Refundable tax offset through your tax return. From 2008 to 2017 for example the CPI was up 224 while average health insurance.

Cbo Scores Better Care Health Insurance Budgeting American Healthcare

How the small business health insurance tax credit works The health insurance tax credit is available to small businesses that pay at least half the cost of single coverage for their employees.

Does private health insurance reduce tax. The Private Health Insurance Rebate reduces the premium you pay for having private health insurance. For instance you may be entitled to the private health insurance. As of 2017 your health insurance plan qualifies as a high-deductible health plan if your deductible is at least 1300 for an individual and 2600 for a family.

The credit implemented under the Affordable Care Act ACA is designed to help eligible families or individuals with low to moderate income pay for health insurance. Health insurance isnt cheap but theres also a number of ways you can get rebates and tax deductions with the right cover. You can receive the rebate or refund as either a direct reduction of the cost of your private health insurance through the year and this is a reduction.

Your income for Medicare levy surcharge purposes. As the rebate is income-tested the size of your rebate will reduce as your income increases and once you earn over the maximum threshold you wont be entitled to any rebate at all. However as a general rule of thumb theres no tax due on a personal policy.

The private health insurance rebate is income tested. The Australian federal government introduced rebates and the Medicare Levy Surcharge to incentivise people to take out private hospital cover. Tax credits are subtracted directly from a persons or business tax liability.

Health insurance isnt tax deductible but there are a bunch of ways you can pay less tax. This may result in you receiving a private health insurance tax offset or a liability depending on. Youre right in that you would have paid tax on your company Health Insurance scheme.

Firstly HMRC taxes Private Health Insurance differently depending on whether its a personal plan or Group Health Insurance your employer offers. Yes though there are significant differences between the treatment of health insurance premiums for tax purposes for persons with individual and group health insurance policies. The private health insurance tax offset or rebate is the amount that the government contributes to the cost of.

A health insurance tax credit also known as the premium tax credit lowers your monthly insurance payment either through advance payments to your insurer or through your tax refund. A good way to pay less tax. The excise tax that is scheduled to start in 2022 will effectively reduce the tax subsidy for employment-based health insurance.

For many Australians private health cover makes good sense. Additionally the plans total out-of-pocket expenses cant be more than 6500 for an individual and. Therefore tax credits reduce taxes dollar for dollar.

Healthcare cover is subject to IPT at the standard rate which from June 1st 2017 is 12. Premium reduction which lowers the policy price charged by your insurer. You can deduct your health insurance premiumsand other healthcare costsif your expenses exceed 75 of your adjusted gross income AGI.

The level of rebate you claim for your policy. There are also several other ways you can save on health insurance. Taxation of Health Insurance.

It will be levied on employment-based health benefitsconsisting of employers and employees currently taxable and tax-excluded contributions for health insurance premiums and contributions to FSAs HRAs or HSAswhose value exceeds certain thresholds. A good quality policy looks after your family and provides the security that your family will be looked after quickly when needed. The rebate gives Australians money back in the form of reduced insurance premiums up front or a private health insurance offset at tax time.

On April 1 each year a rebate adjustment is announced based on the Consumer Price Index and the average increase of premiums in the private health insurance sector. That being said private health insurance is yet another expense to add to the daunting list of bills that we all face. Private health insurance rebate calculator.

Luckily you can reduce the cost of your private health care premiums by claiming them as a tax offset or rebate. A premium reduction which lowers the policy price charged by your insurer a refundable tax offset when you lodge your tax return. How you claim your rebate.

The private health insurance rebate is an amount of money the government may contribute towards the cost of your private health insurance premiums. See below Does private cover work. If you meet the eligibility requirements for a private health insurance rebate you can claim your rebate as either.

Is the healthcare cover subject to Insurance Premium Tax IPT. If you are self-employed and purchase individual health insurance then this expense can be deducted directly on your Form 1040 as an adjustment to income. No health insurance isnt tax deductible in Australia.

However you could get up to 33 of your premiums back with the private health insurance rebate depending on how much you earn. Weve nailed down the most important things you need to know to max your tax return. You can claim your private health insurance rebate as a.

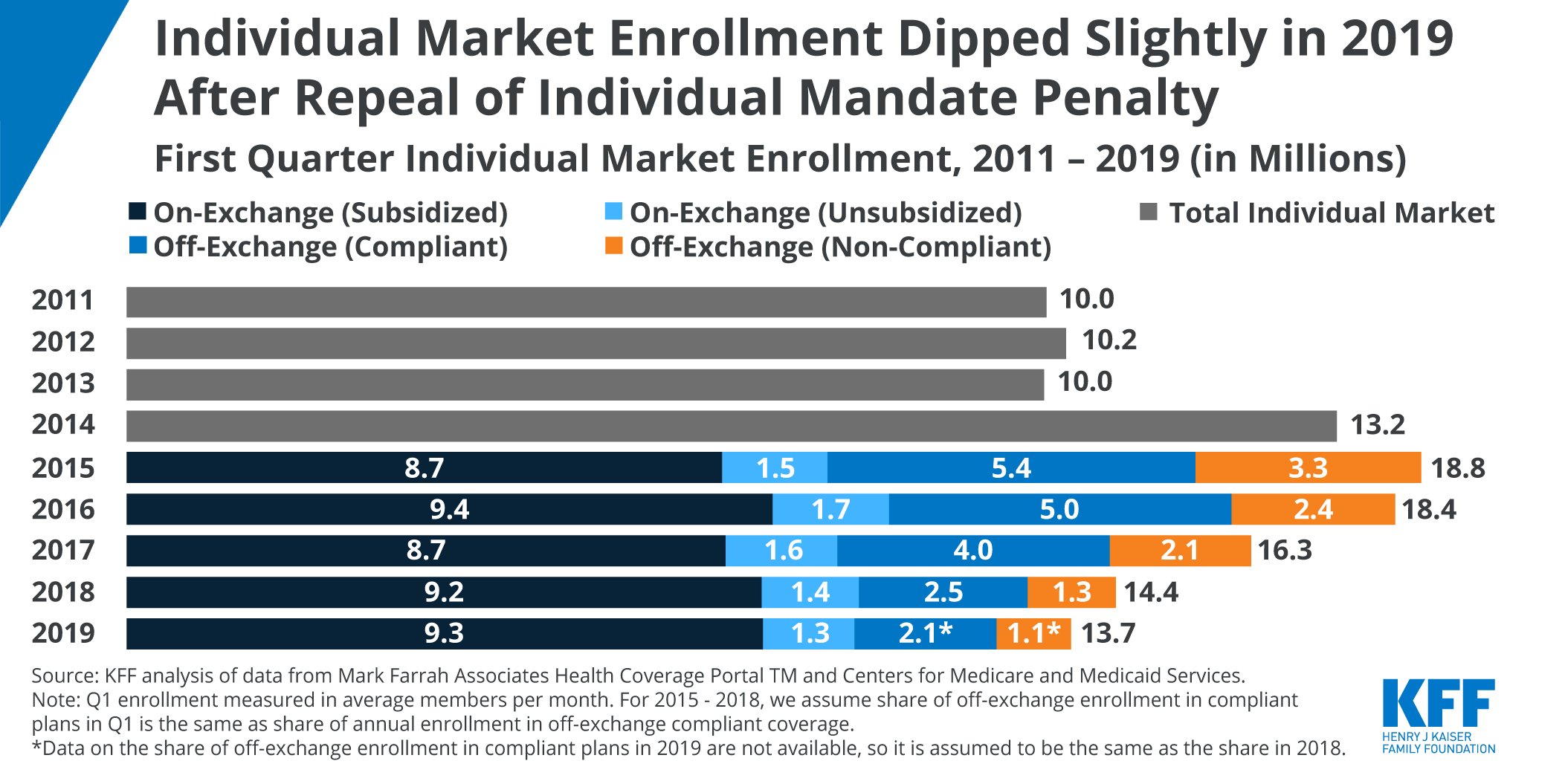

Data Note Changes In Enrollment In The Individual Health Insurance Market Through Early 2019 Kff

Small Business Majority Provides Easy Steps For Shop Enrollment Visit Http Www Smallbusi Marketplace Health Insurance Small Business Marketplace Insurance

Pin By Only Health Matters On Right Religare Care Health Insurance Best Health Insurance Health

Your Health Is Gold Funding Of Health Care In Australia An Overview Health Care Health Private Health Insurance

It Is No Secret Health Care Can Be Expensive Here Are Five Tips To Help You Save Money And Reduce You Health Insurance Companies Health Insurance Health Care

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Pin On Northern California Estate Planning Counselors Llp

How Does Corporate Health Insurance Benefit Employers Buy Health Insurance Health Insurance Health Insurance Plans

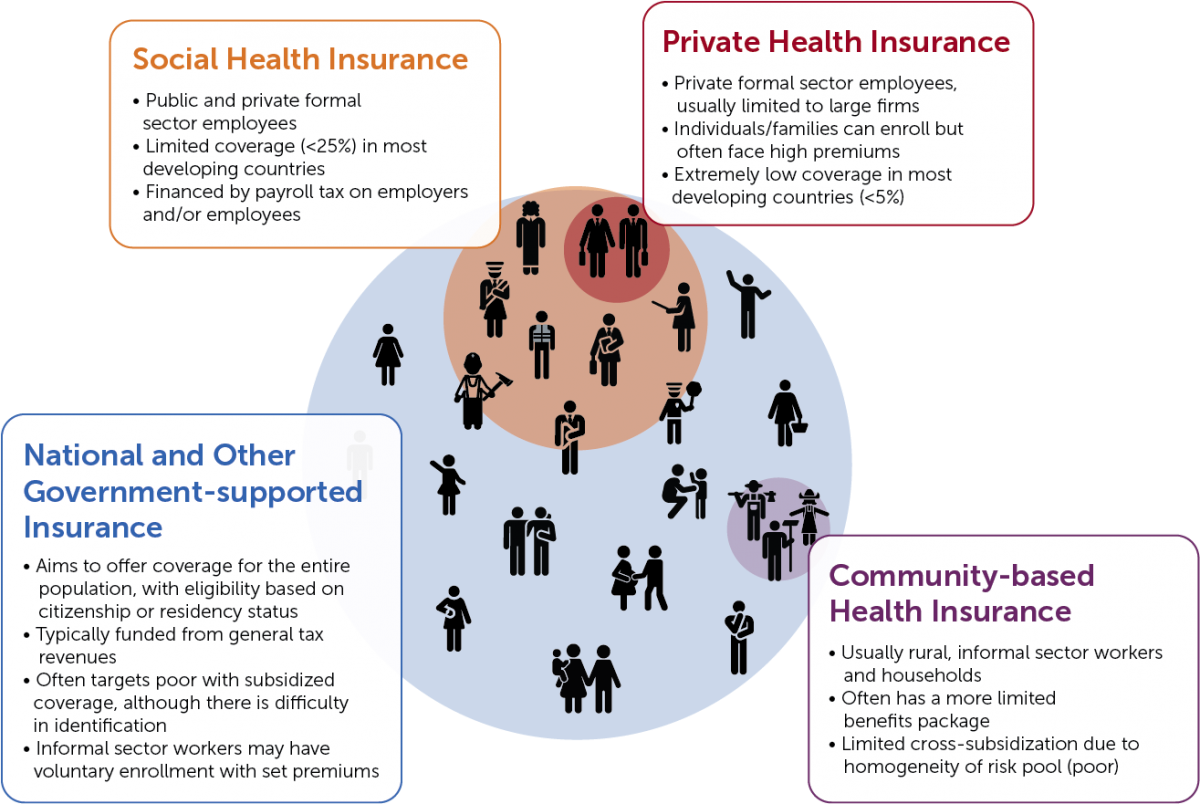

Health Insurance Fp Financing Roadmap

Different Types Of Health Insurance Plans

How Much Should I Pay For Healthcare The Healthcare Affordability Ratio

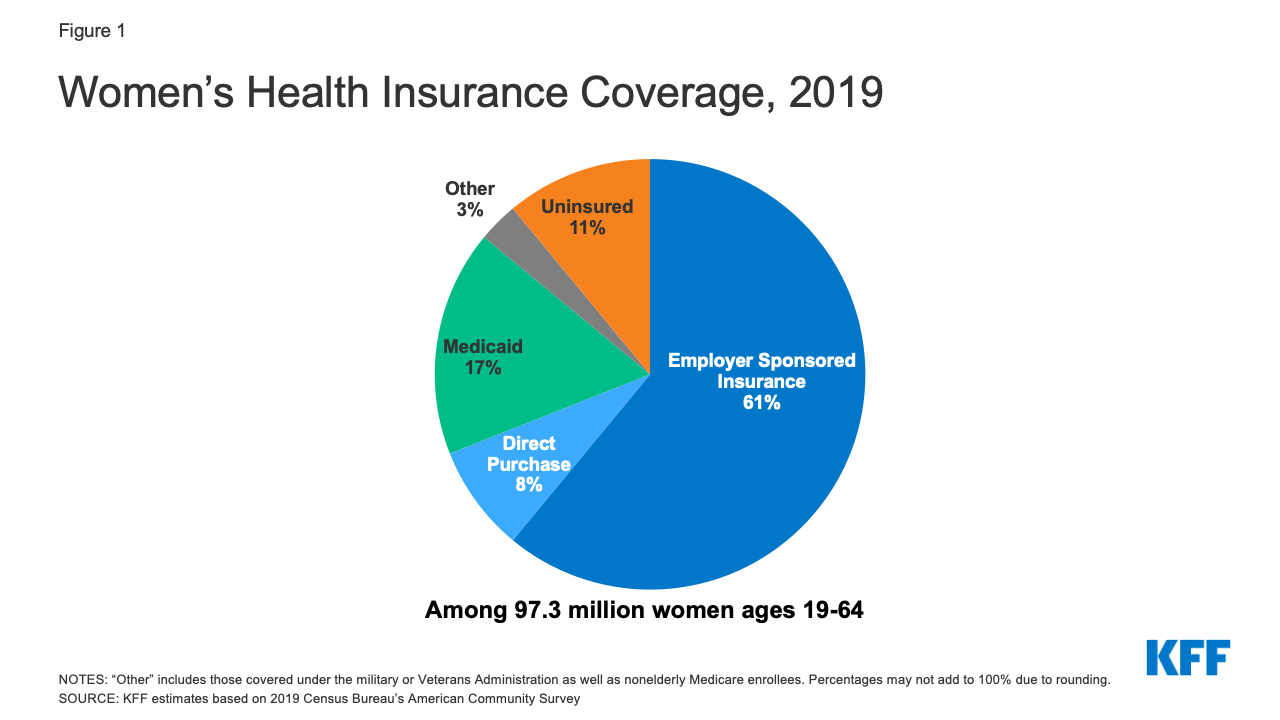

Women S Health Insurance Coverage Kff

How Much Does Individual Health Insurance Cost Ehealth

Five Easy Steps For Enrolling In The Small Business Health Options Program Health Options Care Plan Health

Infographics Health Insurance A Visual Glossary

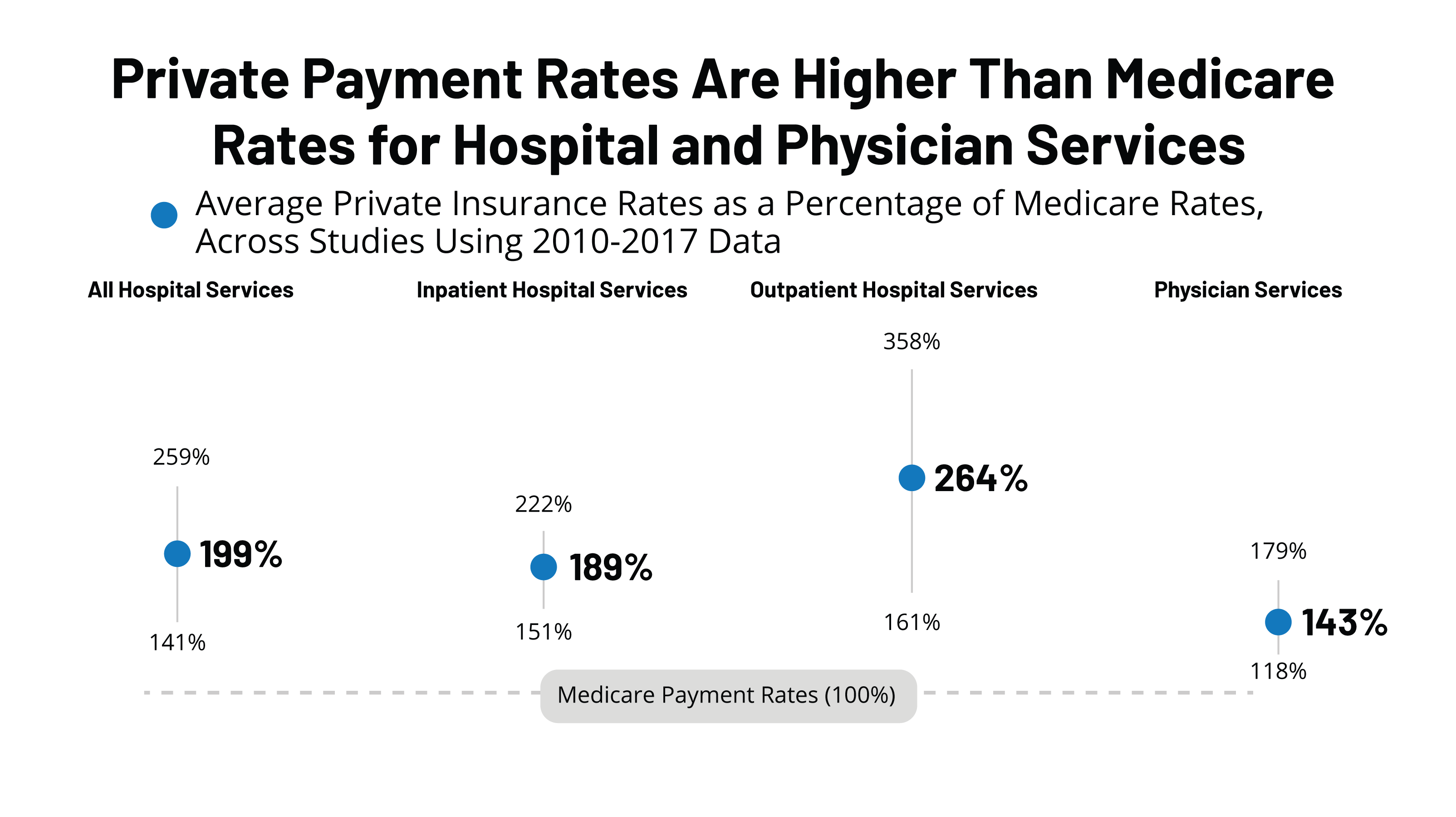

How Much More Than Medicare Do Private Insurers Pay A Review Of The Literature Kff

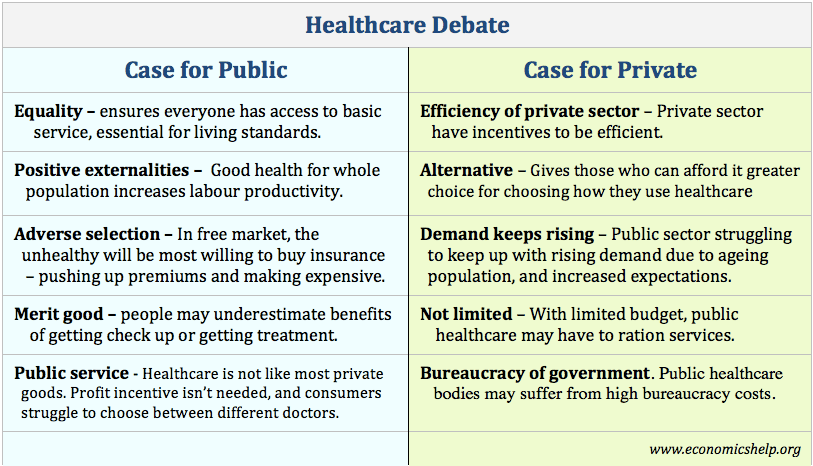

Healthcare Private Vs Public Sector Economics Help

Infographic How Does Health Reform Work Infographic Health Health Care Reform Work Health