.

The downside is that if the economy tanks many borrowers will not be able to pay back their loans and an investment portfolio that mostly consists of P2P loans will do very badly in this situation. Investing in P2P loans you make your money available to individual borrowers or small and medium-sized enterprises SMEs. Click to share on Twitter Opens in new window Click to share on Facebook Opens in.

Cons of P2P investment. Robocash offers very competitive. Illiquidity is one of the main issues in P2P investing.

Das gibt dir die Sicherheit dein persnliches Risiko am besten. Robocash is currently one of our highest rated loan originators due to their profitability and conservative funding structure. 11 Zeilen Robocash is a P2P site that offers loans originated by Robocash subsidiaries in Europe and Asia.

Funding Societies vs Fundaztic Generally both operators are run by experienced and professional teams and are equally good. For those investors who are willing and able to take the risks P2P lending offers higher interest rates than the saving account in your bank. The battle begins here.

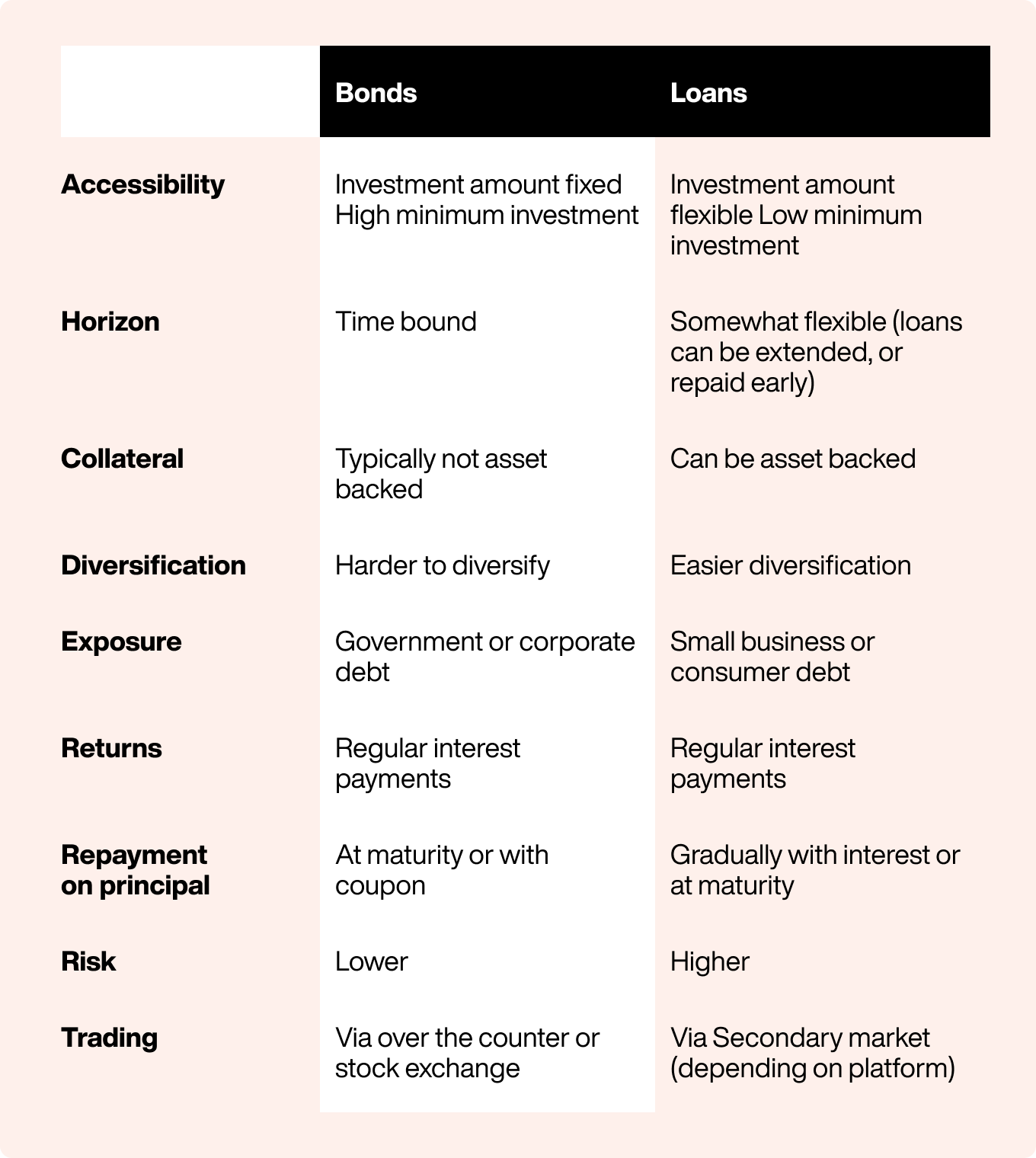

Peer to peer lending P2P This involves lending to businesses or individuals through an online platform alongside other private investors. The golden rule of investing is putting your money in different assets in order to spread the risks. Both are debt instruments and generally produce a fixed income return over a set term.

Verstehe das Investment bevor du auch nur einen Cent in eine Anlageklasse investierst. Investing in bonds you are lending your money to governments or usually large companies. With bank interest rates now close to 0 the difference is more substantial.

Peer-to-peer lending tends to be more in favour of investors as it comes with far fewer risks than equity investing. As promised this topic has investors scratching their heads and curious about when choosing which P2P platform to starts investing with. They both tell you how much money you should expect in return for your investment.

As an investor if you wanted to recoup your investment sooner than later you would have to sell your loan portfolio on the secondary market. P2P is a controversial technology because it is widely used for piracy. Its just that the.

P2P is a fully recognized and legitimate form of finance and investment and is regulated by the Securities and Exchange Commission SEC. The commissions focus is on protecting lenders investors through disclosure requirements. The concept of p2p loans is fundamentally different.

Loans collateralized with cryptocurrency are a safer investment than traditional P2P loans because in the case of default there are assets that can immediately be liquidated to cover lossesmaking them a more steady long-term investment. There are risks as there is no guarantee that. Many P2P lending sites claim that they accept only solvent borrowers.

With different types of P2P Investments your platform often express the return on your investment as either yield or rate. The loans issued often include many tiny slivers from different lenders. After selling the portfolio you would only take out your principal investment and lose a commission percentage.

At the end of the day the difference between rate and yield doesnt matter much. The advantage of investing in P2P loans is that you can count on a nice cashflow. Similar to P2B P2P crowdlending quickly connects borrowers and lenders together bypassing traditional banks.

P2P Property Investment Property-backed P2P lending has become increasingly popular with investors because the loans are secured against bricks and mortar reducing risk of capital loss yet maintaining the healthy returns on offer. Ich glaube an eine interessante und ertragreiche Zukunft der P2P-Anlageklasse. While the technology itself is not illegal and it has many legitimate uses that dont involve piracy the way some people use P2P is illegal.

Durch mein Investment an den P2P-Plattformen konnte ich die Jahre aber oft dennoch positiv abschlieen. P2P stands for Peer-to-Peer. This form of crowdlending enables people to lend their money to other individuals matching borrowers and lenders directly.

We Evaluate Each Borrower On Multiple Parameters Which Include Screening Of Personal Financial And Professional Details Peer To Peer Lending Money Lender Peer

Are You Frustrated Investing In Bonds Check Out Peer To Peer Lending As An Investment From An Expert Following T Peer To Peer Lending Peer Accredited Investor

P2p Lending Vs Stocks What Should You Choose P2pmarketdata

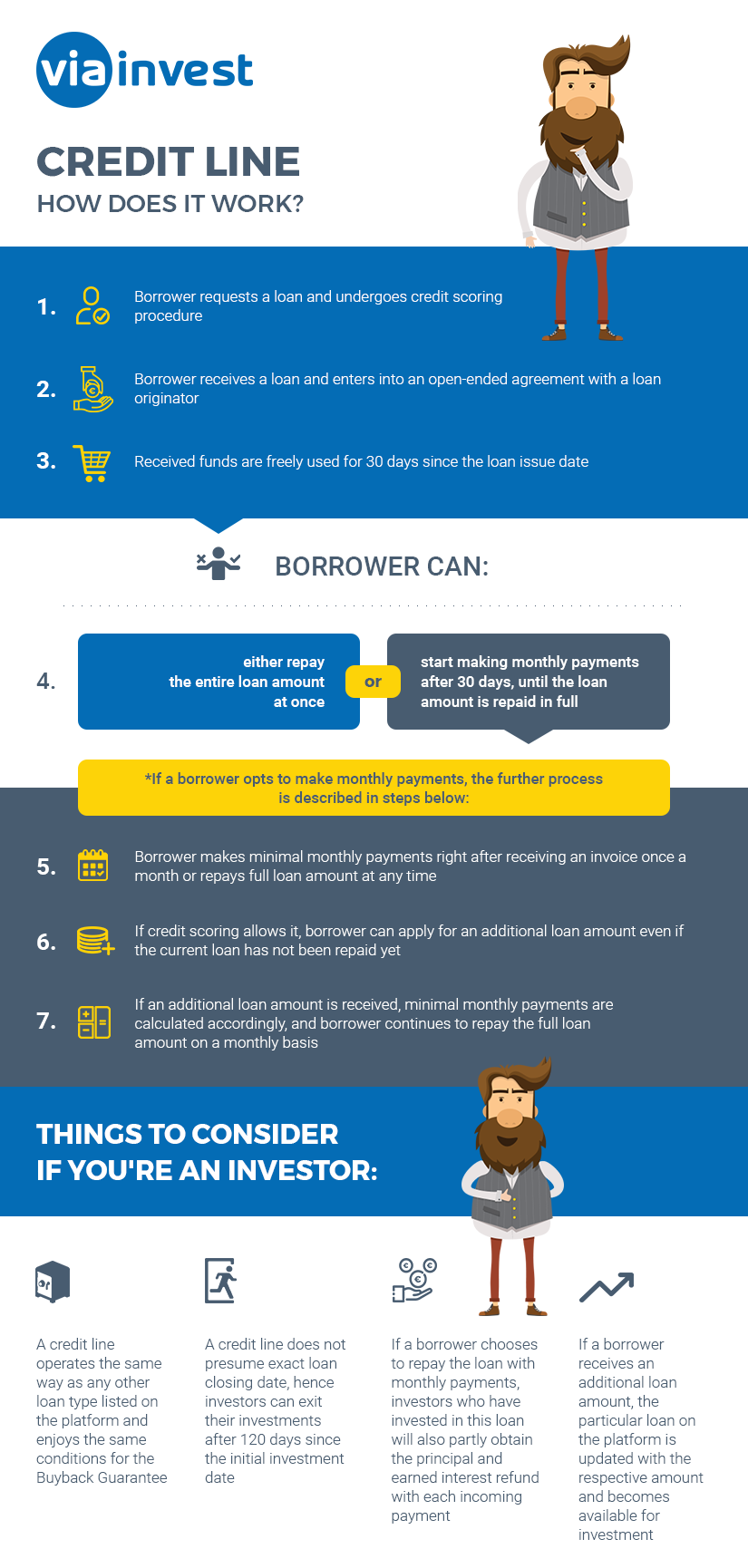

Differences Between Different Loan Types Viainvest Blog

What Is P2p Lending And How It Works The Ultimate Guide

Pin On Crypto Investing Infographics

P2p Banking Model The Difference With The Traditional Banks Model Invest In Club

Pin On Crypto Investing Infographics

Cryptocurrency Investing Vs Trading What S The Difference Cryptocurrency Investing Investing Cryptocurrency

P2p Lenders Be Aware The Two P2p Lending Business Models

P2p Lending Explained Business Models Definitions Statistics

Investing In Loans A New Generation Of Asset Class Mintos Blog

What Is Peer To Peer P2p Lending Peer To Peer Lending Investing Money Smart Money

P2p Lending Vs Bonds Which Is The Better Investment P2pmarketdata

Mutual Funds And Index Funds Are Two Popular Investment Vehicle Types Recognized By Their Key Features Of Offering Convenie Mutuals Funds Index Funds Investing

P2p Lending Vs Stock Market Investing What S Best For You

Relationship Of P2p Lending Crowdfunding And Crowdsourcing Download Scientific Diagram