If your GST credits are greater than the amount of GST you are liable to pay to the ATO you will be entitled. Pre-registration of credit card necessary for GST payment in India.

Myths About Impact Of Gst On Credit Cards

Here we examine whether any operational changes in SEZ after GST implementation.

Credit card what are changes after gst. The GST is out and so are the queries related to many products and services which also include the concerns of credit card shoppers. To do this you must furnish proof of hisher last return filed under the old regime. GST is not levied on the total outstanding amount.

118 of this document to reflect amendments to the financial supply provisions of the goods and services tax law. By Issuing Credit note Supplier GST liability will reduce For Example. This is an increase of 3 percent.

We have applied for GST registration but not obtained registration certificate. Bank fees interest dont attract GST as they are a financial service. But when you pay this amount after the due date it will be levied on the late.

GST of 18 at the time of writing is levied on the interest that is charged. You may want to make the following changes to your GSTHST fiscal year. Is GST Registration required for a Job worker in India.

GST Impact on Credit Cards Forget 15 Service Tax Adapt to 18 GST Rate. How about the annual fee. If the retailer makes credit card sales of 110000 the retailers GST liability will be 10000.

Date of GST registration and date of eligibility to claim ITC. After 1 April 2015 this service tax will be abolished due to the implementation of GST. So if you are a smart user and pay your credit card bills on time there is no way that GST will be levied and your credit card usage will not be affected.

GST financial supply provisions. Credit Card Surcharges GST Inland Revenue have been asked about their position on credit card surcharges GST. Currently there is a RM50 service tax on principal card holder and RM25 service tax on supplementary card holder.

Use a non-calendar fiscal year. SEZ operations changes under GST regime. Credit card users would know that before GST there was no Service Tax levied on the payment of utility bills.

According to the model GST Law a taxable person can accumulate credits of taxes paid and carry them forward in a return. If Sales was Rs. There were rumours doing round that GST will be levied doubly on credit card transactionspayments once on the Utility Bill and again on the Credit Card Bill.

All credit card services incur GST at 18. 5000- was issued so GST needs to pay only on Rs. Special Economic Zones are considered to be a foreign territory for trade operations and duties and is mainly set up for promoting exports.

You will therefore need to make sure that all input taxes paid are included in it. With the introduction of the GST the last set of credits will have to be transferred. The GST Council had approved a proposal in this regard at its meeting on December 18 to check tax evasion and menace of fake invoicing.

The financial institution will deduct 605 from the 110000 and remit the remainder of. 10000- and GST charged 18 so GST liability for that month was Rs. You can also offset these GST credits against the amount of GST you are liable to hand over to the ATO because of your customers purchases.

For credit card holders there is confusion on how GST is being charged. Before the introduction of GST all credit card services incurred service tax at 15 but now this service tax has been replaced with 18 GST on credit cards. Over here we are talking about the service tax and annual fee.

However the truth is that there would be 18 GST applicable on Late Credit Card Payments but nothing would be charged doubly. GST is levied at 18 percent whereas Service Tax was earlier levied at 15 percent. Can we claim ITC in India.

As you know that after making a transaction with your credit card you need to pay this amount back within the due date. They are characterised as exempt supplies under the Goods and Services Tax Act. GST will increase my credit card bills.

SEZ operations changes After GST. Hansmukh Adhia had also clarified this in one of his tweets earlier. SEZs are located within a countrys national borders however they are treated as a foreign.

We are still updating issue no. After 1 April 2015 this service tax will be abolished due to the implementation of GST. Interest on credit card balance and EMI interests are charged as per Card member agreement.

Change your previously chosen GSTHST fiscal year. Revenue Secretary Dr. Use a calendar fiscal year.

This fact hasnt changed even in the GST. The govt permitted officers at the level of commissioners to bar debit of input tax credit for one year in case of credit being availed fraudulently. If you are entitled to claim a GST credit you can claim back the GST that is incorporated into the price of purchases you use for your business.

If you qualify you can make changes to your GSTHST fiscal year online in My Business Account or Represent a Client or by using Form GST70 Election or Revocation of. Read Schedule of charges in MITC Most Important Terms and Conditions. However 6 GST will be imposed on the credit card annual fee which ranges from RM50 up to RM500 depending on the type of card.

If the merchant fee is 055 the retailer will be charged 605 by the financial institution which will include 55 of GST. On 22 July 2017 I have registered as on 110717 but i have not received. Dont be worried with the removal of 15 service tax rate with 18 GST rate.

Input Tax Credit. This will be applicable on interest on credit card EMIs processing fees late payment charges annual fees over-limit charges and all other fees and charges levied by your credit card provider. To be clear these surcharges should not be confused with the credit card charges levied by the banks on their customers.

1800- and later Credit note of Rs.

Why Is Gst Applied If I Have An Emi On A Credit Card Even Though Interest Is Already Being Charged By The Bank Quora

Get Amazing Services By Our Professionals Of Gst Suvidha Center Credit Card Services Tax Services Personal Loans

Business Connexion Framework Of Gst As Introduced In India Harmonized System Small Scale Business Goods And Services

Know About Types Of Gst Returns And File Your Return Under The Desired Categoriy Timely Timley Gst Return Filing Gi Credit Card Design Card Design Credit Card

Gst Helpline India Is An User Friendly Mobile Application It Is Aware Of All Current Update News Articles Related To Gst Mobile Application Mobile App App

Sbi Is Gst Ready Goods And Services Tax Can Be Paid Digitally Through Our Internet Banking Or Debit Card All Our 2 Banking Debit Cards Goods And Service Tax

Here Is Detailed Infographic On The Gst And Its Impact On Various Sectors In India You Can Also Find Answers Related Marketing System Business Finance Finance

Gst Tariff For Credit Card Debit Card Charge Card Or Other Payment Cards Related Services

What Is Gst Gst Is A Comprehensive Value Added Tax On Goods And Services It Is Collected On Value Added A Goods And Services Study Materials Value Added Tax

Gst Inspector Received Bail In Illegal Gratification Case By Court Within 7 Days Goods And Services Goods And Service Tax Indirect Tax

How To Gst Economic Growth In India Indian Economy Economic Growth Economy

Gst Credit Card Bill Insurance Premium To Get Costlier Insurance Card Insurance Card Template Car Insurance

Check Out The Purchase Credit Card Fees Charges Hdfc Bank

Highlights The Government On Friday Has Increased The Gst Collection Targets For The Month Of January And February By Rs 1 Instant Loans Target Government

A Comprehensive Software To Manage All Your Gst Billing Compliance Needs File Your Gstr1 Gstr3b Now Filing Is Ju Tax Software Income Tax Return Income Tax

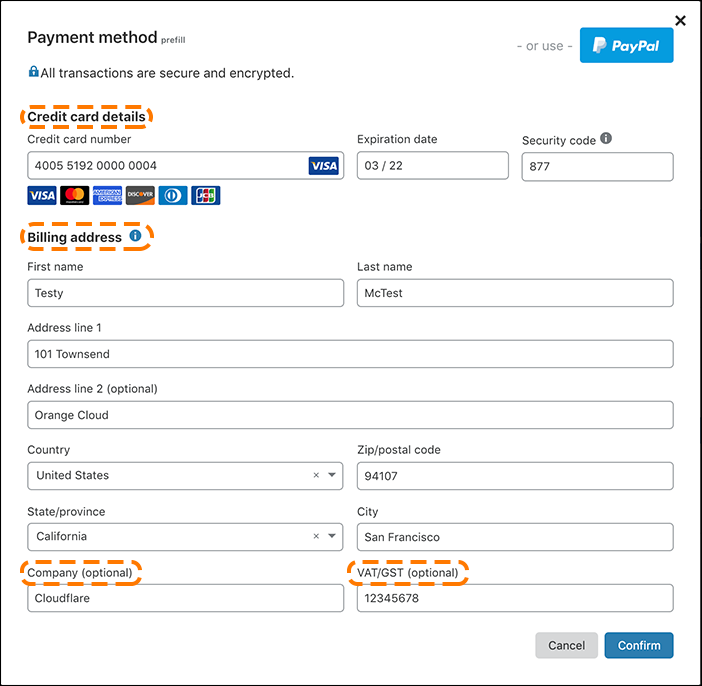

Updating Cloudflare Billing Information Cloudflare Help Center