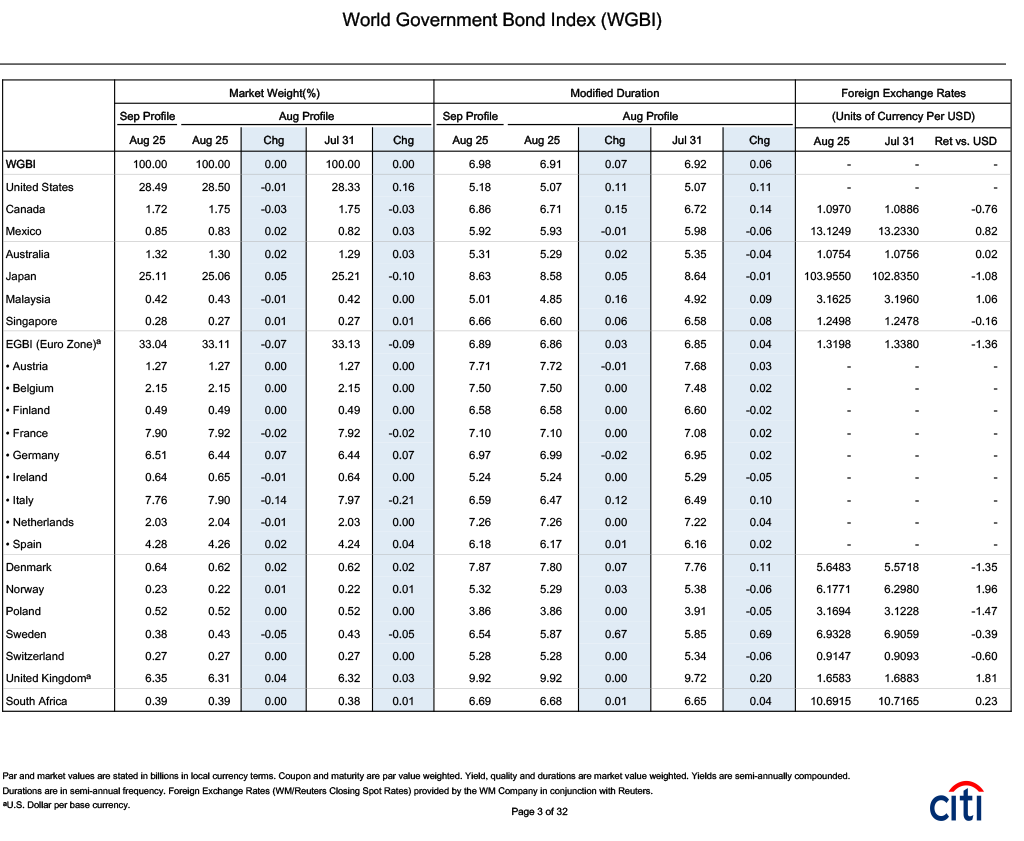

Why we find it attractive November 24 2020. The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds.

Ftse Russell Announces Results Of Country Classification Review For Equities And Fixed Income Ftse Russell

Calculated to be an index of the total return of government bonds of major countries weighted by the market capitalization of each respective market.

What is the ftse world government bond index. EMTX 7-10 Y RT. FTSE World Government Bond Index FTSE World Government Bond Index. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a variety of currencies and has more than 30 years of history available.

FTSE Nonyen World Government Bond Index ex-Japan no hedge yen based is a bond index developed by FTSE Fixed Income LLC. FTSE Canada Fixed Income Indexes. More information is available in the different sections of the FTSE World page such as.

China Govt Bonds offer an attractive proposition given its combination of high yields investment grade rating low interest rate risk and stable RMB. That will be Chinas third entry into a. FTSE Russell Factsheet June 30 2018.

FTSE Russell said Thursday it will add Chinese government bonds to its flagship World Government Bond Index from October next year. Historical data charts technical analysis and others. 1-5 Year Laddered Government Bond.

Facing a potential removal from the FTSE World Government Bond Index WGBI half of the sellside individuals 49 active in the ringgit bond market expect liquidity to decrease while the other half 51 believes it will remain the same or even increase according to the latest survey done by Asset Benchmark Research ABR. FTSE Russell today published the results of the annual Country Classification Review for countries monitored by its global equity and fixed income indexes. The Fund aims to achieve a return on your investment through a combination of capital growth and income on the Funds assets which reflects the return of the FTSE World Government Bond Index the Funds benchmark index.

The FTSE World Government Bond Index WGBI measures the performance of fixed-rate local currency investment-grade sovereign bonds. The Ashburton World Government Bond ETF aims to provide investors with exposure to investment grade sovereign bonds across developed and emerging markets through the purchase of a JSE listed ETF representing the FTSE World Government Bond Index WGBI. FTSE MTS Eur Gov Bond IG 7-10Y Ex-CNO.

The Fund aims to invest as far as possible and practicable in the fixed income FI securities such as bonds that make up the benchmark index and comply with its credit. FTSE Russell is pleased to announce that Chinese Government Bonds will be included in the FTSE World Government Bond Index WGBI with inclusion scheduled to start in October 2021. TR South Africa 10 Years Government Benchmark.

FTSE Global Debt Capital Markets Inc. It comprises sovereign debt from over 20 countries denominated in a variety of currencies all of which are hedged into Canadian dollars. It comprises sovereign debt from over 20 countries denominated in a variety of currencies.

Thats because one of the criteria for being included on the index is an investment grading from one credit rating agency and SA has already been junked by SP and Fitch in 2017. The index provider. Liquid Short Term Capped Bond Laddered Bond Indexes.

FTSE World Government Bond Index WGBI A broad index providing exposure to the global sovereign fixed income market the index measures the performance of fixed-rate local currency investment-grade sovereign bonds. World Government Bond Index Currency-Hedged in CAD The World Government Bond Index Currency-Hedged in CAD measures the performance of fixed-rate local currency investment-grade sovereign bonds. TR Hungary 10 Years Government Benchmark.

FTSE World Overview Comprehensive information about the FTSE World index. FTSE Russell will not include China in its flagship government bond index citing market liquidity and foreign exchange concerns in the countrys 5tn government debt market. Is a leading provider of fixed income indexes in Canada and is used as the benchmark for approximately 2 trillion in assets globally invested across ETFs mutual funds and segregated mandates.

FTSE MTS Short Eurozone Government Broad IG 10-15Y. Fixed Income Chinese Govt Bond Index ETF. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries denominated in a.

Corporate Bonds Etf Ubs Germany

China S Wgbi Entry Will Confirm Its Arrival As A Global Market Ftse Russell

Yield Book Indices Citi Rafi Bonds Index Series

Https Research Ftserussell Com Products Downloads Ftse World Government Bond Index Developed Markets Capped Select Index Ground Rules Pdf

Capital Flight Fear Continues As Malaysia Stays On Bond Watchlist The Star

Site Www Economist Com Ftse World Government Bond Index South Sea Stories Google Search International Energy Agency Solar Power System Energy Being

Ftse Russell Launches First Climate Index For The Inflation Linked Government Bond Market Ftse Russell

China S Bond Market What And Why And When Asi

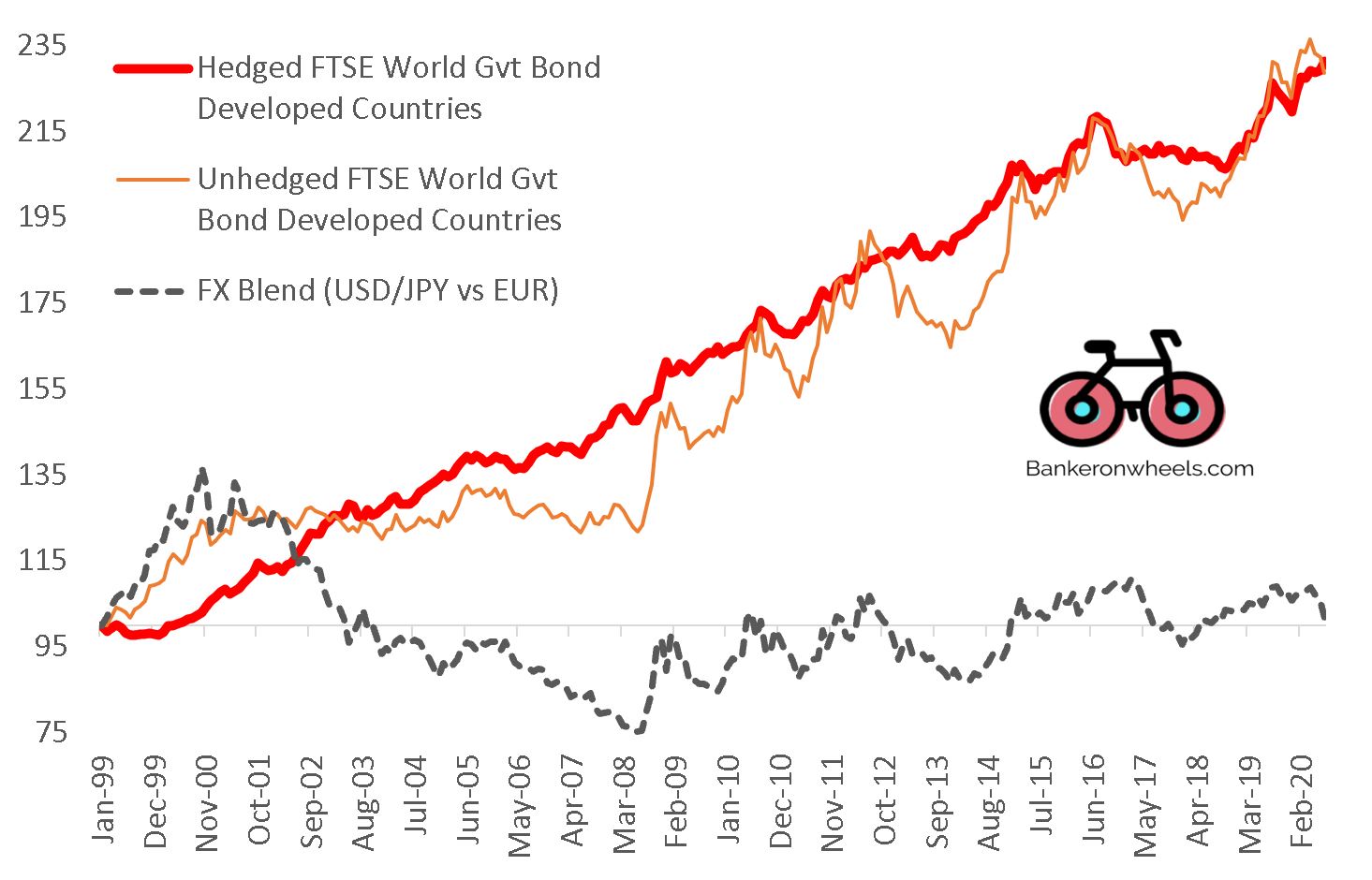

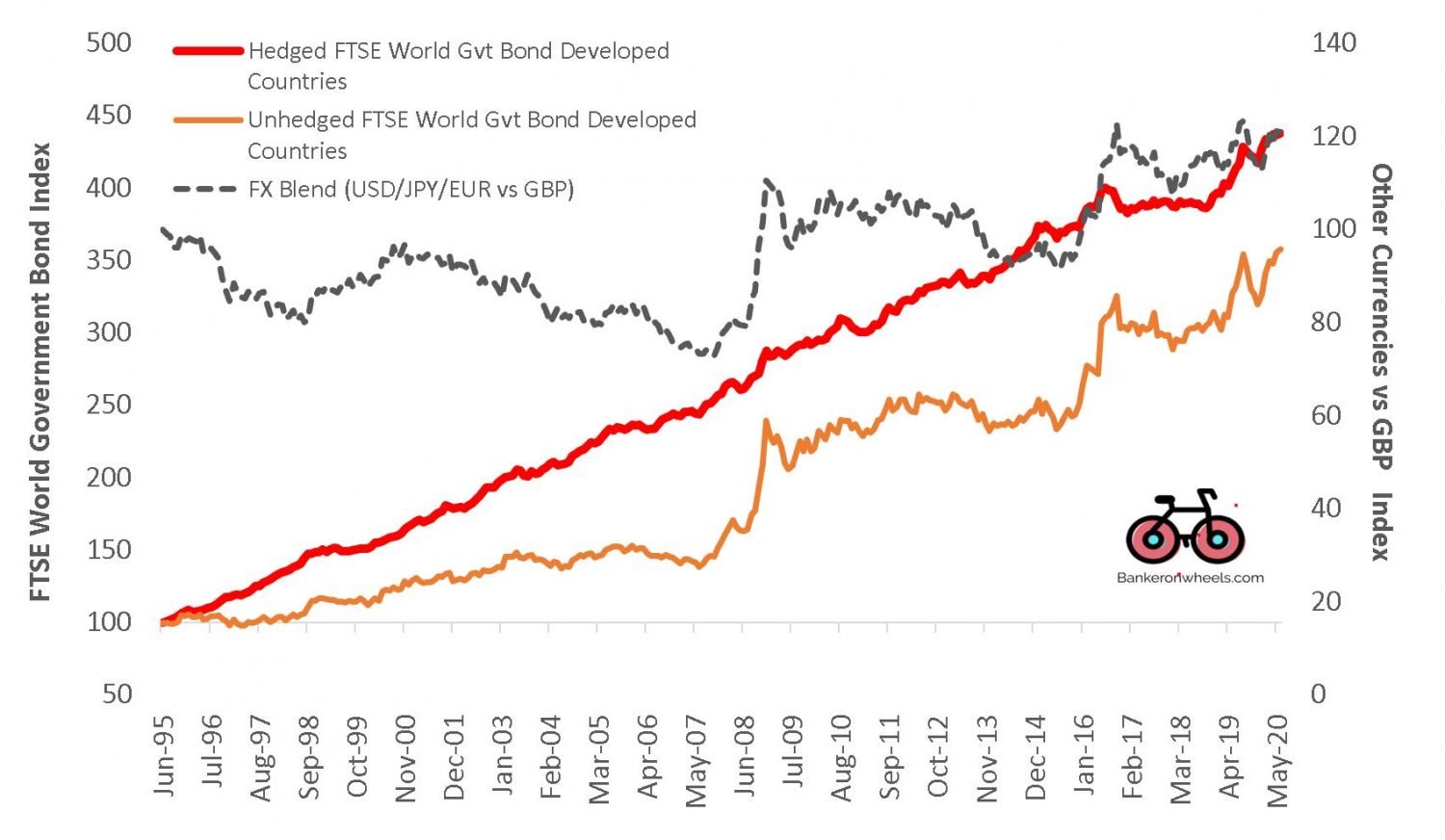

How And When To Hedge Your Investments All You Need To Know About Etf Currency Risk Bankeronwheels Com

Ftse Russell Says China To Be Included In Global Bond Index

Investegies Ishares Stock Index Investing

This News Could Not Be Found Global Indices Design Country Flags

Ftse Russell Confirms Chinese Sovereign Bonds To Join Wgbi Index Nikkei Asia

Ftse Russell Announces Results Of Semi Annual Country Classification Review For Fixed Income And Equities Ftse Russell

How And When To Hedge Your Investments All You Need To Know About Etf Currency Risk Bankeronwheels Com

Xtrackers Ii Global Government Bond Etf 1c Etf Anlagestrategie Dbx0a8 Lu0378818131 Finanzen Net

Ftse Russell Launches First Index To Define And Track Frontier Emerging Government Bond Markets Ftse Russell